Peruvian agroexports recovered lost ground

Published on 09 December 2021

Figures are even above pre-pandemic levels. In this note, we focus on the importance of the U.S. market for this rise.

Peruvian agriculture has not stopped growing since the change of economic model in the 90´s to allow the free entry of capital. Crops have been transformed from corn for animals to high-value fruit and vegetables. But better yet, the desert has given way to hectares that resemble large green carpets that accompany trips along the pan american highway as one travels through the country from north to south.

The United States has played a fundamental role in this transformation due to different factors such as government support for policy change and the entry of investors. And of course, none of this would be possible if the dimensions of food demand were that of a smaller scale economy. In sumarry, a mix of affinity with geographic proximity and accommodation between the harvest seasons of two opposite hemispheres has allowed the conditions for a boom to occur.

This led to the establishment of a solid industry that has been able to grow even during 2020, the year of the toughest recession in global history. And if that was achieved last year, so far in 2021 the rebound in demand due to the removal of mobility restrictions has led to an advance towards a point significantly higher than the pre-pandemic stage. The Peruvian Exporters Association (Adex) pointed out that up to September of this year there has been a 19.7% growth compared to the first nine months of 2020, a figure that corroborates that the opening to the consolidation of agribusiness was a success.

Positioning of the United States in the Peruvian agribusiness sector

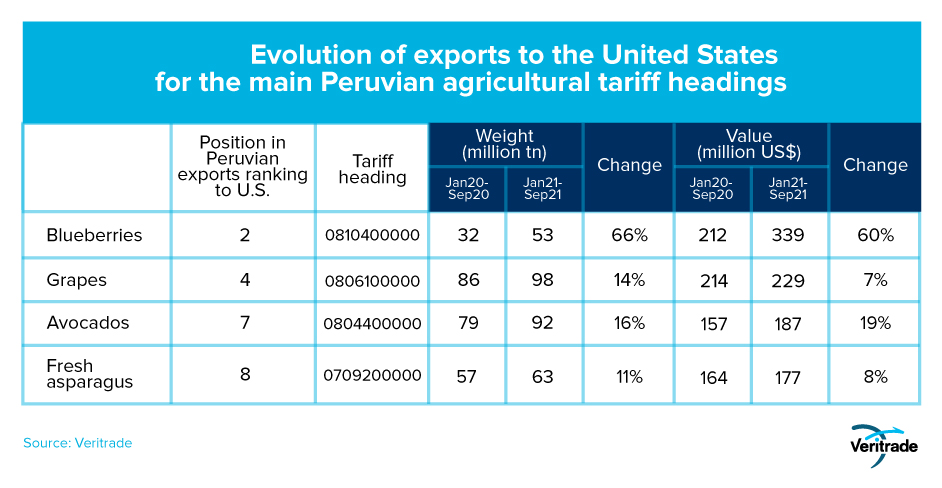

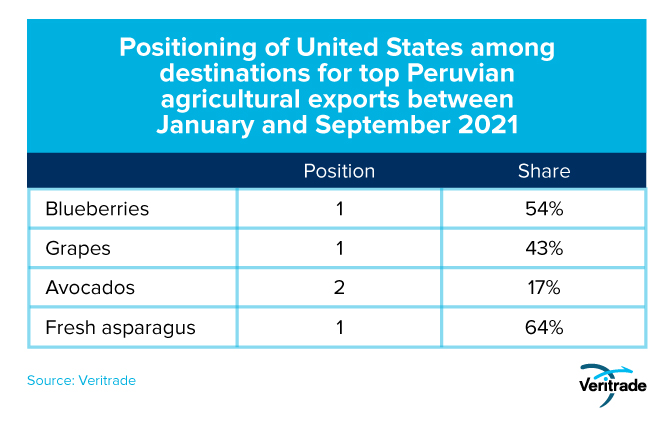

The U.S. market has been essential. The products that stood out for their growth were avocados and blueberries, precisely the two with the highest value and for which the United States is the first and second destination, respectively. In addition, there were other cases such as grapes and asparagus, which although they did not have such large increases, generated significantly higher sales than in the January-September period last year. And above all, what stands out is that in both cases these are products from the top 5 of the ranking of Peruvian agricultural exports for which the United States is the main destination.

This can be seen in the following tables, which show the importance of the United States for the performance of Peruvian agricultural exports.

DadoGiven that most of Peru's top agricultural products have the United States as their main destination, the fact that shipments increase considerably affects the result for the entire country. There are also other products with high potential, such as pomegranate, which although so far is mainly shipped to the European Union through the Netherlands (53% of the total), reaches the United States (8% share and third place in the ranking of its destinations), and has had a 27% growth in value thanks to an increase in the selling price (also 27% on average for that market).

Overall, all indications are that the United States should continue to be a source of growth in 2022, offsetting any downturn that may arise in the Peruvian economy due to the complications of its political environment. The analysis can be further deepened by comparing price increases in different markets, high-value products that have yet to take off in potential destinations, and historical price trends, among other variables.

Request your free trial at https://bit.ly/VRTFreeTrial to analyze your product opportunities in different markets.