Colombian mango ready for the U.S. market

Published on 20 December 2021 The diversification of Colombia's export portfolio continues, now with the sanitary authorization for the entry of mango into the United States.

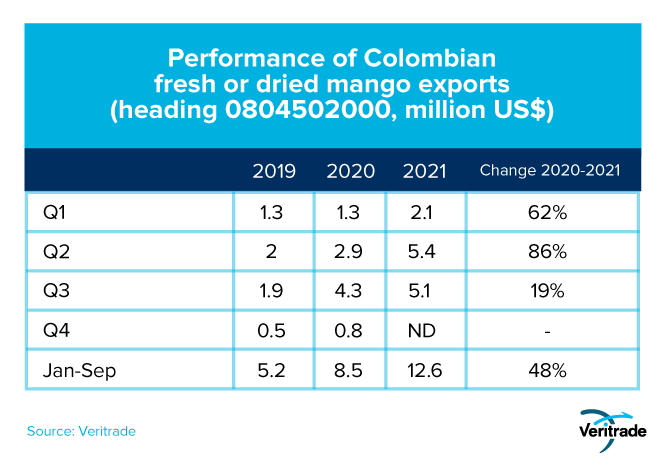

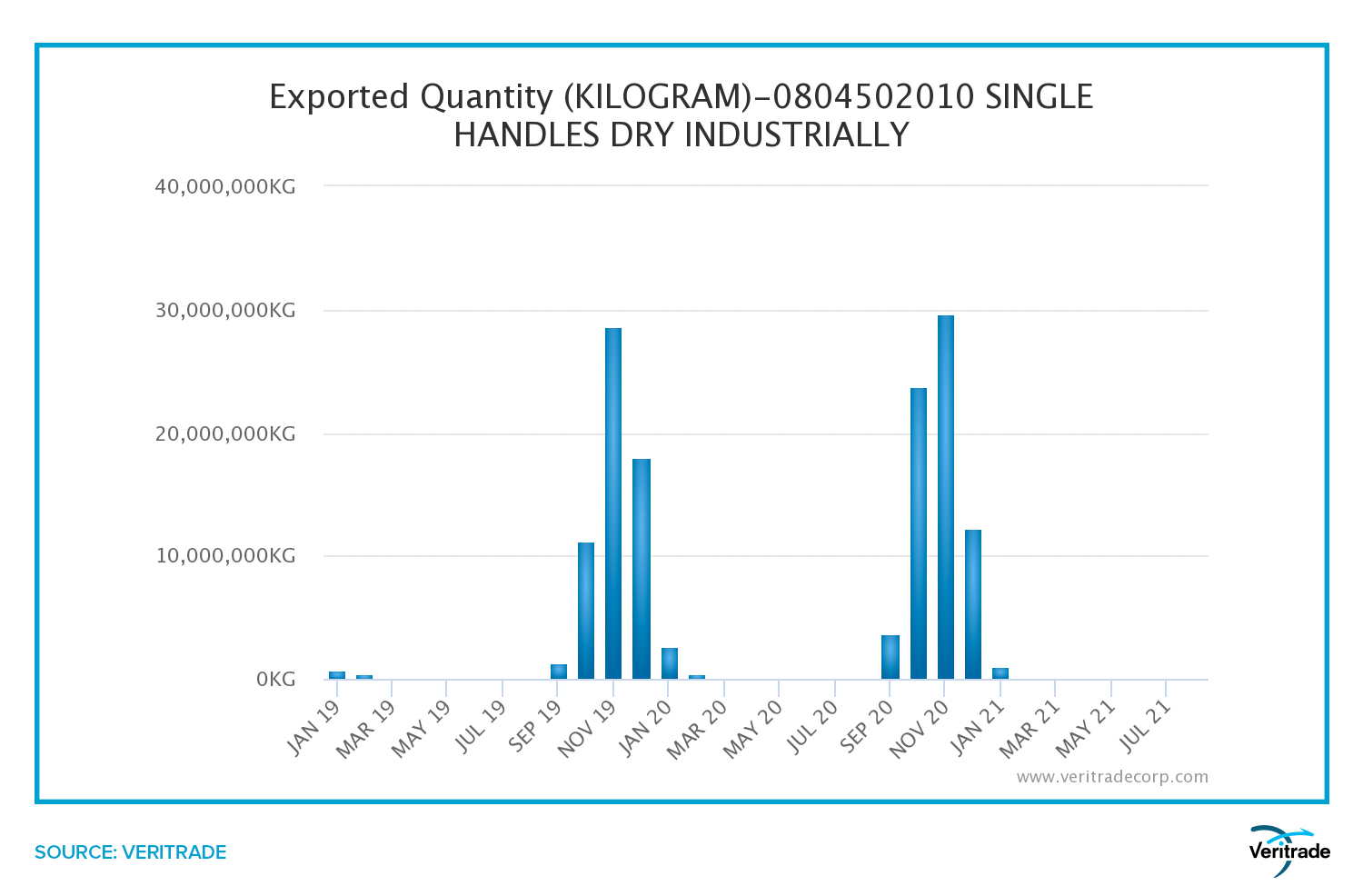

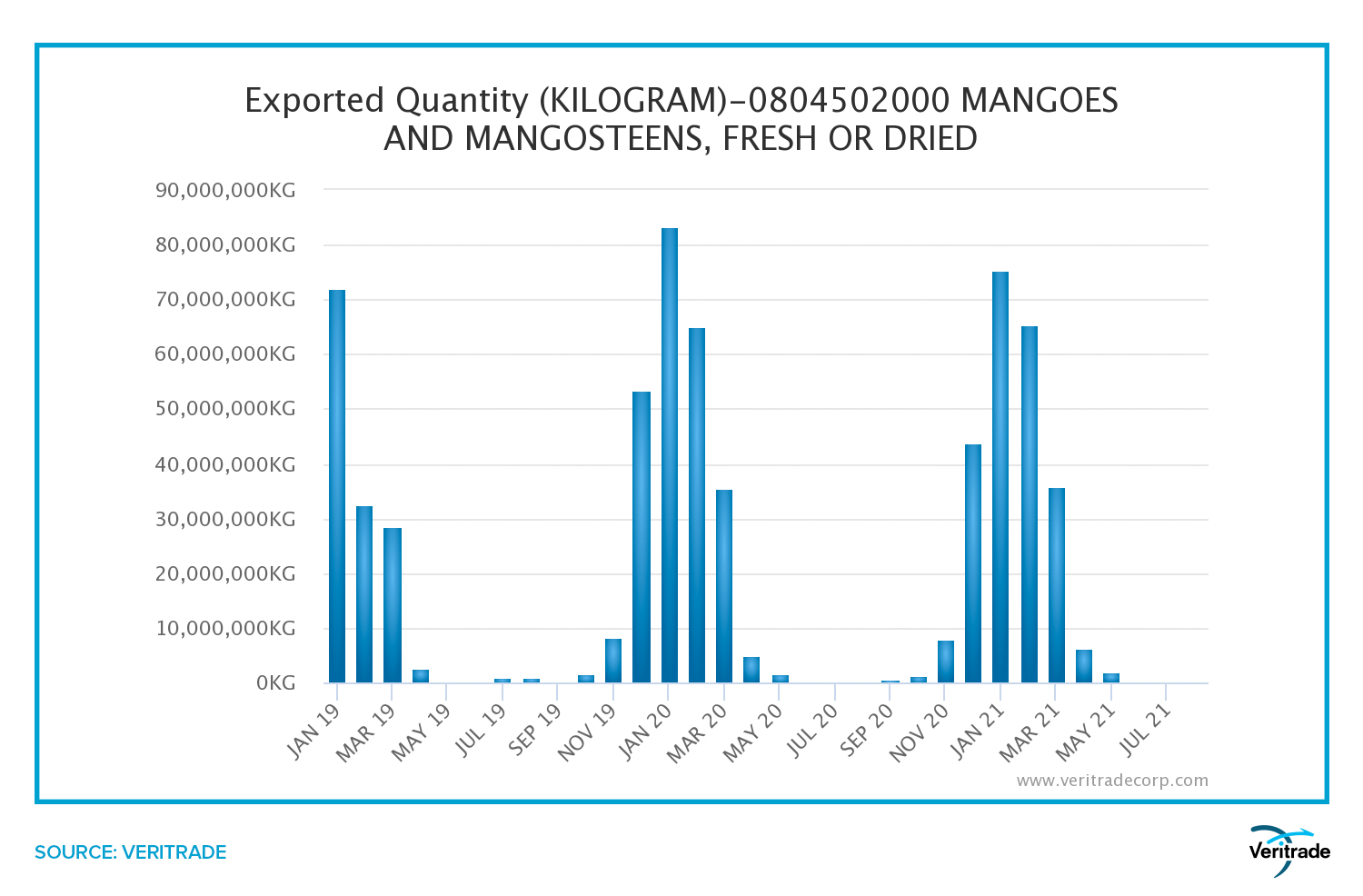

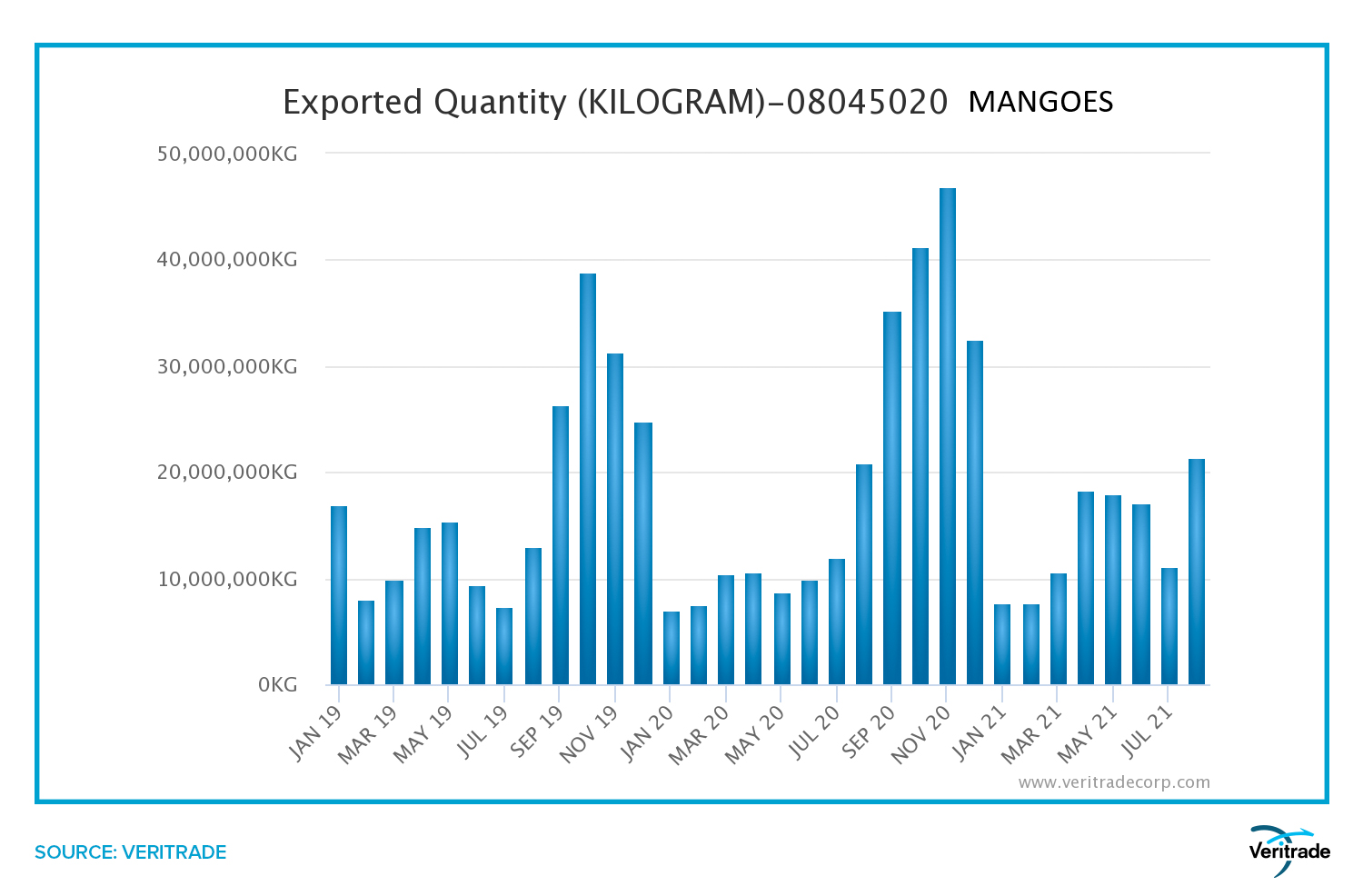

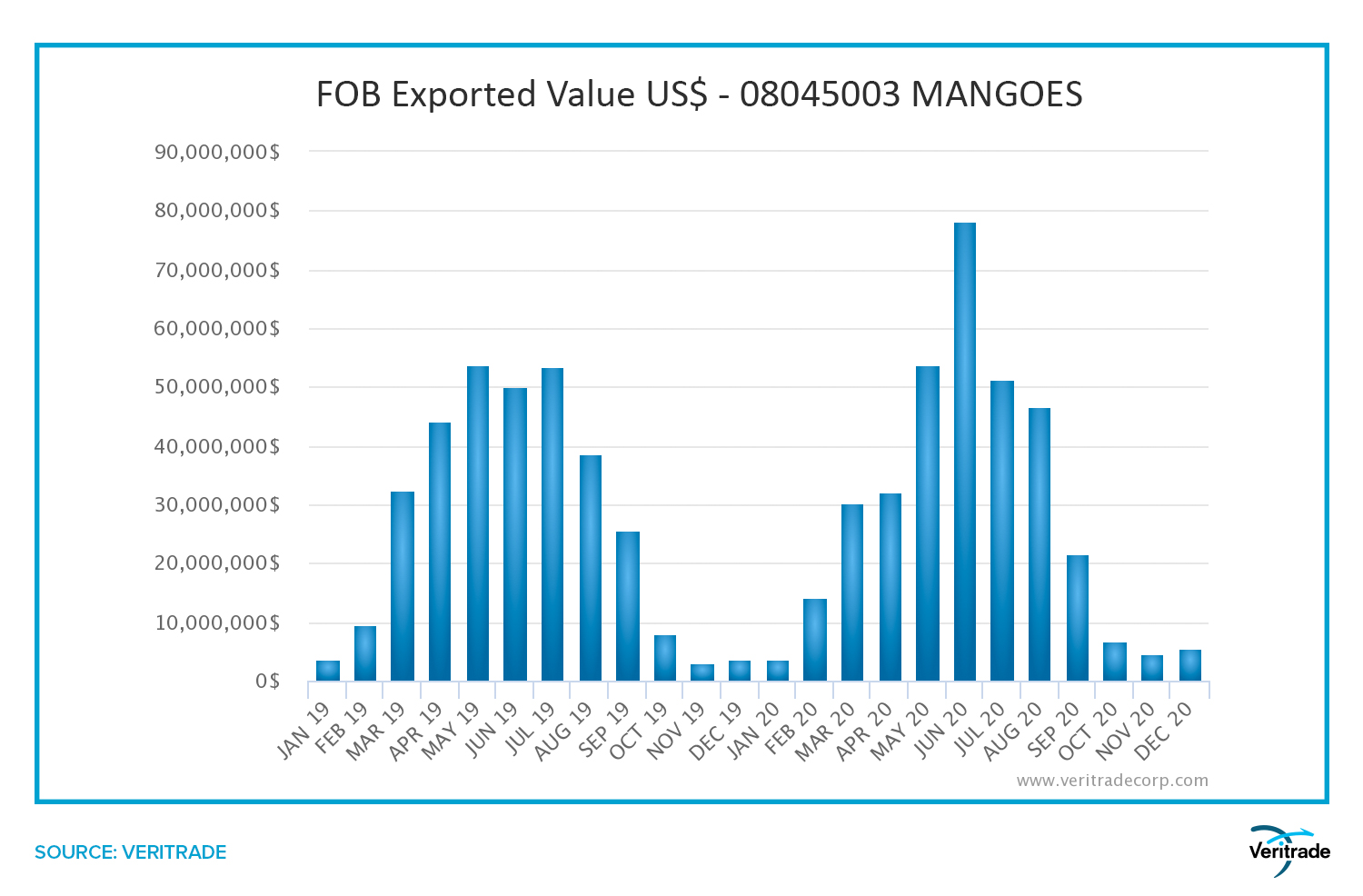

Introducing an agricultural product to the U.S. market is complex. Exporters must show the health authority that the fruits or vegetables they intend to sell do not harbor elements considered harmful to the biological balance. Recently, the Colombian government overcame this barrier and obtained sanitary authorization from the Animal and Plant Health Inspection Service (Aphis). Farmers and traders will thus be able to take full advantage of this new opportunity for international growth. The following tables show the recent evolution of Colombian mango exports, and give a clear idea of the development that this may imply. The evolution of Colombian mango exports reflects the expectation of approval to enter the United States. If this year's results have been auspicious, taking advantage of the markets available so far, the prospects are optimistic if we consider the fact of accessing one of the areas with the greatest purchasing power and the largest in the world. In this line, it is worth asking what qualities make the country competitive with respect to other origins in order to achieve the objective of consolidating it as a large-scale market. Set of opportunities: intermittent competitors Perhaps the most striking feature of Colombia's current mango production compared to that of other countries that supply the United States is its continuity. The following graphs show the annual trend of shipments, and it is evident how the country distinguishes itself by being able to take advantage of windows of opportunity when not exporting from the rest. Ecuadorian mango exports between January 2019 and August 2021 Peruvian mango exports between January 2019 and August 2021 The difference is notable. While Ecuador and Peru have almost simultaneous campaigns between September and May, in Colombia sales take place in the other months of the year. This generates a mismatch that avoids excess supply and allows taking advantage of better prices in shipments from the southern hemisphere. Set of opportunities: continuous competitors Brazil is the only other country with relevance comparable to that of Ecuador and Peru as the origin of mango imported into the United States from the southern hemisphere. The difference lies in its ability to ship throughout the year, making it a more direct competitor to Colombian agroexporters. This is shown in the following chart. Brazilian mango exports between January 2019 and August 2021 However, if we are looking for a direct competitor, Mexico turns out to be even more relevant. Unlike Brazil, it shares with Colombia the quality of having its high season between April and September. Consequently, a window of opportunity opens during this period for Colombian producers. Mexican mango exports between January 2019 and December 2020* *Report available only in terms of value With the approval of the entry into the United States, Colombia has access to a market in which there is a great space to make up for the shortages generated by the end of the Peruvian and Ecuadorian export campaigns. In particular, the fact of having plants of younger age and with prospects for new crops, allows taking advantage of the development of better qualities or the use of higher value varieties. At this time, Colombia has the opportunity to consolidate its position in the U.S. market as one of the five major origins of fresh mangoes. Specifically, the opportunity lies in filling the gap that production from Brazil, Guatemala and Mexico falls short when Ecuador and Peru do not produce. Currently, Mexico is the leading origin with a 41.8% share in 2020 resulting from the possibility of year-round shipments. But the second and third positions occupied by Peru (21.3%) and Ecuador (15.7%) correspond to shipments made in the summer of the southern hemisphere, while there is a window between the fall, winter and early spring that Brazil (14.5%) and Guatemala (3.4%) do not cover. On the other hand, it is worth reviewing the opportunities that Colombia has to replicate this strategy in other destinations. If we take Peruvian shipments as a reference, we can see that the Netherlands (which generates 41% of the income from Peruvian mango sales abroad) may be the market with the greatest potential because the port of Rotterdam is the gateway to all of Europe. It is followed by the United States, currently with a 29% share of sales, and smaller-scale destinations such as the United Kingdom (6%), Spain (5%) and Canada (3%).Considerable progress has been made that may be just the beginning of a success story in the diversification of Colombian agriculture. For more information on which months and markets represent the greatest opportunity with additional factors such as prices and names of importing companies, log on to Veritrade's website. Find out what we have for you by going to https://bit.ly/VRTFreeTrial to request a free trial.