Gold in the water: Chilean salmon and its brilliant recovery

Published on 23 July 2021The quasi-luxury consumption pattern led to the product being discontinued as food after the global economic slowdown of 2Q20, but this was reversed towards the end of the year.

The economic recovery following mass immunization against Covid-19 was anticipated since March 2020, when the pandemic began. This materialized from the fourth quarter of that year, when a combination of intermissions between waves of contagions in developed countries, with the announcement of authorizations to distribute vaccines, led to a rebound in the markets.

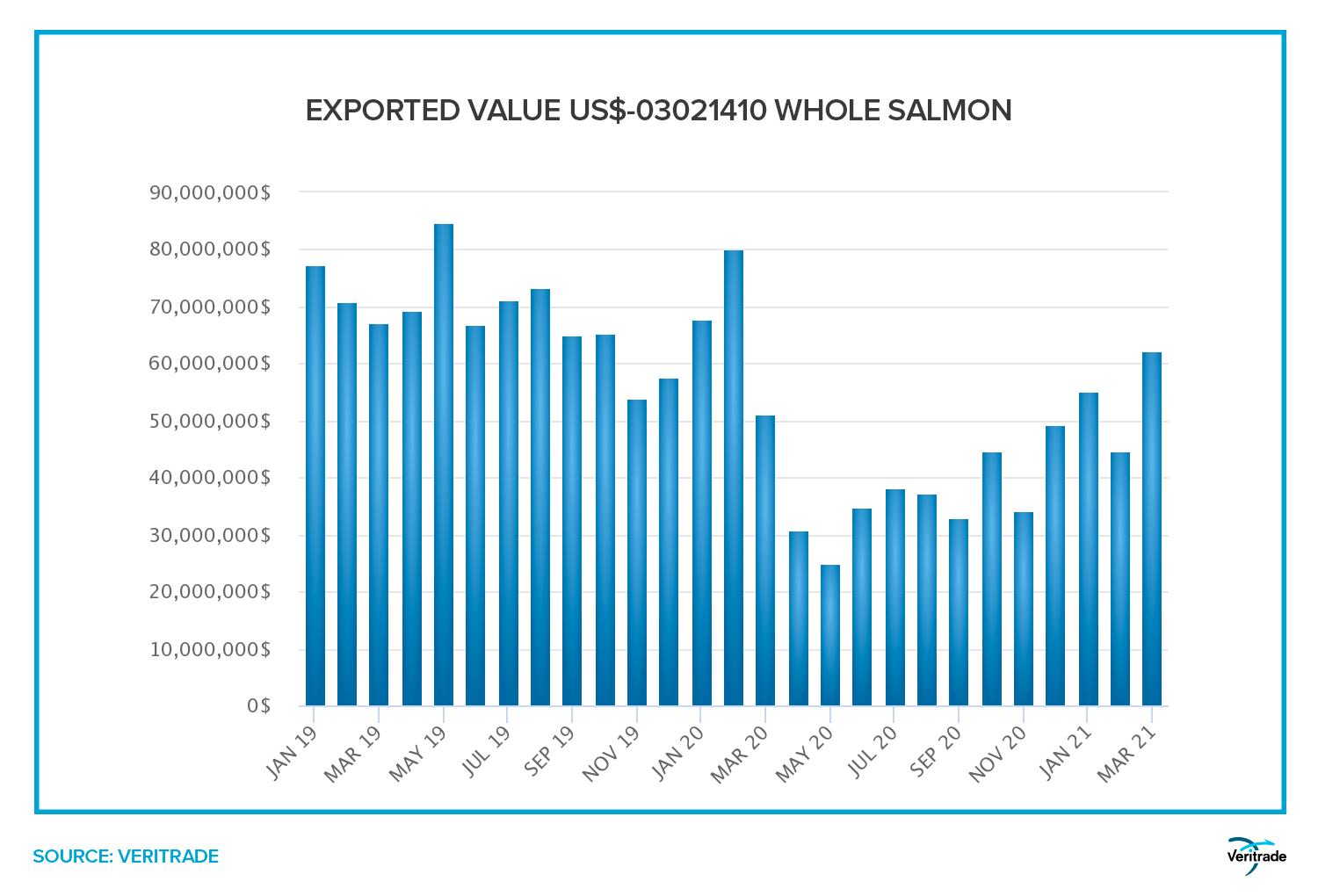

The value of salmon exports has reflected this evolution, which is visible in the case of shipments from Chile. This is the second largest source of this product in the world and, therefore, a benchmark in the high-value aquaculture sector at a global level. This segment contrasts with most food products such as fruits, vegetables and low-cost fish, which experienced stable and even growing demand throughout the year. For this reason, the drop during the pandemic appears to have been difficult to avoid.

With substitutes such as canned tuna or tilapia, salmon is now expendable on the list of household table staples. Additionally, out-of-home demand was also affected because restaurants were closed or operated with limited capacity for most of the year. And finally, an import blockade by processing plants in Russia also played a role in this outcome.

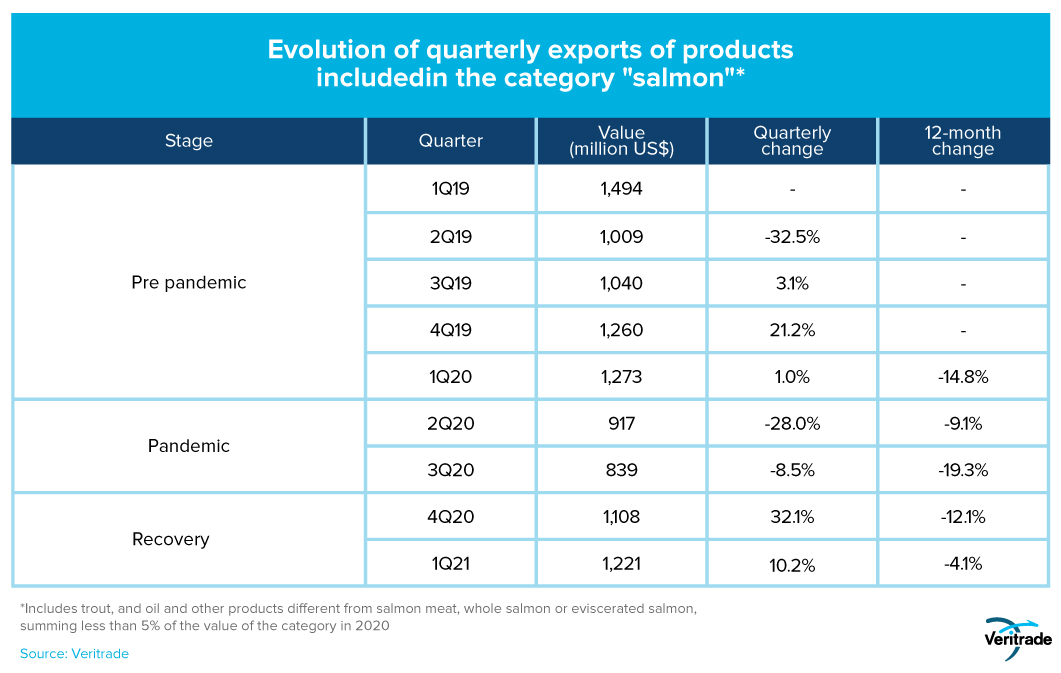

Fortunately for Chilean fish farmers, the reversal has been marked since October. This is shown in the following table, which shows the impact of the recovery of optimism and the lifting of mobility restrictions.

Detail by phase

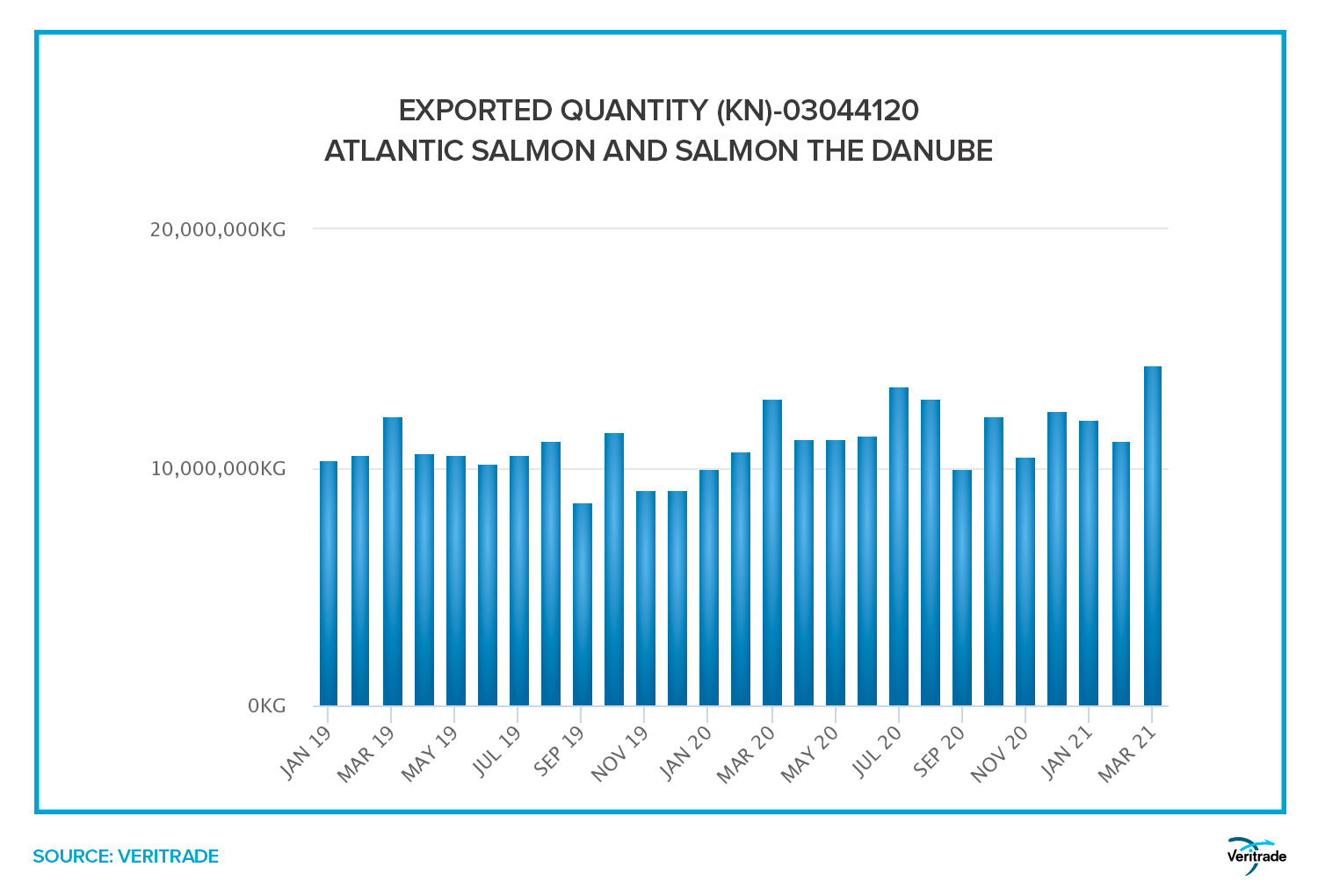

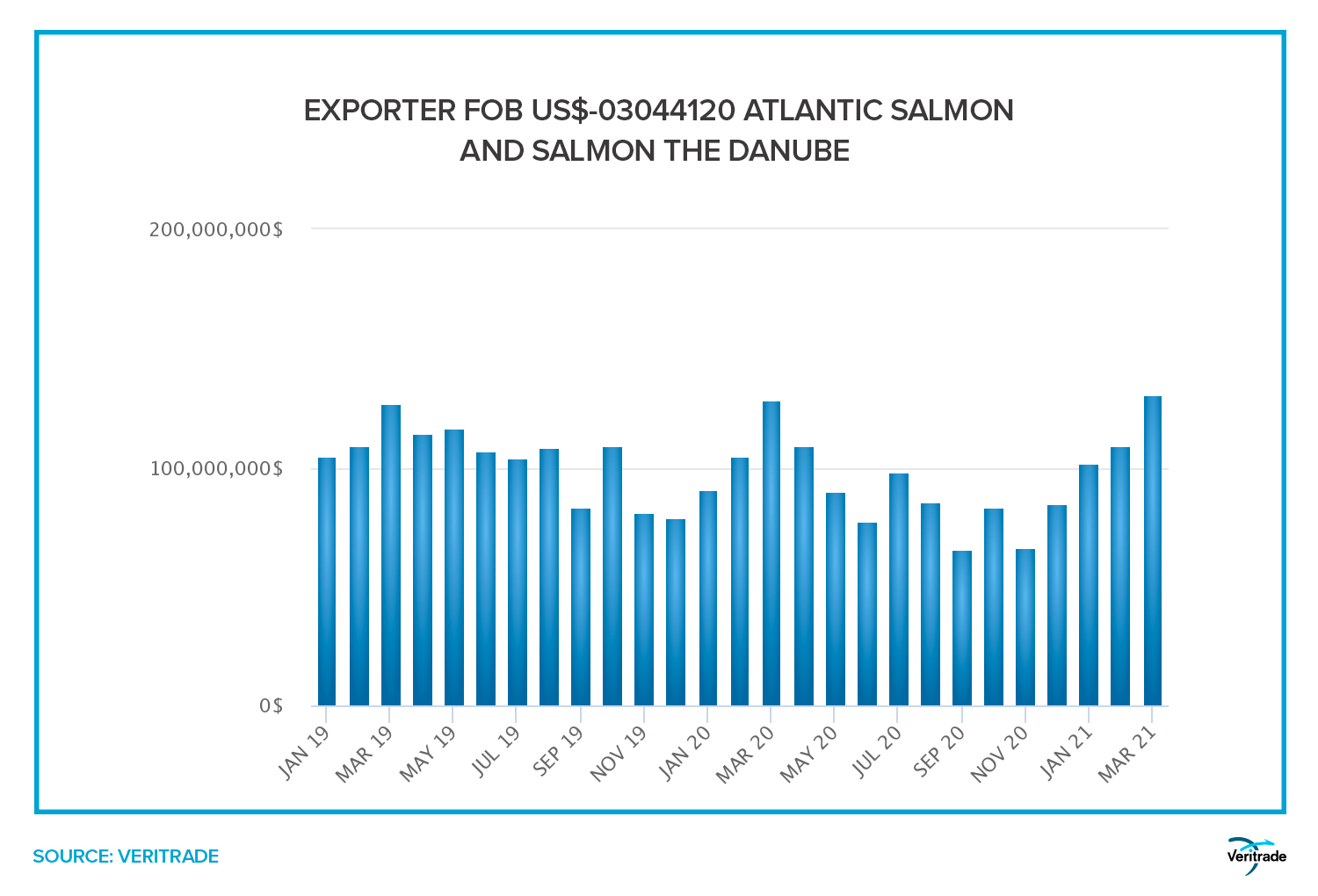

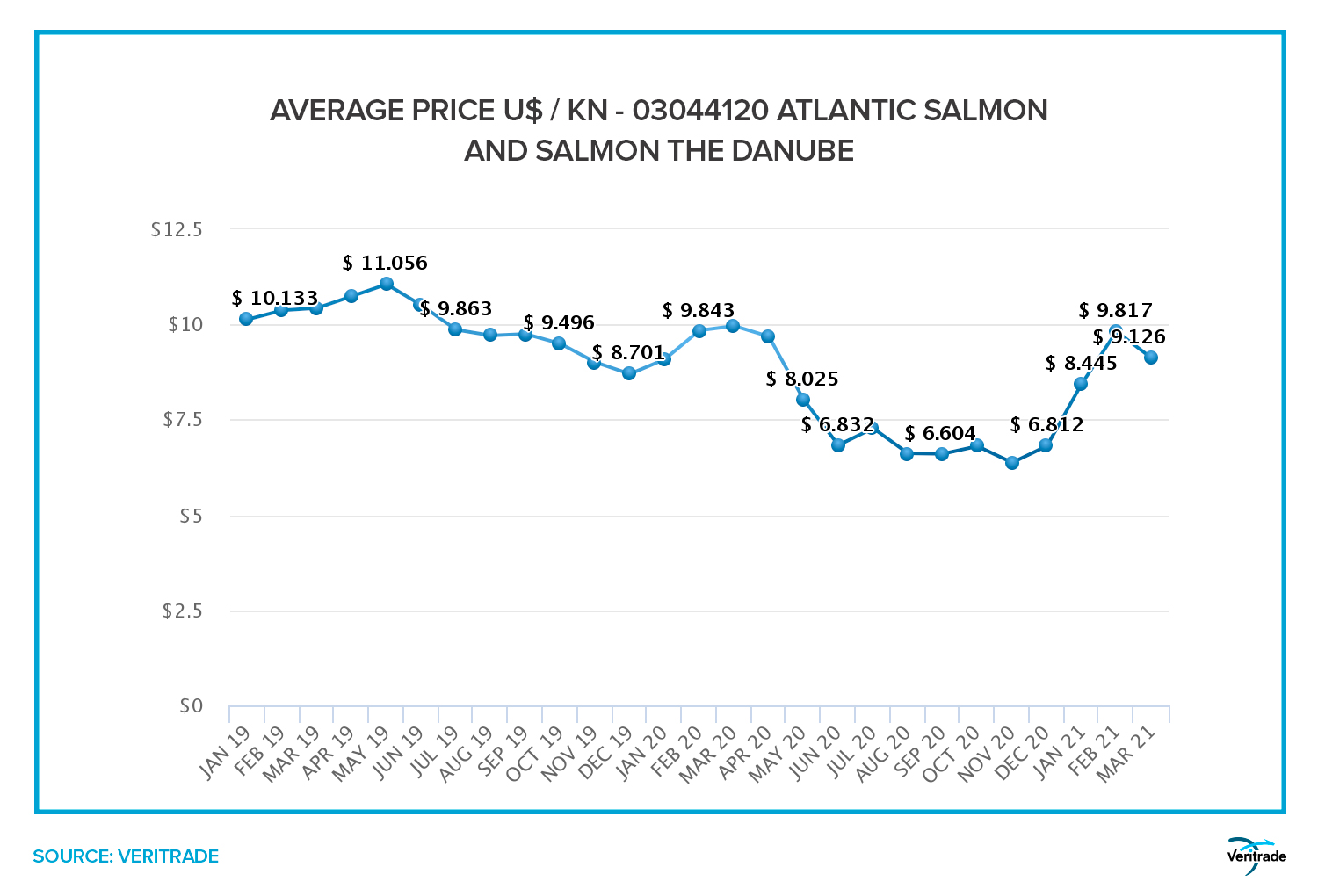

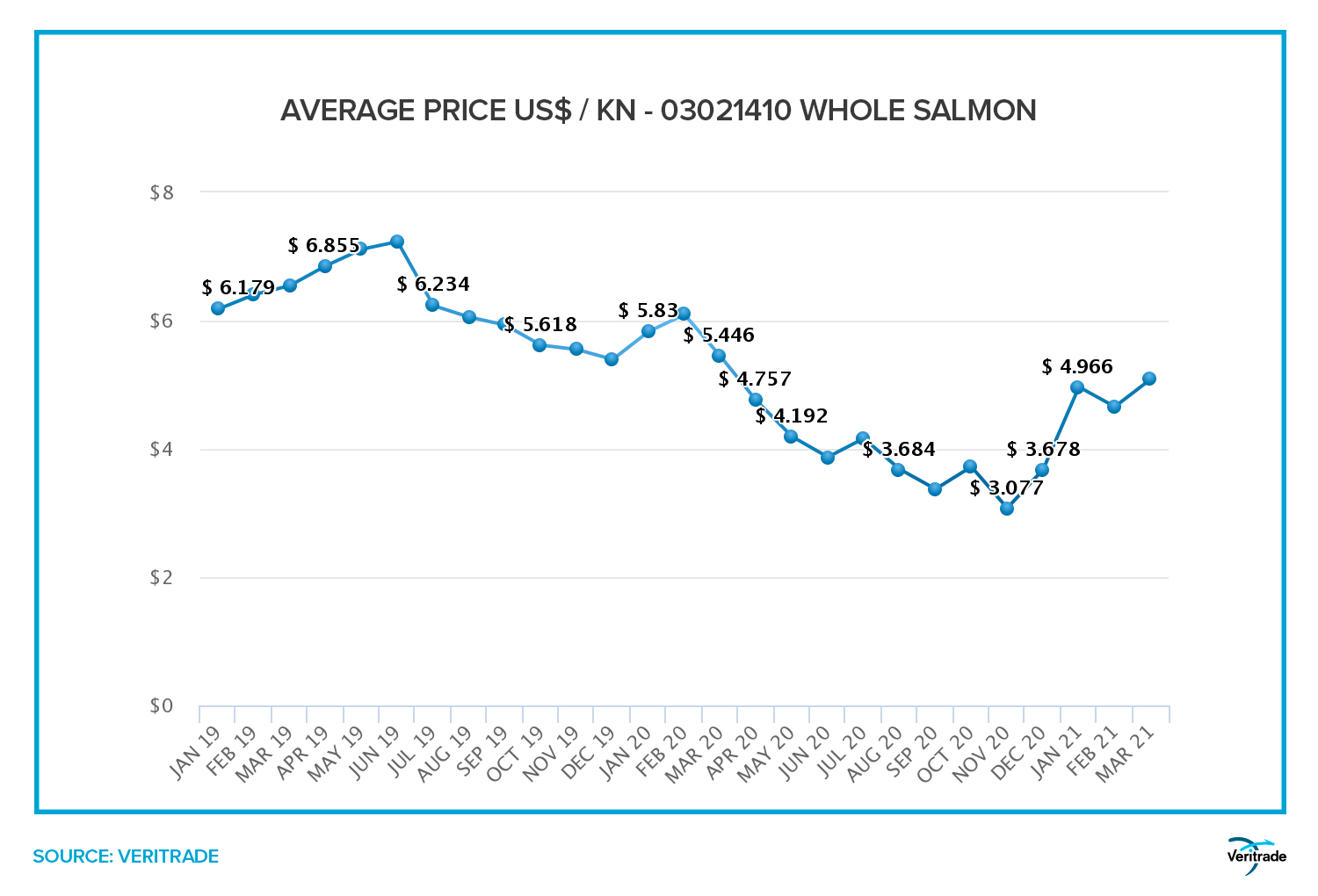

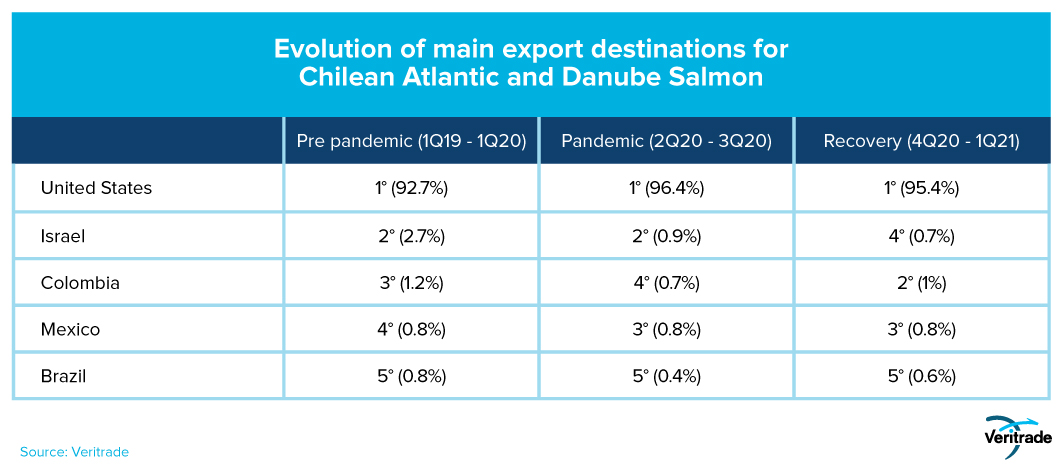

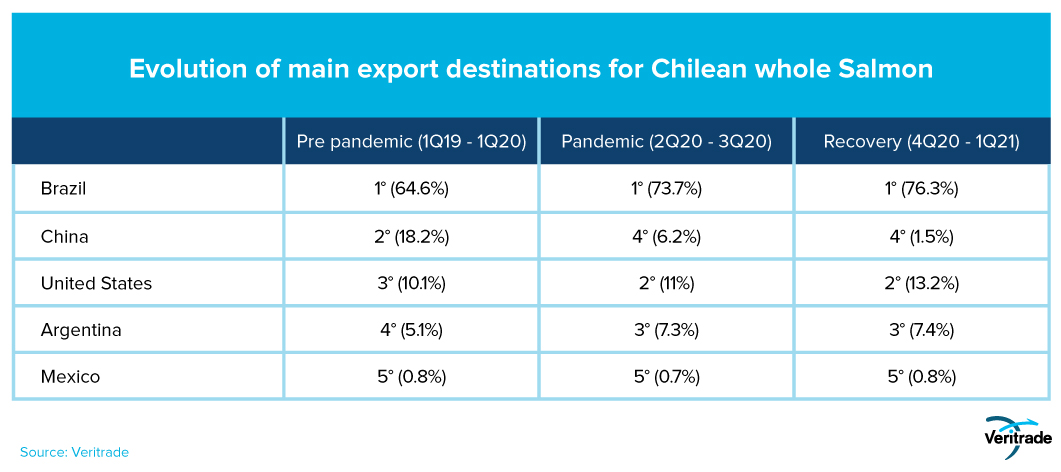

Segmentation by phase is marked. The mobility restrictions due to the pandemic started in the second half of March 2020, and the results of the consequent lower demand were clearly shown since 2Q20.The following chart for the cases of Chilean exports of Atlantic and Danube salmon, and for whole salmon, help to better understand the evolution of what is described in the previous table, with a greater component of prices than quantities. This is evidence that the producers had to accommodate to the new balance between supply and demand, which led them to reduce prices in order to continue selling their products. The following graphs show what happened with exports in each of the stages mentioned in the table above, for the two high value items that underwent a marked change in this sense.

Prior to the pandemic, the trend was already visible from the first quarter of 2020, as can be seen in the case of whole salmon. This product was particularly impacted by the advance of the disease in China since the end of 2019. Subsequently, the drop became generalized in the second quarter, and finally a marked upward trend started in December, in parallel with the start of vaccination.

Changes in the global market

The reestablishment of the movement of Chilean salmon exports after the pandemic is almost at levels similar to those observed before the pandemic. However, there has been a perceptible change in the lower recovery of shipments to China and in a greater relevance of the United States in the recovery, as can be concluded after observing the following graphs.

The reduction in China's share could be temporary, given the scale of the market. On the other hand, there are indications that the U.S. market has taken off and there could be room to look for opportunities in view of the jump in consumer confidence. Added to this is the Latin American market, which although smaller in size, always offers the advantage of better prices due to lower transportation costs.

This is the kind of conclusion that can be supported by figures obtained from Veritrade. To get a better idea of the potential of having access to trade information from all over the world, request a free 5-day trial by registering here https://bit.ly/VRTFreeTrial.