Peru lives the American dream

Published on 13 August 2021

In a context of global recovery, sales of Peruvian aquaculture products are also on the rise. The U.S. market is key to progress.

The search for animal protein sources with the best nutritional qualities can be complicated by scarcity or high prices. However, aquaculture has made it possible to expand the supply and for consumers to find products tailored to their possibilities.

In this context, in the midst of the global economic recovery during the reversal of the Covid-19 pandemic, Peruvian exporters have been able to take advantage of a window of opportunity that has allowed them to grow by more than 30%. The U.S. market is especially relevant due to its greater participation in portfolios, consumption capacity, and logistical and operational facilities resulting from its proximity.

The United States as a protagonist

According to Comex Peru, aquaculture exports from Peru increased 34.7% in the January-May 2021 period compared to the same period last year. The importance of the United States is fundamental in this, with a 36% share of the total value exported in the period, compared to 16% for China, the second largest destination.

Therefore, what happens with sales to the United States is a significant reference for Peruvian aquaculture exports to the entire world. The following table summarizes the performance of shipments.

Shrimp is by far the most demanded product in the United States. The productivity of the lagoons built in northern Peru is high due to the balance of warm climate with low water and land costs in areas close to ports, which is why the industry has been developing for more than two decades.

Meanwhile, fan shells are another high-value product with space in the U.S. market, with the difference that export performance is also subject to the evolution of the climate. On the other hand, their use is less widespread in U.S. gastronomy than shrimp, so there is room to grow by educating the consumer. In any case, the fact that the jump has been greater in value than in quantity suggests that demand is dynamic and there are opportunities to be seized.

As for tilapia and trout, the cases are similar to those of shrimp in terms of production. Both are produced in lagoons and are less subject to weather issues. However, competition is high and the work to distinguish Peruvian origin is important.

More attractive ports

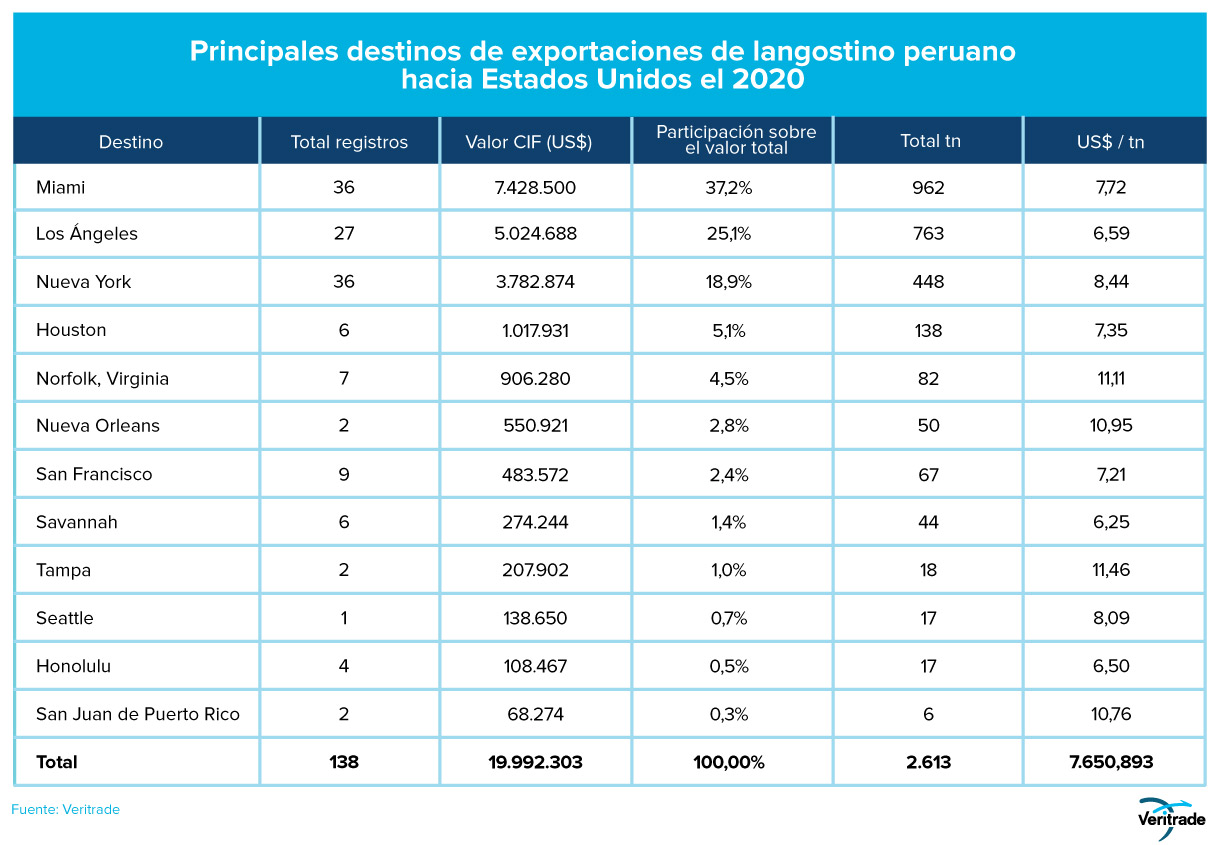

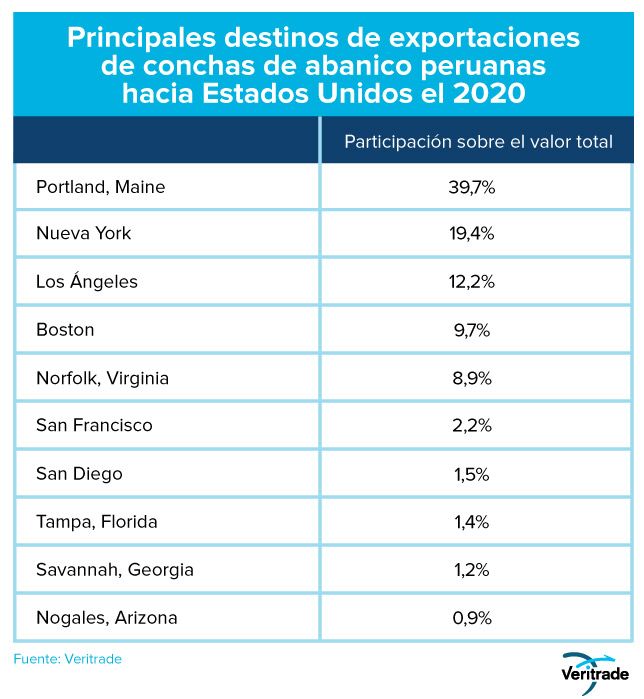

When evaluating export markets, the United States has the advantage of being a decentralized country with coasts on both oceans. For this reason, it is convenient to analyze the ports of entry of the merchandise, in order to study where the current consumers are and in which areas an expansion could be evaluated. The following tables show the details for shrimp and fan shells.

In the case of shrimp, the distribution of destinations is similar to that of the general commercial movement from Peru, with the ports of the large cities as the main points. This suggests that consumption is uniform throughout the country, and that the geographic location of the market will be easily supplied by operators who are already familiar with the product.

In the case of shells, there is a marked difference. It seems that the fact that it is mainly destined for the northeastern market is linked to the Europeanized gastronomic culture. However, this may also be an indicator that the southern market is underserved, so the potential of areas such as Florida, Texas and California should be investigated.

Looking ahead

Finally, a relevant aspect to take into account is the Peruvian government's work to achieve sanitary certification of origin. In this regard, the strengthening of the National Fisheries Health Agency (Sanipes) is among the State's priorities.

For more information on how to take advantage of the potential of Peruvian aquaculture products, request a free 5-day trial by registering here: https://bit.ly/VRTFreeTrial