CPTPP has begun: the Pacific is already a free trade zone

Published on 15 October 2021

With the incorporation of China, the former TPP will become the treaty on which the world's largest trade bloc will be formed. Find out what benefits Peru will have

Two days after the entry into force for Peru of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), on September 21, China submitted its formal request to become part of it. This agreement will allow 13 economies in the Americas, Asia and Oceania to be united in a free trade network that frees tariffs and provides access to cumulation of origin agreements. Its preparation is the consequence of 12 years of structuring, negotiation and incorporation of new members to the Trans-Pacific Partnership Agreement (TPP) between 2005 and 2017, and the restructuring and change of name following the departure of the United States that year.

The original members remaining in the group are Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. With the incorporation of China, the economic zone with the highest production in the world would be formed, with a GDP of US$ 28 trillion (close to 38% of the global total), and would generate benefits through lower prices, greater supply, investment and employment.

Benefits of the agreement

The implementation of the agreement brings two major benefits for Peruvian exporters. The first is the automatic transformation of Malaysia, New Zealand, Vietnam and Brunei into free trade partners, since no treaties had been signed with these four countries for this purpose, known as FTAs.

The CPTPP not only eliminates tariff payments between countries. Its special feature is the incorporation of cumulation of origin. This consists of not adding tariffs to intermediate goods moved between member countries as part of a production chain, so that the price of the final product is not increased. For example, if Peruvian cotton is moved to make Colombian underwear for export to Japan, the Colombian manufacturer will not have to pay for the Peruvian cotton to enter his country, and the Chinese importer will not have to pay for the Colombian garment either.

The second major benefit is the consolidation of Peru's international relations. The country will be part of a trading bloc that is committed to the benefits of the free market at the international level, and it will be the largest economic bloc in the world after the incorporation of China and could be even larger if the United States rejoins.

On the other hand, imports will also fall in price. As a result, capital goods will become cheaper and exporters will gain efficiency.

What does Peru export in the CPTPP?

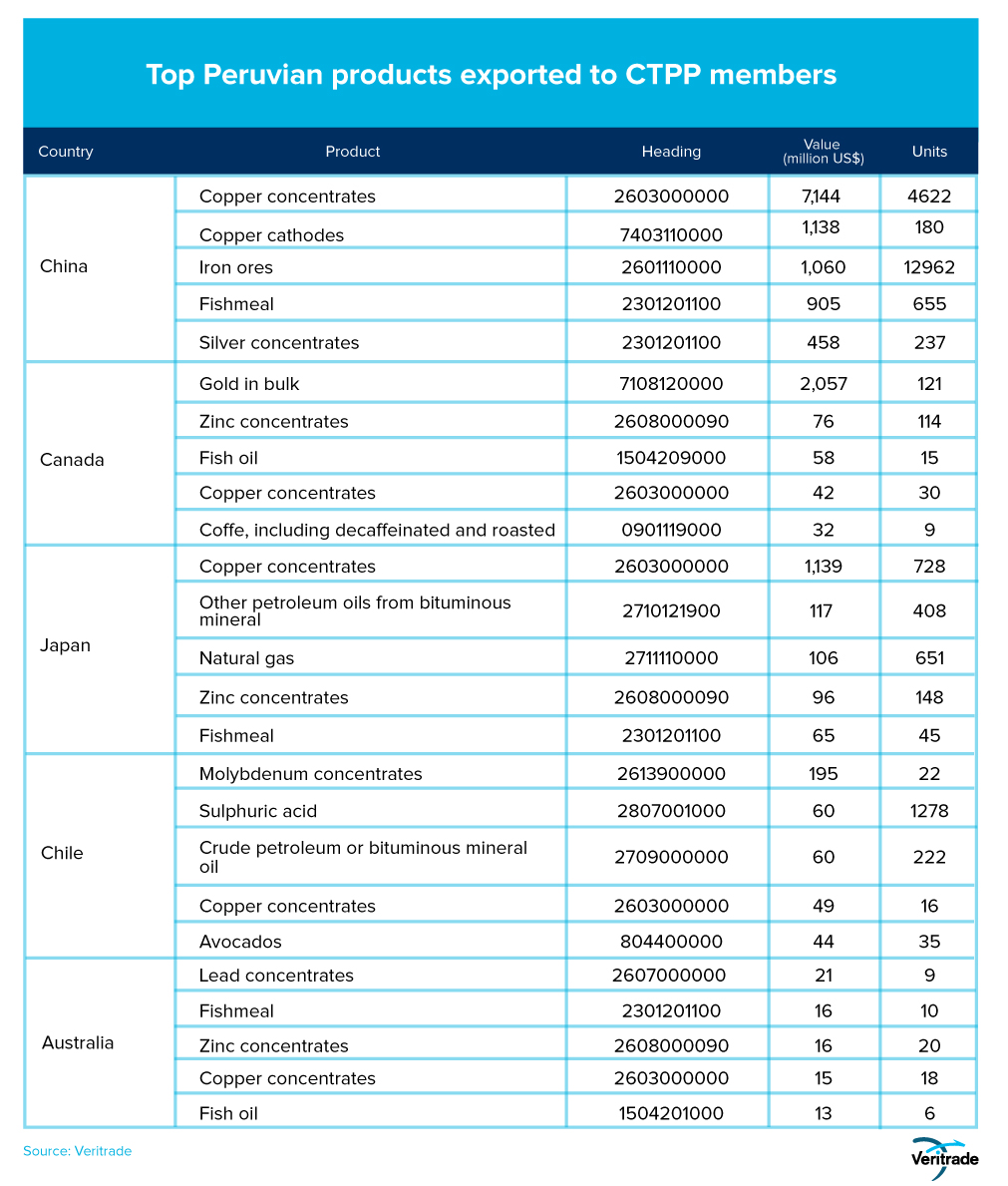

Having said that, it is worth analyzing what Peruvian products are currently being sent to the countries of the bloc. This can give an idea of the sectors in which there is potential to be exploited, and those already consolidated in which it will be possible to gain competitiveness. The following table shows the details.

The current list of products is mainly raw materials. This is precisely the segment in which Peru is most competitive at the international level due to the abundance of resources in conditions that are more profitable than in other countries

In general, there are three aspects that are important in the member countries of the bloc. The first is the importance of the industrialized economies of Asia, as well as Canada and Australia for industrial metals, fishmeal and hydrocarbons. The second is the importance of Canada as a destination for gold exports, being one of the world's financial and industrial centers for high-value mining. And finally, the third aspect is the high purchasing power of most markets, which provides an opportunity for the advancement of agricultural and non-traditional products such as coffee, fruits and vegetables.

Items with better projection

In line with the above, we analyzed the recent performance of the most important agricultural products in the Peruvian export supply. In general, the greatest potential remains in agribusiness. Avocado exports have generated record revenues as a result of exporting more than 100,000 tons per month in June and July, up from 92,000 in 2020 which was already a historical figure. And this is an export product that has been consolidated for more than ten years, so we cannot speak of a simple take-off from a low base.

The same is true for grapes. In December 2020 and January of this year, shipments totaled 133,000 and 142,000 tons, respectively. This also exceeds the historical record of the previous season, when the peaks were 108,000 and 122,000 tons, also respectively for December and January. And with blueberries the pattern was also repeated: 44,000 tons have been exported in September this year, compared to the unprecedented peak of 33,000 tons for the same month in 2020. October's figures are yet to be reported, but if the trend continues, it should exceed last year's 48,000 tons for that month.

It is clear that both demand and supply of the three stars of Peruvian agribusiness are strong. Records have been set despite the difficulties caused by the COVID-19 pandemic, and this growth has occurred despite starting from a large base in previous years because they are already consolidated.

Thus, the CPTPP can be a tool to expand the presence of Peruvian grapes, avocados and blueberries in China and, above all, in the four new free trade partners: New Zealand, Malaysia, Vietnam and Brunei.

Incidentally, it is worth remembering that the value supply is also in imports. The import of dairy products for industrial and final consumption from New Zealand, as well as the import of textiles or technological products from Asian countries, also for industrial use or final consumption, will be beneficial for the whole country.

And above all, micro, small and medium-sized entrepreneurs will also benefit from greater opportunities for their sales and lower input prices. The latter becomes even more relevant in days in which the exchange rate has generated a negative impact unprecedented in the last three decades (except for the 2014 cooling mainly due to external factors, the previous sustained increases occurred in contexts in which capital was entering the country).

To make an in-depth analysis on the potential benefits of the CPTPP in each market, you can enter the Veritrade portal. Request your free trial at: https://bit.ly/VRTFreeTrial