Coastal Andeans: agro-export stars

Published on 21 January 2022

Agricultural exports from the coastal Andean countries have seen solid growth during 2021. The opportunity continues in 2022.

The latitude of South American countries and their geography make it possible to produce fruits and vegetables with ease to place them on the market. The mixture of counter-seasonality (production when the northern hemisphere is out of season) with particular soils, such as rainforest or flat, fertile, irrigable deserts, makes it possible to generate a competitive industry.

That is why even in 2020 good results were achieved despite the largest global economic slowdown in history. In that line, and with even more reason, in 2021 good results were again recorded at a generalized level. In this article, we review the performance of the main products of each of the countries in the group, as well as the opportunities ahead.

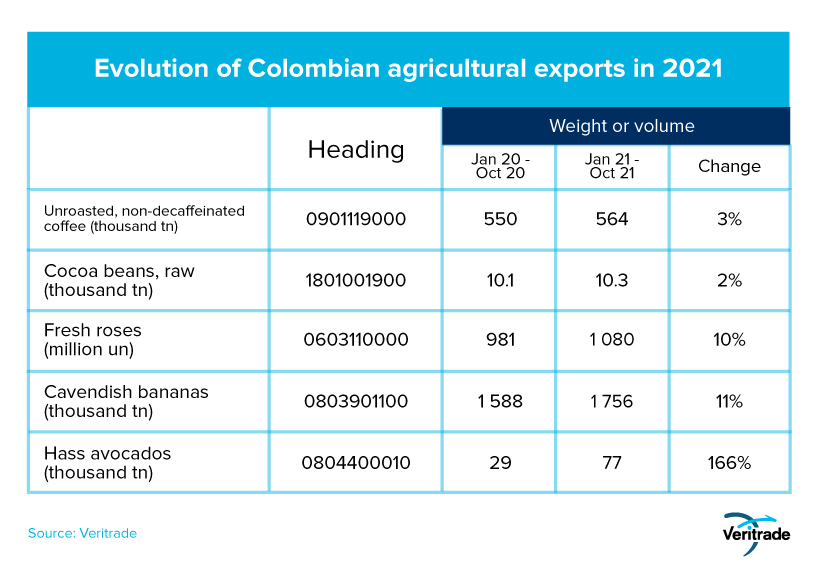

Colombia

LaColombia's geography makes it possible to take advantage of the rainforest to produce coffee, its flagship crop, and other tropical products such as bananas and flowers, grown in greenhouses. However, the supply has also diversified and avocados are now being planted on a massive scale. The following table shows how Colombian exports have grown, up to triple digits, as part of its initial consolidation phase.

In general, Colombia offers two great opportunities: the optimization of coffee crops and commercialization through the management of productive organizations for the constant renewal and modernization of crops and management models, and the reinforcement of diversification with fruit trees. Avocado will continue to be the star, but other underexploited seasonal products for which the land offers good conditions can be sought, as could be the case with berries and citrus.

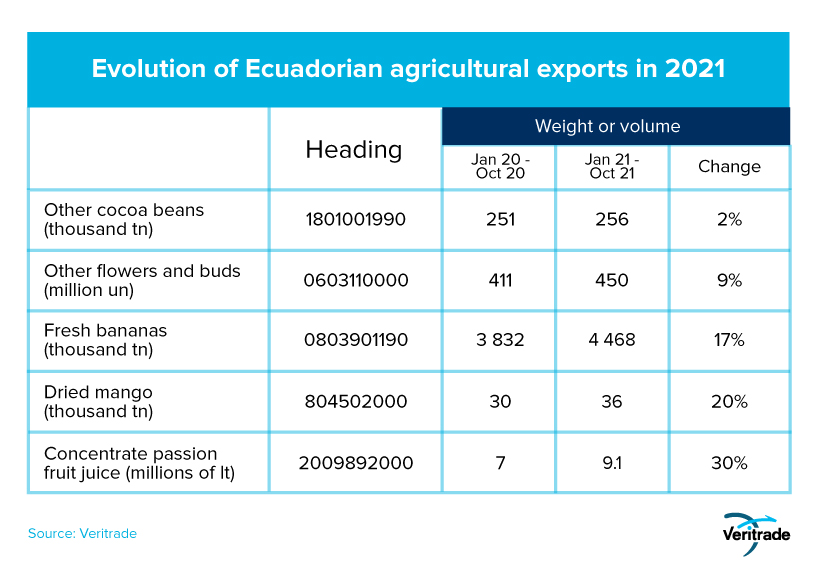

Ecuador

Ecuador's geography is similar to Colombia's, and therefore its supply of agricultural products is similar. Coffee is exported mainly as essence and is handled as a niche product when exported as beans. The country's emphasis is on cocoa, flowers and bananas. On the other hand, the processing of passion fruit juices and extracts is used.

The increase has also been generalized.

An opportunity for Ecuador is to take advantage of varieties considered exotic or of high value. The smaller size of the territory forces them to bet more on value than on volume, something that can be exploited with special varieties of cocoa or products that mix their derivatives with fruit essences, as well as with niche coffees. In parallel, floriculture and the banana industry remain solid and consolidated segments in which opportunities can always be found to market products with recognition abroad.

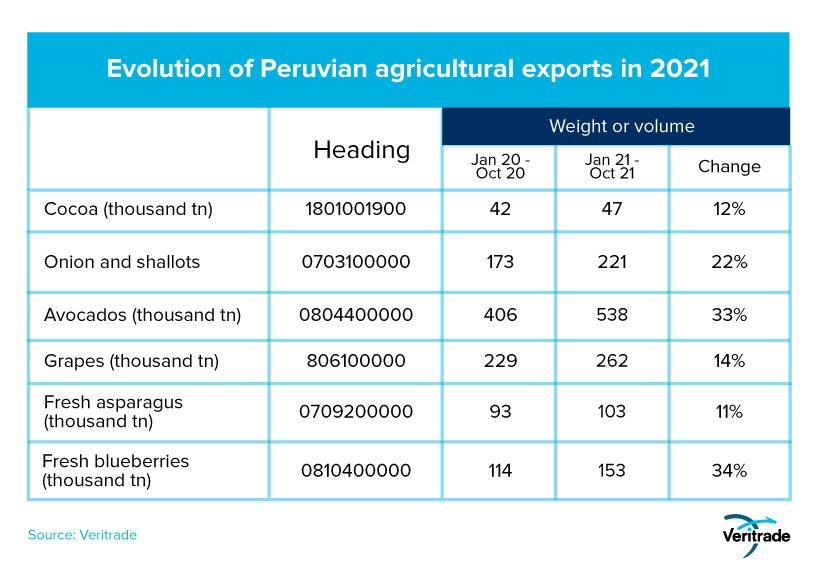

Peru

The mix of rainforests and irrigable deserts allows Peru to have a diversified supply. With the exception of floriculture and fencing, which require very cold climates, the country's portfolio includes all products from the rest of the region. For this reason, there is a correlation with the performance of the other countries: if agro-exports from the north and the south are doing well at the same time, it is to be expected that shipments from Peru have also increased. The following table demonstrates this.

The greatest opportunity in Peru resides in taking advantage of a mix of consolidation of conventional crops with the development of organic certifications. Likewise, the case of blueberries could be repeated with other crops that until now have not been exploited on the coast, and the model of associations can be used to stockpile superfoods such as quinoa or maca, along similar lines to that of exotic products in Ecuador

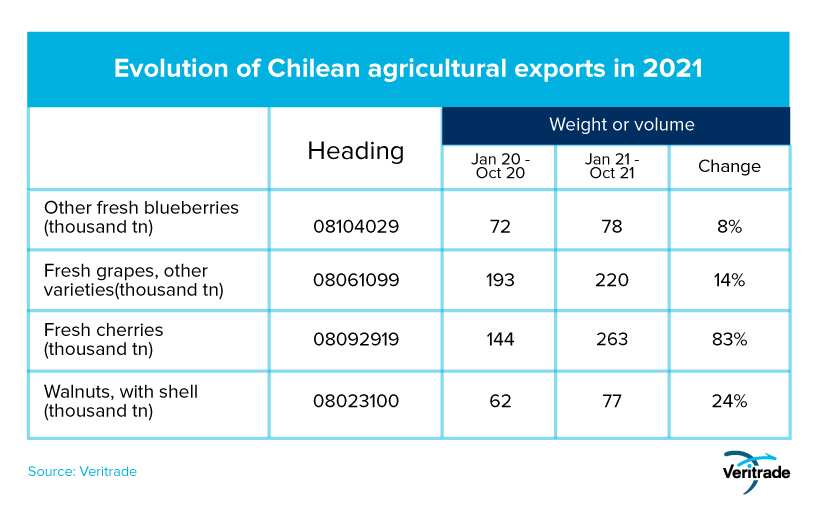

Chile

Being located at the southern tip of the continent allows Chilean farmers to exploit the potential of crops that require cold weather, such as cherries. On the other hand, the wide extension of irrigable deserts has also been taken advantage of and its entrepreneurs were pioneers of modern agriculture in the region, with crops such as avocado and grapes as main examples.

Fortunately for its exporters, 2021 has not only been a year with good conditions for those in the north of the region.

The opportunity is in taking advantage of the consolidation of origin, as is the case with bananas and flowers from Ecuador. On the other hand, it is always possible to evaluate the possibility of developing new cold crops that are not endemic and that can grow well in periods when the northern hemisphere is out of season.

To be considered: Asian market

In conjunction with the structural advantages, there is the opportunity to take advantage of the purchasing power and size of the Asian market. In the case of China, avocado is a product that has been introduced on a massive scale since 2013, and in 2021, it was imported in a much larger quantity than in the previous year: the 27,000 total tons in 2020 had already almost been reached in August, when purchases totaled 24,000 tons, 33% more than at the same point in 2020. In the case of India, the product was almost unknown until 2018, when it was imported at most 11 tons per month, while in 2019 it rose to ranges of between 30 and 50 tons, and last year exceeded 100. This suggests that there is a big opportunity and it is still an incipient destination if one takes into account that it would reach 1,200 tons with that level, more than 20 times below what is reached in China.

The second visible opportunity is in passion fruit juice. Chinese imports of this product amounted to 3.6 million liters in 2018, while in 2020 they were 9.8 million liters after not exceeding 1 million annually until 2016. Like avocados, it could be a good time to evaluate opportunities for these fruits and their derivatives.

And in third place, blueberries stand out. The value of Chinese imports of this fence has risen from a range of US $70 million per year between 2015 and 2016, to US $170 million between 2019 and 2020. This occurred despite the fact that the price has dropped from US $10 per kilogram to US $7 per kilogram in that seven-year span. And in the case of India, imports have risen from a ceiling range of 100 tons per month in 2018 to 200 tons per month last year.

In general, the Andean region is a privileged space for planting that should be exploited for the benefit of its habitants and consumers around the world. Explore more about its potential and opportunities by entering our platform to obtain detailed information about the products you are interested in. Access a free trial by clicking here to register.