Market opportunity: export organic food to France

Published on 19 January 2018

In December, Reuters reported that the local organic food supply in France has a considerable imbalance compared to imports. According to the note, the European country, which consumes 7% of the organic offer in the world and is only surpassed by the United States (40%) and Germany (11%), the local organic production of the country only amounts to 57% of its imports in this category.

This is due to the fact that local producers have not been able to meet the growing demand: it is estimated that last year sales of organic food would have reached US $ 9.4 billion, which implies a growth of 14% compared to 2016. And within the foreseeable horizon, it is expected that the annual growth rate in the consumption of these products will remain between 10% and 15%.

Consequently, it is expected that the prices of organic products continue to increase in the French market. Any attractive offer that is put somewhere between the unattended capacity of its local producers, and the exporters that currently benefit from the mismatch between supply and demand, may be successful in finding buyers.

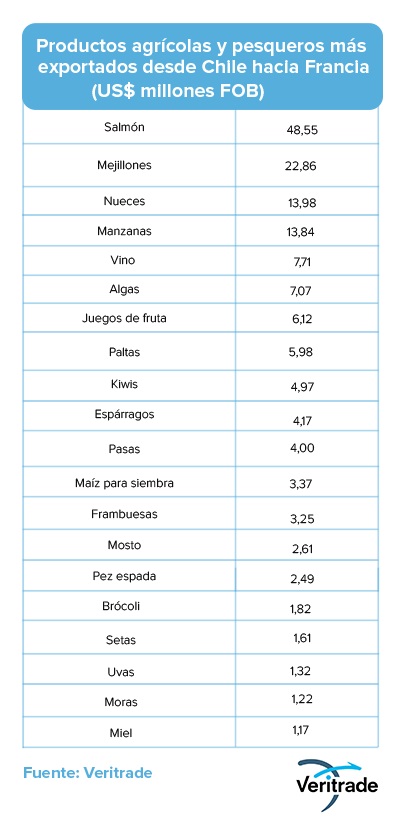

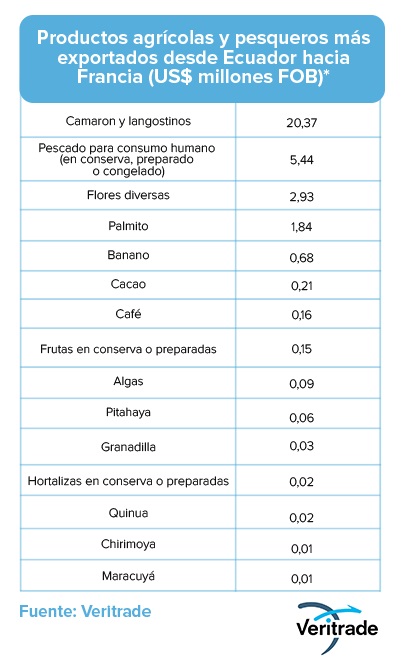

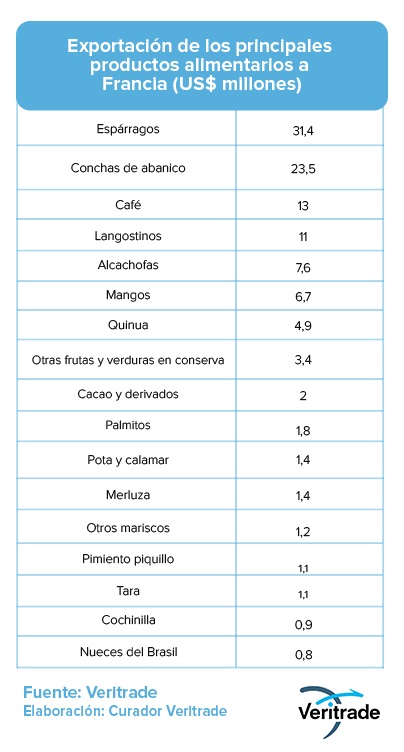

Next, we review some of the food products that were exported to France between November 2016 and October 2017, the last month for which complete information is available (September 2017, the case of Ecuador).

The farmed salmon fed with organic inputs (if viable) can be an excellent product for the French market, in view of the gastronomic sophistication of the destination and the affinity of the product with its dishes. To this, fruits and vegetables are added, especially apples, kiwis and berries, in which the absence of cranberry is striking. Chile has favorable conditions for the production of fruits dependent on the cold, and there are undoubtedly opportunities to fill the gap in French supply.

Colombia has great potential for the export of organic coffee. It is the second producer of arabica coffee in the world (15 million bags of 60 kg per year), then Brazil (40 million bags), but has focused on conventional coffee (higher market) unlike Peru, which is the main exporter of the organic segment. Other products with potential are the exotic fruits, such as pitahaya, uchuva (aguaymanto in Peru), mando, granadilla and passion fruit.

As in Chile, aquaculture can take advantage of the use of organic inputs (if viable) to supply market niches. In this case, hatchery prawns can represent a good opportunity. Added to this is the search for certifications that are also valued by organic consumers for products of marine origin, such as Fair Trade or those that demonstrate that the treatment in the processing plant has only involved contact with organic products.

On the other hand, due to the geographic similarity with Colombia, there are opportunities for exotic fruits and vegetables, but a product added that Peruvian and Bolivian exporters have taken advantage of very well: quinoa, easily exploitable in high Andean areas, and even in the coast. Additionally, organic coffee and cocoa always have excellent options.

Perú

Except in the case of products of marine origin (fan shells, squid or squid, hake and other seafood, for which you can seek to do what was already suggested for the Ecuadorian case with respect to certifications), in all cases It is possible to certify the production as organic. There is, therefore, much to take advantage of, as in berries (only blueberries were exported to France for US $ 162,772 between November 2016 and October 2017), and superfoods (no chía shipments are registered, and maca only generated US $ 272,214 for that destination in the mentioned period). In addition, organic coffee and cocoa of Peruvian origin can continue to gain ground by taking advantage of what is already known in the market.

It is time to explore new opportunities. All the data contained in the table can be obtained in a matter of seconds through the Veritrade portal.

Enter here https://bit.ly/2FS1dnc and request your free trial.