Ecuador stands out in non-oil exports

Published on 26 October 2021

Ecuadorian agricultural and fishing producers have achieved good results in the first half of the year. In this article we review the most successful products and their main markets.

The recovery of the European economy has been excellent news for Ecuador. This recovery has contributed to the strong growth of the country's non-oil exports in the first half of 2021, particularly due to the increased consumption of fruits and vegetables, as well as fishery and aquaculture products.

According to the Ecuadorian Federation of Exporters (Fedexpor), the increase in the value generated by shipments in this category to the other continent is equivalent to US$ 314 million in profits. This is part of a 7% growth figure compared to the first half of 2020. And in general terms, sales of Ecuadorian non-oil products worldwide grew 12% and represented 65% of the total value generated by your shipments.

What factors contributed to this success?

The first favorable factor in achieving this accomplishment was the strengthening of the trade relationship with the European Union. Since January 2017, Ecuador joined the trade agreement that Colombia and Peru had already signed. With this, tariffs were freed, and regulations and procedures were adjusted to allow a more fluid exchange.

Secondly, Ecuador has comparative advantages based on its location, climate and soils. The abundance of rainforest at a short distance from the bad weather makes it possible to produce crops that require high temperatures and abundant water, as well as long daylight hours due to its location in the middle of the two tropics. At the same time, the cost of logistical operations is low due to the proximity to the ports.

In addition, the modernization of the organizational structure of Ecuadorian agriculture has occurred at a time when much of the land had not been used for conventional crops. Therefore, the abundance of land free of chemical fertilizers has made it possible to develop certified organic plantations. In this way, it has been possible to diversify sales with a differentiation between mass audiences and high-value niches. For example, while conventional bananas saw a decrease in shipments, there was an increase in the quantity of organic bananas shipped.

Finally, it is worth noting that the change of government has allowed a key factor to improve the outlook for exporters. The agreement with the International Monetary Fund for a second and third review of the country's economic program, which will provide access to US$800 million for budgetary needs. In this way, programs and projects that contribute to productive development, health and infrastructure will help considerably to increase income, as will an eventual greater inflow of capital to the agricultural sector.

The star products

That said, it is worth reviewing which products have been the best performers in order to get an idea of which elements of the portfolio may be the ones that will continue to perform well. The integration to the international market, the stabilization of public finances and the general promotion of openness would serve as leverage to continue with the increases.

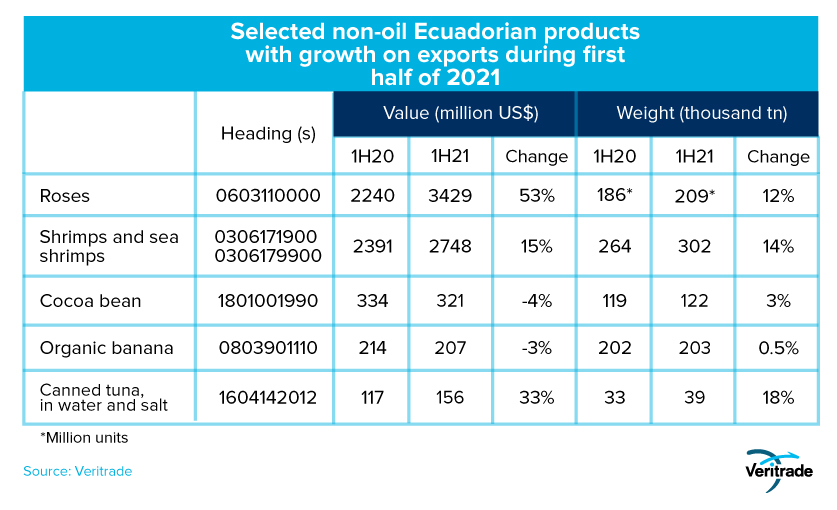

The following table shows the details.

From the figures, it can be understood that Ecuador stands out as an origin in the already consolidated products. Roses, shrimp and prawns have been representative elements in the Ecuadorian export portfolio for decades and are at the same time those that have generated the greatest growth in value. However, the fact that the quantity exported of cocoa and organic bananas has been higher is a sign that progress has been made in the controllable part of the business, which is the sale itself. On the other hand, prices respond to external factors such as the supply of competitors, the weeks in which the harvest is made, and the quality achieved in the production of that year, among others.

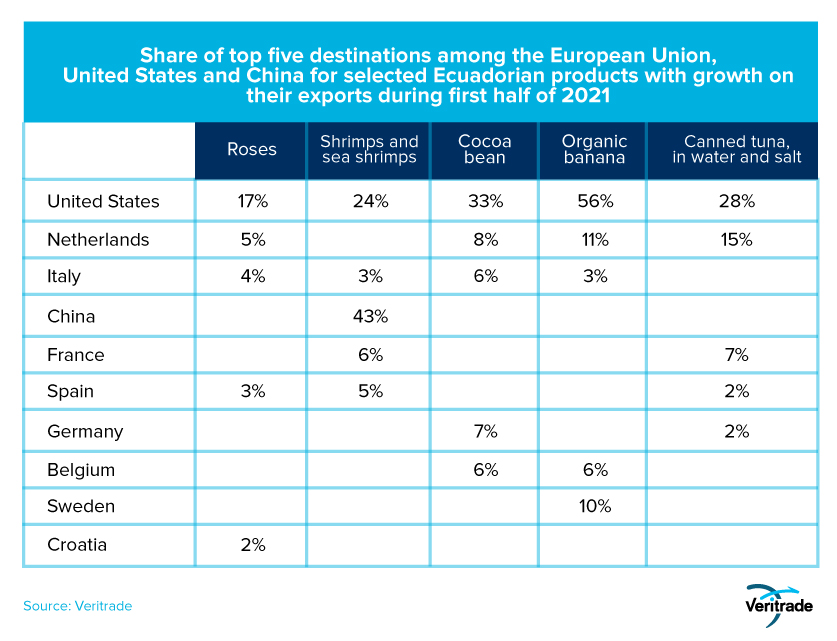

To counteract price drops, new markets must be sought, or new buyers must be evaluated in the main destinations. The following table reviews the main markets for the most important products to get an idea of the dimensions.

The United States is clearly the most important destination for Ecuador's non-oil products. However, the European Union is close behind, with the difference that the diversity of countries offers an opportunity. Different strategies for each can help to increase sales, as well as targeting areas where products pay more.

Finally, China is always an untapped market. Both the size of its population and the large number of inhabitants with high purchasing power are opportunities to place new products or expand those that already have a presence. In this regard, cocoa and roses have a particularly high potential, as there is no significant competition among local producers, and only in some cases in Southeast Asia (Indonesia for cocoa and Malaysia for some flowers).

In any case, the dimensions are so large that there may even be room for redundant products with local production. The most important thing is to assess consumption habits, sanitary protocols and the capacity to supply large orders. And finally, it should be noted that making inroads in the Chinese market may also involve developing a culture of consumption, as has been achieved by those who have introduced avocado as an aspirational product that was previously unknown in the country.

For more information on Ecuador's non-oil exports, please visit Veritrade's website. Request your free trial by entering: https://bit.ly/VRTFreeTrial