Mexican exports recovered ground in 2021

Published on 17 January 2022

Mexican exports grew at a particularly fast pace as a result of the global economic recovery. Agriculture and oil were key to the rebound.

Mexico has the most dependent economy on regional trade in all of Latin America. As such, it benefits particularly greatly from the reactivation of the United States and Canada, with whom it has strengthened ties since the signing of the new treaty to replace Nafta, the agreement that has governed North American trade since the 1990s.

According to the Economic Commission for Latin America and the Caribbean (ECLAC), the value of Mexican exports grew by 17% during 2021. And within this figure, the contribution of shipments to countries in the North American region is particularly high: its share among the destinations of sales from Mexico abroad is 83% (approximately 80% to the United States and 3% to Canada), and according to ECLAC would have generated 25% higher revenues for Mexican exporters compared to 2020.

Mexican portfolio

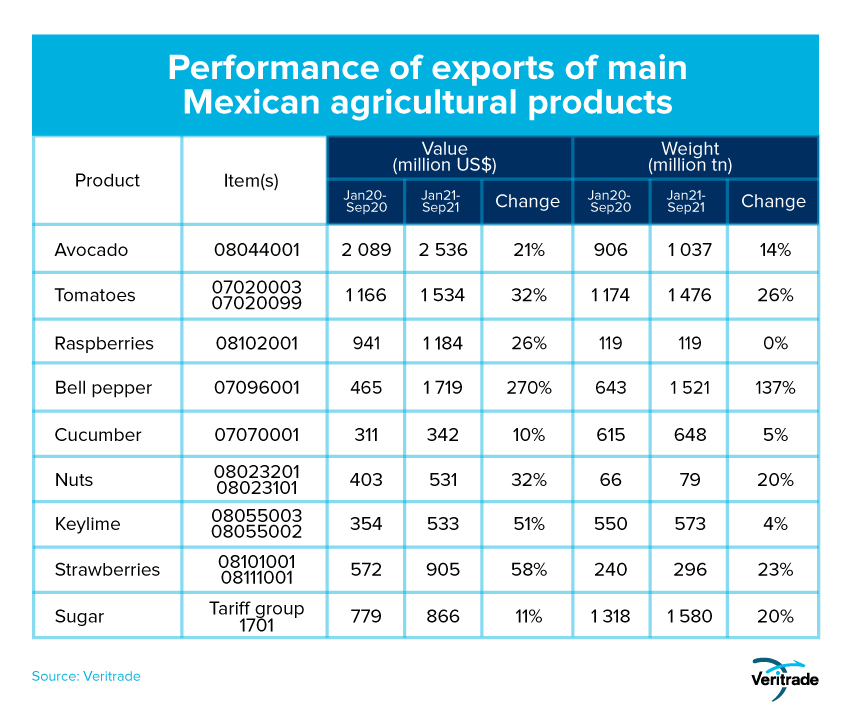

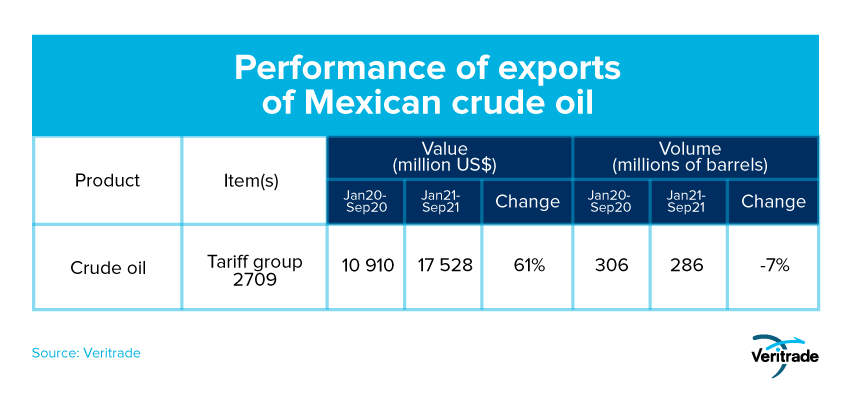

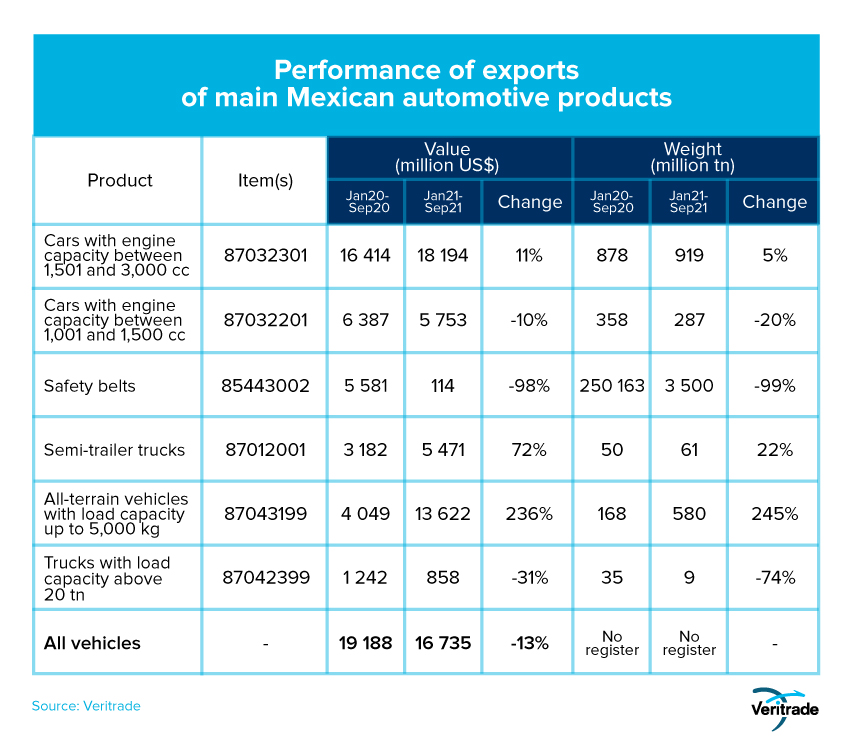

In general, the performance of Mexican product sales abroad depends mainly on what happens with domestic and industrial demand in the region, and on the international price of oil. A review of the list of the main products shipped to the United States and Canada, shown in the following tables, gives an idea of the importance of the technological, automotive, hydrocarbon and agricultural markets.

A particular feature that distinguishes the United States is the agglomeration of refineries, which generate market niches with higher levels of efficiency. Consequently, crude oil is present in the list of its main imports from Mexico, while it is not among the most relevant for Canada.

On the Canadian side, the list of main products has a mostly industrial profile for consumer and capital goods, such as cars and trucks. In this particular case, there is a producer of off-road vehicles for sand, while the aeronautical industry is relevant but generates almost one-sixth of what is achieved by selling to U.S. customers.

And in general, agriculture is always important for all markets, including Europe. But again, the United States turns out to be the most important partner, and the area where consumers are most accustomed to products such as avocados and chili peppers.

Recent evolution

At the sector level, the rise in the main agricultural products has been generalized. Demand for food was sustained during the pandemic, but was nonetheless contained and has experienced accelerated growth. At the same time, it is important to keep in mind that inflation in the United States may benefit Mexican exporters, who have also had the advantage of taking advantage of a slight depreciation of the peso against the dollar.

Meanwhile, oil exports recovered after a difficult year. The response to the market's reactivation and political intrigue generated a price rise to levels around US$ 80 per barrel, the highest in three years.

On the automotive side, performance has been favorable in several relevant categories. It is possible that the cutback in chip supply and other factors that have negatively affected the U.S. assembly industry could have impacted orders for components such as seat belts. In contrast, there would have been no drawbacks for the sale of stock vehicles. Finally, the tightness of work vehicle sales in 2020 is noteworthy, suggesting a reduced sensitivity to the need to fulfill work contracts or signed projects, as well as a drop in the face of a global driver shortage in 2021.

This can be corroborated in the following tables.

All indicates that 2022 could be another good year for Mexican exports if stability in global markets is maintained. The performance of the automotive industry is particularly relevant within this, while agriculture advances on a sort of autopilot as gastronomic culture expands and eating habits improve, to the detriment of sugar. Along the same lines, oil could have its years numbered if renewable energy sources consolidate their position as the most important. It will therefore be crucial to take advantage of technological progress to remain competitive.

For more information about Mexican exports, you can access Veritrade's website.

Request your free trial at https://bit.ly/VRTFreeTrial.