Ecuador: the new favorite of the European Union?

Published on 21 July 2021

Since the treaty came into force in 2017, shipments to the old continent have generated more income, where organic products stand out.

The beginning of the contemporary trade relationship between the two regions has a clear date: in 2019, the Ecuador - European Union Trade Agreement came into force.

After more than a decade of loss of competitiveness against Peru and Colombia, countries noted for their openness policy aimed at eliminating tariffs and establishing protocols to enter new markets, the Ecuadorian government has managed to catch up in foreign trade. Indeed, according to the Ministry of Production, Foreign Trade, Investment, Aquaculture and Fisheries in 2017, the first year the agreement was in force, the value of non-oil exports increased by an imposing 12%, and, as proof of the resilience of the effects of the agreement, a similar growth was achieved in 2020, despite restrictions due to the global health crisis.

Looking at the figures

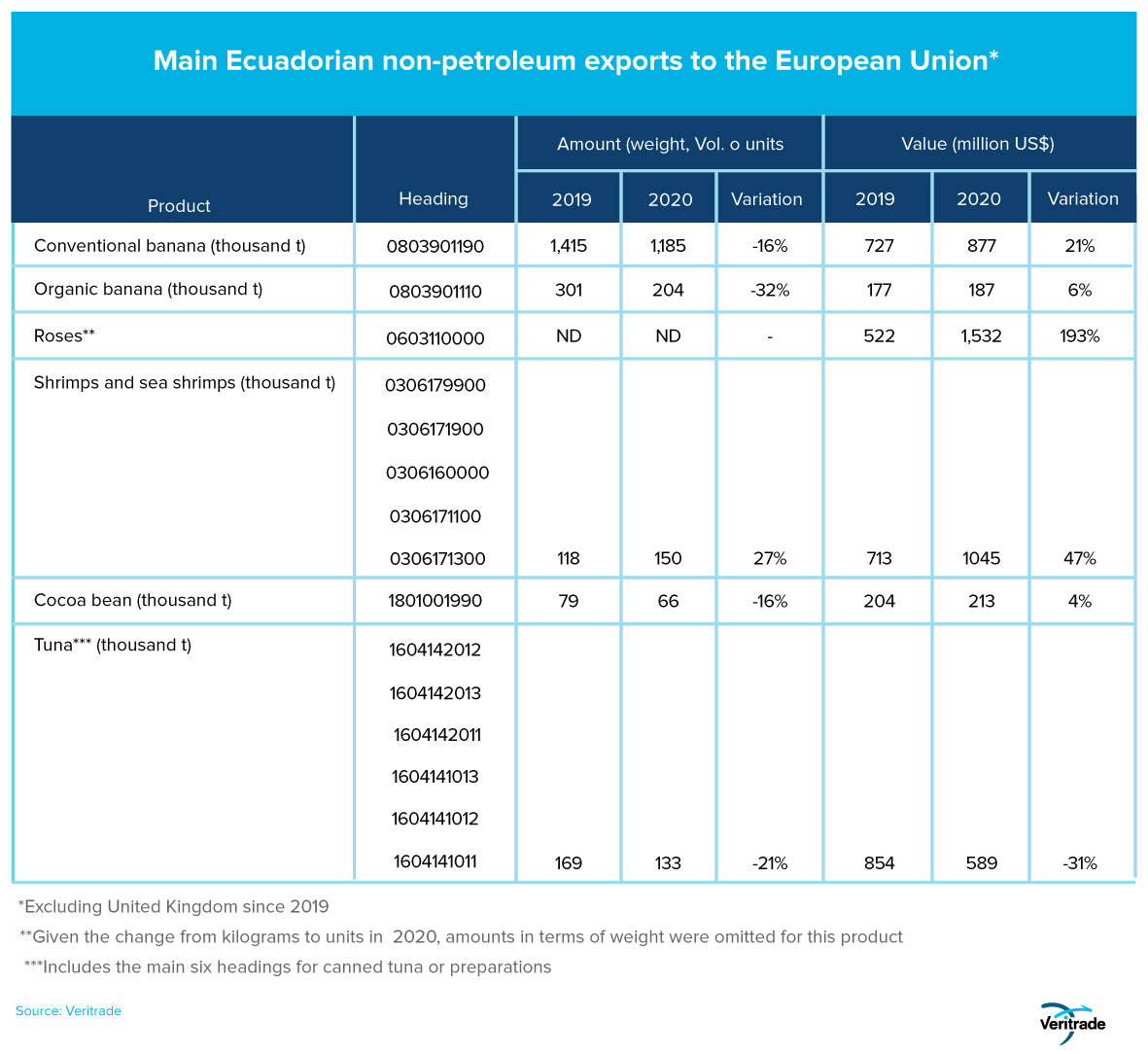

To better understand the impact of the tariff reduction, it is important to analyze Ecuador's non-oil export portfolio. A first relevant factor is that its products face high competition from Colombia, Peru, African and tropical Asian countries.

It is worth mentioning that the progress of the last year has not only been in terms of merchandise movement. Prices have reflected the improvement in future expectations, as shown by the contrast between the negative variations in weight or volume for certain products, compared to the higher value generated by their sales. However, there are external factors that cannot be controlled, such as the La Niña phenomenon, which affected the fish supply.

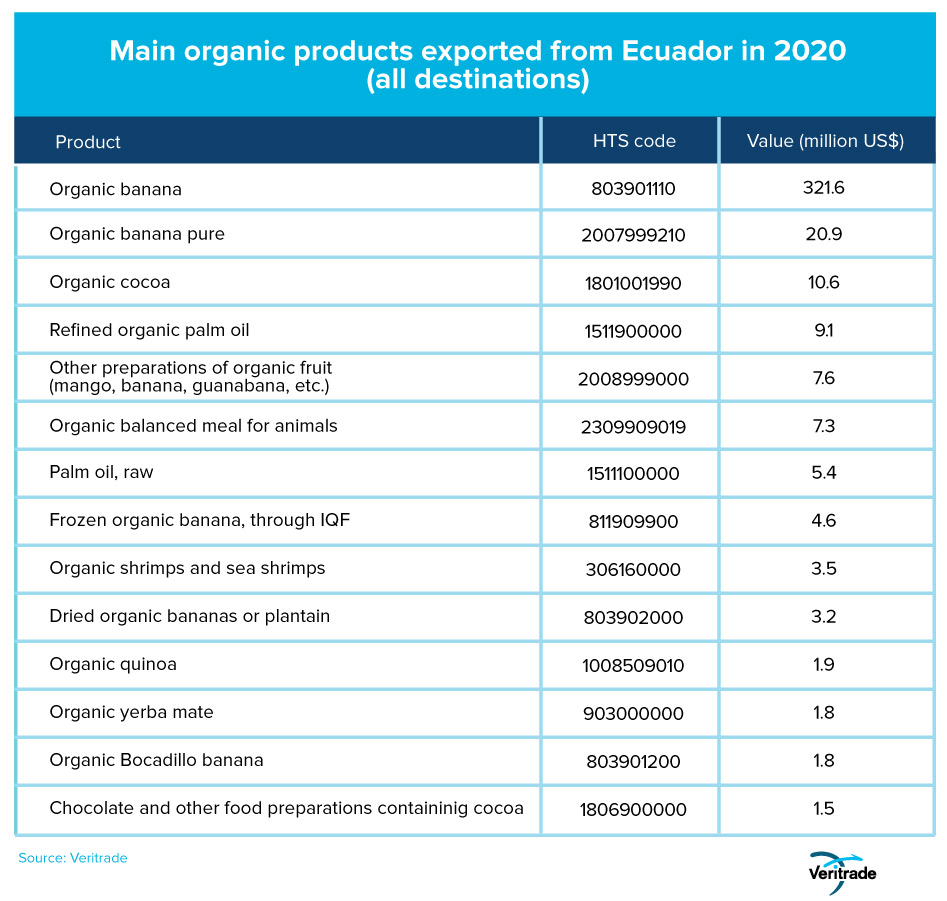

The organic opportunity

Among the alternatives to take advantage of the opening and protect against external factors are products with organic certification. This is more easily obtained thanks to the cleanliness of the land due to the absence of extensive crops and the rudimentary nature of the planting processes, which have gone from being a source of backwardness to a comparative advantage. In addition to cocoa and bananas, there are other niche products such as dehydrated fruit, palm oil, animal feed and even shrimp.

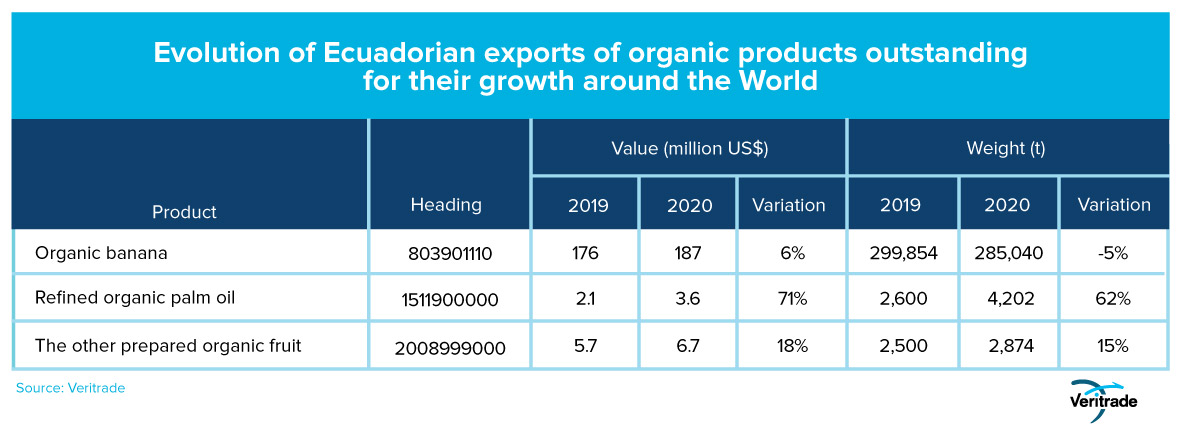

The qualities of organic products allowed them to prosper in the midst of a difficult year. This can be seen in the following table, which shows the performance of Ecuadorian organic products in the European Union market with the highest growth in the world.

A look at the top

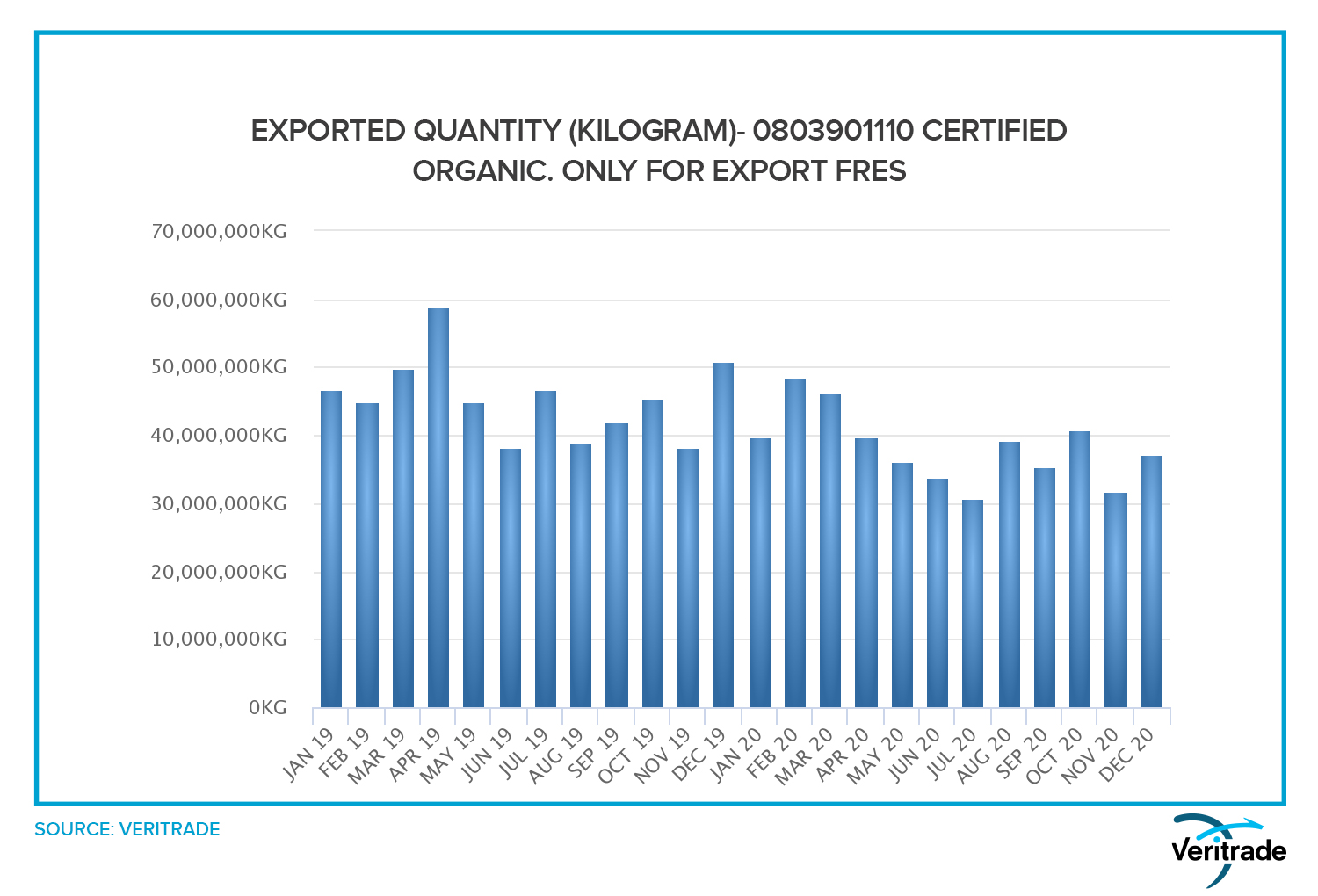

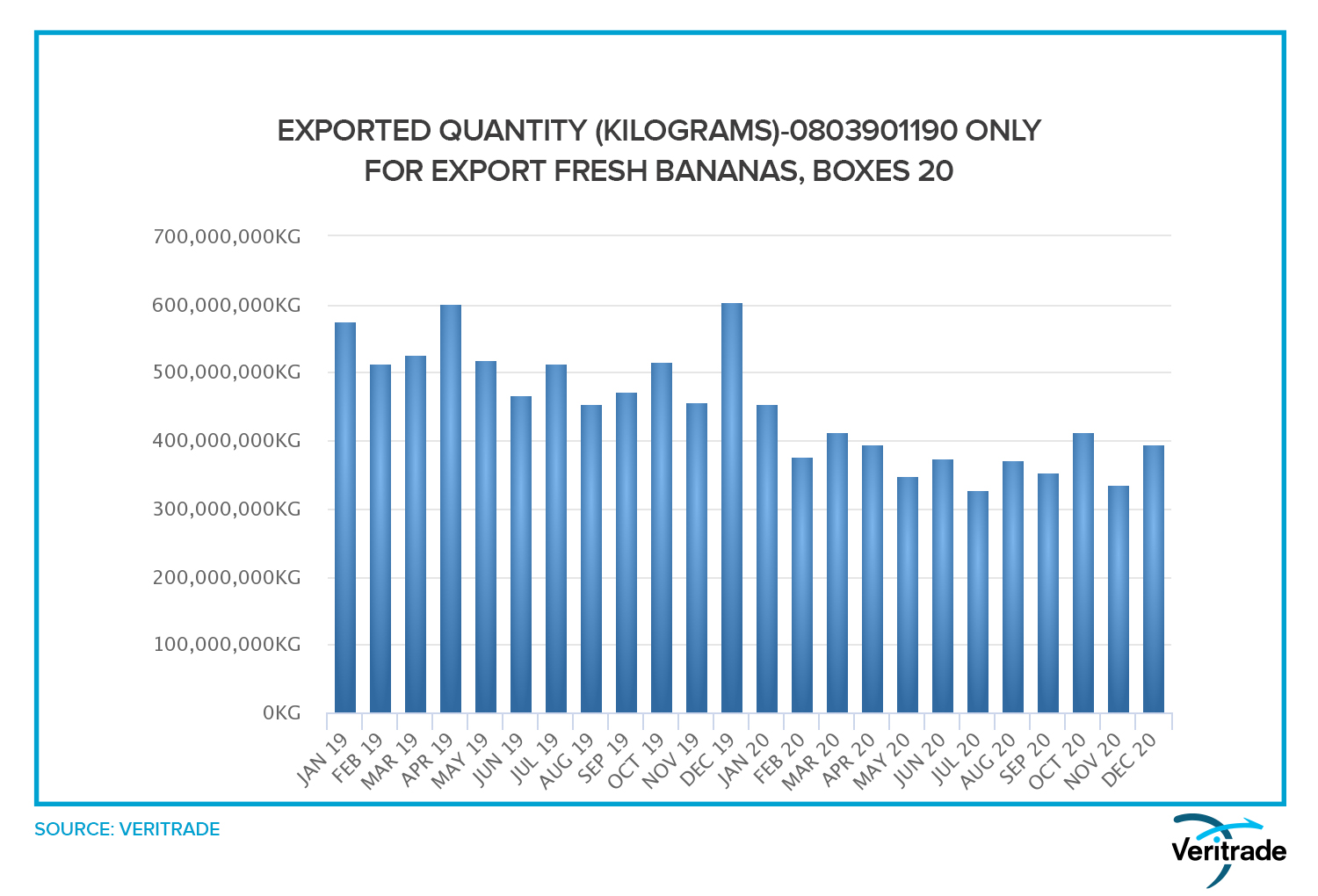

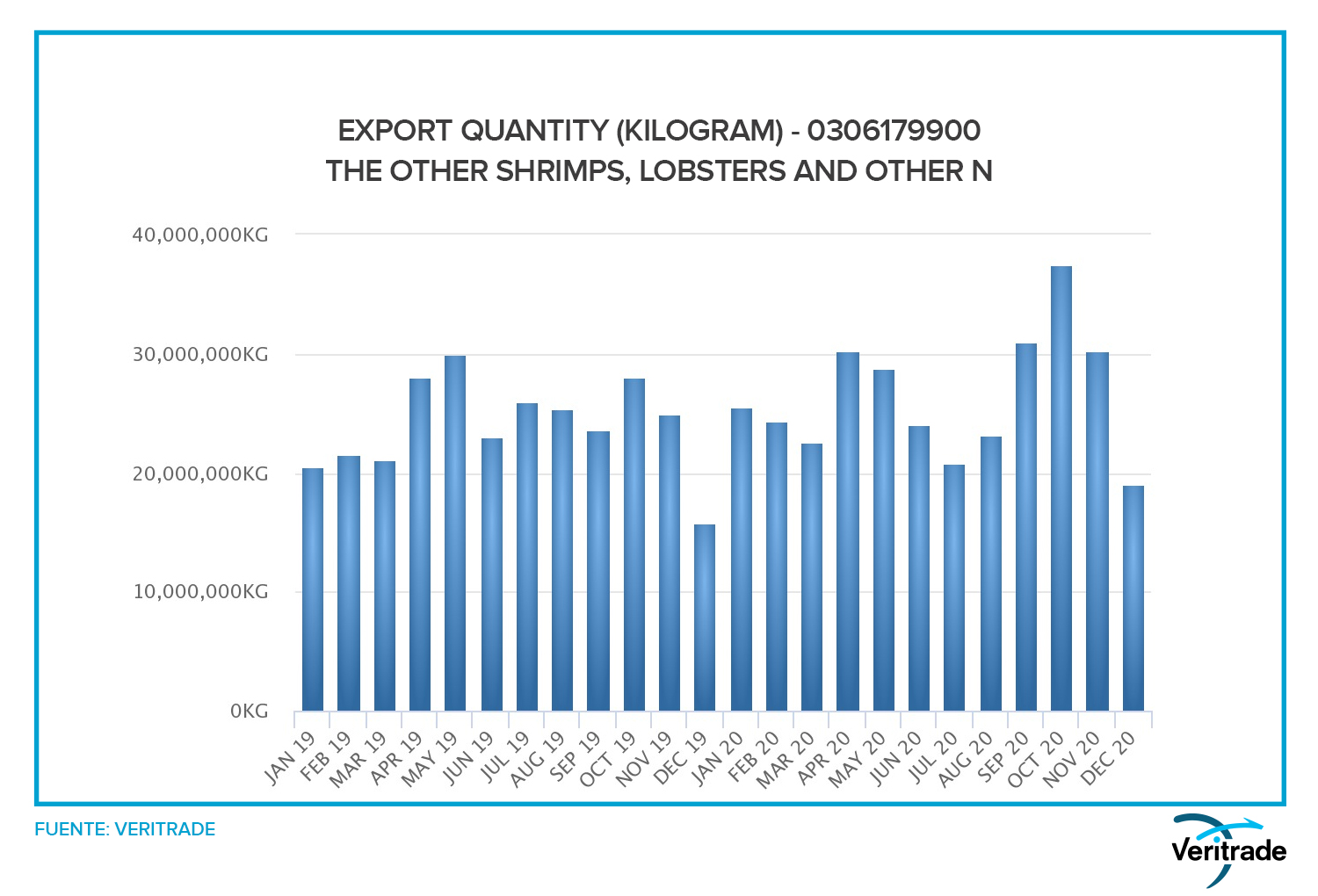

The results have been mixed in shipments of Ecuador's main non-oil products to the rest of the world. In some cases, there has even been an increase in value that contrasts with what happened in quantities, which, as shown in the following bar graphs, have fallen in important cases such as bananas, which nevertheless registered an increase in value. In contrast, there was a rise in shrimp and prawns, the third most important product with a uniform record in terms of weight (roses were omitted due to a change in the notation from kilograms in 2019 to units in 2020).

All indications are that, in the absence of weather problems, non-oil products exported from Ecuador should record similar or even better sales levels than in 2020. If the investor is attentive, he can achieve greater profitability by finding open windows for exports of organic products, for which margins are higher.

To monitor competition and prices, you can enter the product description or item number in the spaces on our platform for entering filters. This will provide information on exporters, importers, ports of departure and entry, means of transport used, values and magnitudes of shipments. Additionally, all the information can be downloaded in Excel spreadsheets, and you can even automatically generate reports with graphs such as the bar charts shown above.

All data on trade between Ecuador and the European Union can be found on the Veritrade portal. Request a free 5-day trial by registering here https://bit.ly/VRTFreeTrial