Latin American metallurgy forges optimism for 2022

Published on 14 February 2022

Rising prices and increased quantities sold in response to higher demand over the past year bode well for refined metals in the region.

In 2022, the challenge will be to maintain economic growth after the post-pandemic rebound effect wears off. Fortunately, Latin American countries have products in high international demand that will help to overcome the situation.

Among the sectors with a positive outlook is metallurgy, in view of the recovery of construction, the technology industry and the inflationary uncertainty that raises the price of precious metals. Furthermore, the profit potential is not only for mining and refining companies. Suppliers of any goods or services involved directly or indirectly can also take advantage of the opening of the window.

There are large and abundant polymetallic, coal and rare metal deposits in the region that can be shipped as concentrates or sold at a higher level of processing without losing competitiveness in the price paid by customers. Therefore, in some logistically strategic locations there are refineries dedicated to processing the minerals into sheets, ingots or alloys.

In parallel to the purely metallurgical part, the increased movement of the steel industry has been beneficial for coal-producing countries. The recovery of the real estate and infrastructure sectors has generated an increase in the purchase of coke to supply the blast furnaces in which steel is smelted, and this has been taken advantage of by producers.

On this occasion, we share a summary of the main statistics for the most important related products.

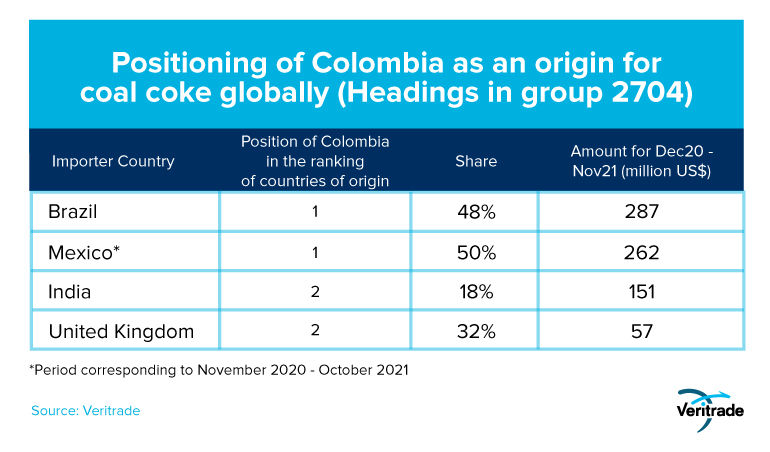

Colombia: coke supplier

Colombia's relationship with metallurgy is based on the supply of blast furnaces in steel plants. Except for gold and ferronickel, it is a country with limited metallic mining production.

However, every time the steel industry recovers in the world, the demand for coke reacts positively and Colombian producers benefit. So far, this type of coal continues to be an important input for iron smelting, and does not face the downward pressures of hard coal, which has been discarded by most power generation plants.

The following table shows the good positioning that Colombian producers have achieved globally.

In general terms, Colombia is consolidated as the third main origin of coke globally. This is also the country's sixth main export product, and would have generated earnings of US $1,200 millions for exports made between January and December 2021, compared to US $1,100 millions in 2020.

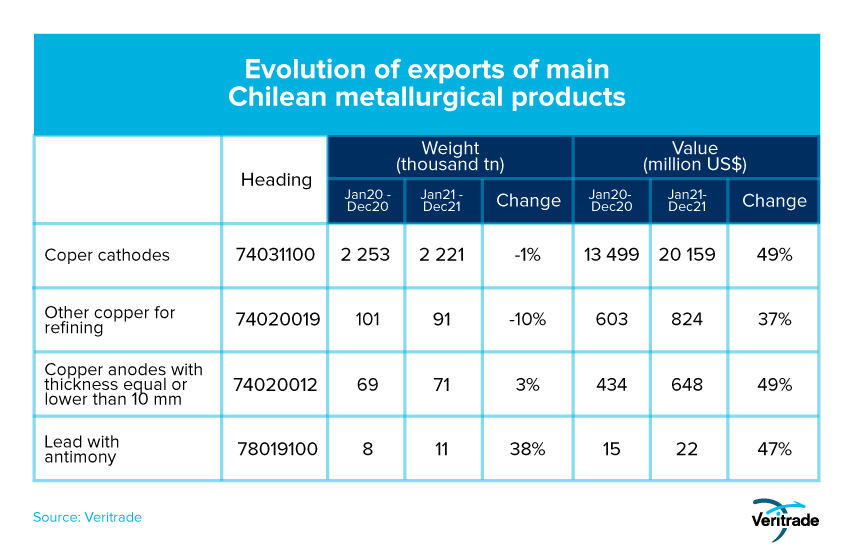

Chile: copper feast

The main copper-producing country also benefited from the recovery in demand for industrial metals. The price has risen nearly 60% in two years, going from a range of US $6,6000 per ton to a level close to US $10,000, a ceiling only reached in mid-2011.

Therefore, the amounts generated by sales abroad have been higher than those of 2020 despite the fact that lower quantities have been sold. This has been achieved despite the strikes at La Escondida, the country's main mine, and even in December 2021 the Association of Metallurgical and Metalworking Industries (ASIMET) reported that its sector would have achieved a 7.7% growth in its activity, compared to 5.4% in 2020.

Additionally, and predictably, another industrial metal such as lead also recorded higher sales as a result of the recovery of the markets, especially the construction, heavy and electronics industries.

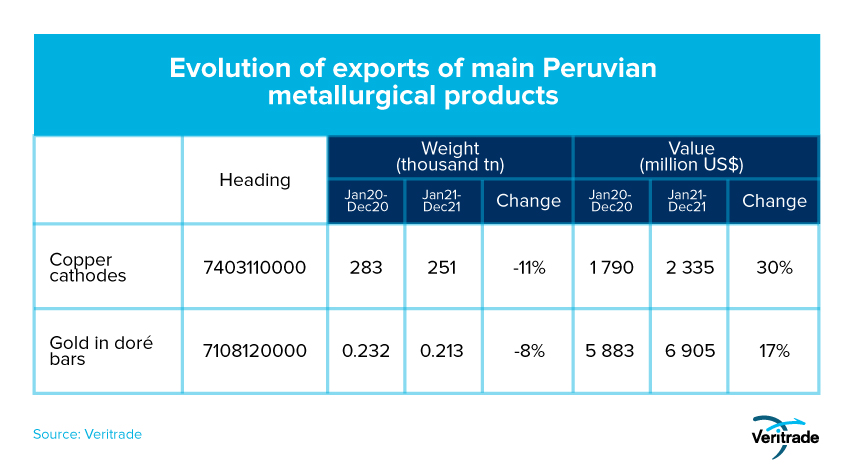

Peru: golden opportunity

The case of copper in Peru follows the recovery trend of industrial and construction demand. In addition, the country has the particularity of having polymetallic deposits and both industrial and precious metals.

Thus, the economic uncertainty resulting from the pandemic and international monetary instability has driven up the price of gold. Therefore, refineries have melted more doré bars, which is the presentation in which the gold metal is exported, mixed with 5% silver. With all this, according to the Multiannual Macroeconomic Framework of the Ministry of Economy and Finance, metallic mining would have grown 15.1% in 2021, and according to the report Panorama Actual y Proyecciones Macroeconómicas 2020-22 of the Central Reserve Bank, it would complete an increase of 14.4% in the period.

In Peru, the mining industry is mainly focused on concentrates and only two large refineries operate for industrial and precious metals, which are also put into doré bars within the plants of the mines themselves. For the time being, metallurgy is still part of the productive matrix of the sector, and can show good results as long as prices and market conditions justify its operation, as they are a low margin business of high operational complexity.

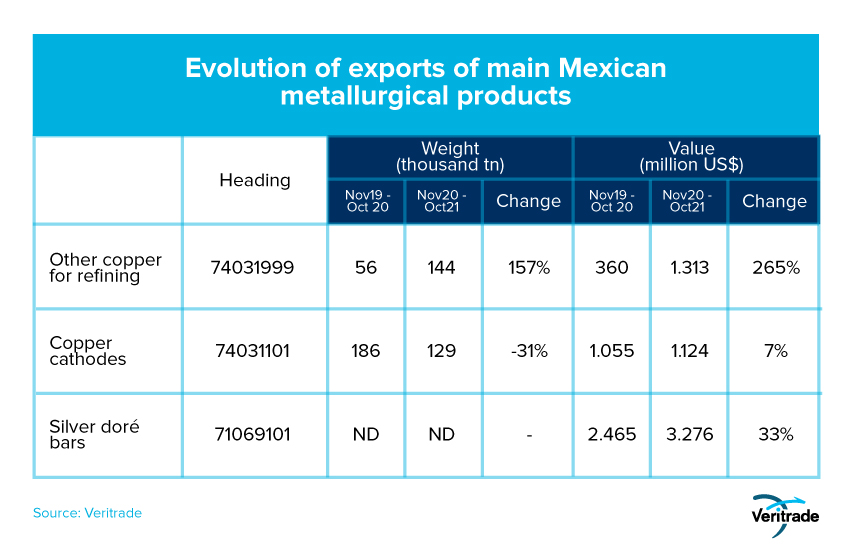

Two opportunities: Mexico and Bolivia

Since colonial times, these two countries have been a source of precious metals, lead and others. The tradition is maintained with modern industry and the recent market recovery has also brought good results.

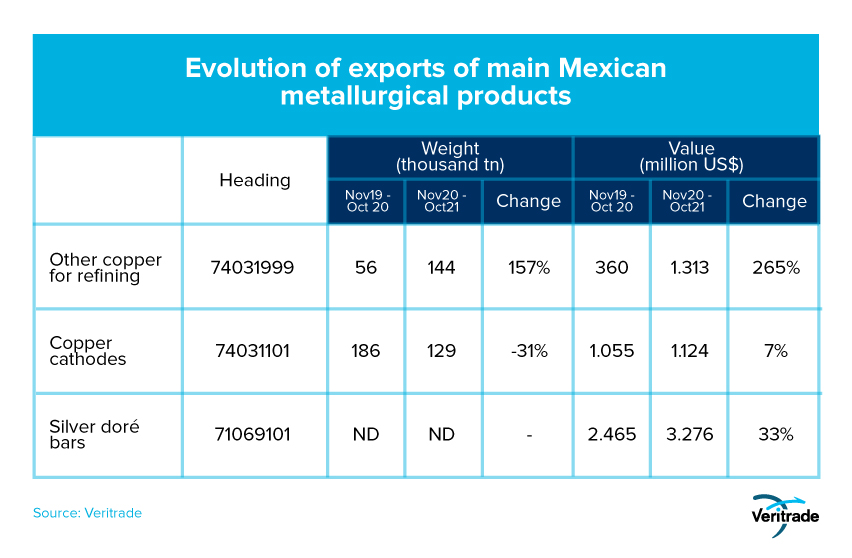

The following table showing the main metals processed by the refineries of both, and their recent export performance, makes it clear that there has also been a considerable expansion in their exports.

Above all, the greatest opportunity lies in the continued expansion of the industrial and construction economies. But both countries have more to exploit, and as in the Peruvian case, they have a polymetallic supply that includes gold and silver and can serve as a hedge against economic uncertainty.

If 2021 was a good year, 2022 could be even better. Everything will depend on the ability of governments to maintain the conditions conducive to investment growth, and on maintaining the balance between monetary policies and taking advantage of windows of opportunity such as the one opening up for precious metals during the transition to stability.

For more information about the Latin American metallurgical industry you can access Veritrade's website. Request your free trial by registering at this link.