Latin American and Caribbean Exports Expected to Fall 14% This Year

Published on 03 November 2015

The panorama

It is official, The Economic Commission for Latin America and the Caribbean (ECLAC) warns of a slowdown in the regional economy. In crude figures, this translates into a 14% contraction in exports. For what is this?

The main cause is the fall in prices for raw materials (the main export product of the Latin and Caribbean countries) and reduced demand for them. They speculate that the slowdown in the Chinese economy (one of the largest buyers of Latin American and Caribbean raw materials) had a lot to do with this result.

The Veritrade Numbers

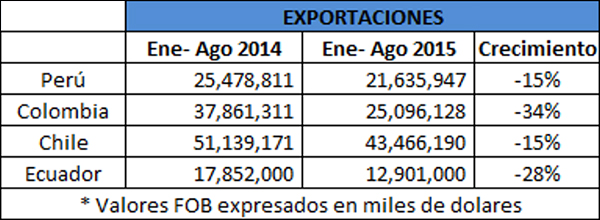

Let's see what our data says about this fall for the following countries in the region:

Countries such as Colombia and Ecuador have suffered a more critical blow due, in large part, to their dependence on oil and petroleum exports. Peru, although it has also fallen, it seems that it is not one of the most affected countries.

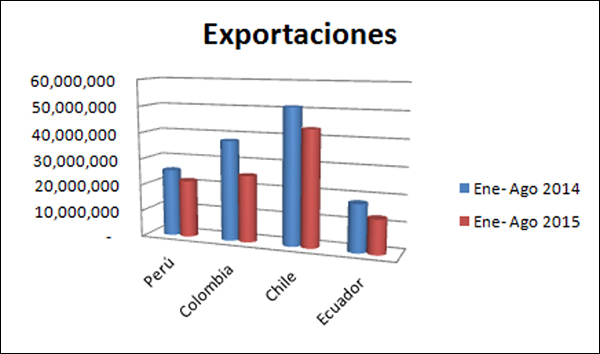

By means of the previous graph, we can see that Chile, even having fallen by 15%, remains as the exporting giant. Being the world leader in exports of metals (mainly copper), the fall in prices of minerals was a blow for the southern country. The forecast for 2016 is also not favorable, even having recently discovered the largest copper deposit in history within its territory.

The Solution

ECLAC advises that strength is in the union. The countries of the region should give greater focus to trade between neighboring countries, through agreements that save the costs of such exchange. In this way, the Caribbean and Latin America could look for a positive forecast in the global context. On the other hand, the very warned dependence of our region on the export of raw materials and raw minerals is evident. Alicia Bárcena, executive secretary of Cepal sentenced,

"The region is at a crossroads: either it continues on the current path restricted by the global context or it is committed to a more active international insertion that privileges industrial policy, diversification, trade facilitation and intraregional integration"

The solutions are present. Armed with initiative and necessary foreign trade information, we can change the course of current forecasts