Commodities: drivers of recovery in Latin America

Published on 15 July 2021

The fact that expectations recovered before sales of products and services generated a reactivation based more on prices than on quantities.

The global economy has experienced a sudden recovery as a result of improved expectations. However, this has not yet translated into more transactions to purchase goods from other countries. With the announcement of mass immunizations at the end of last year, financial and commodity markets (minerals and agricultural products whose qualities vary little or not at all between producers and origins, which can also be stored as inventory for speculation and are traded at unique prices in international markets) reacted abruptly as more laboratories announced successful testing of their vaccines to prevent contagion and extreme symptoms of the virus.

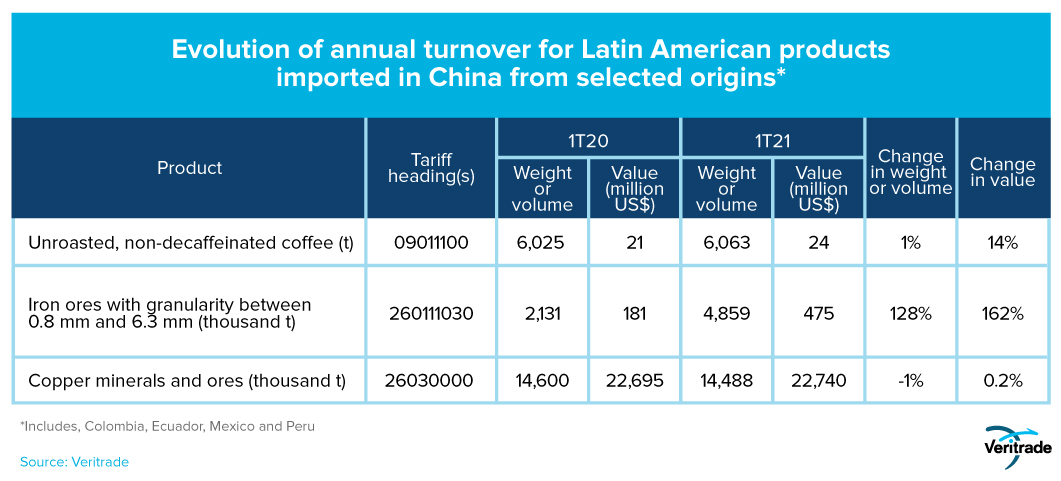

The transition from an expectations shock to a demand shock is gradual. The following tables show the evolution of outstanding commodity exports by Latin American countries to the world's main markets.

Clearly, market expectations did not materialize in terms of increased product movement. However, the results began to show a marked contrast in terms of value. According to a report by the Inter-American Development Bank (IDB), revenues generated by Latin American exports fell 9% in 2020, a more moderate figure compared to the range of between 11.3% and 13% that the same organization estimated in December for the drop in terms of weight, volume or units.

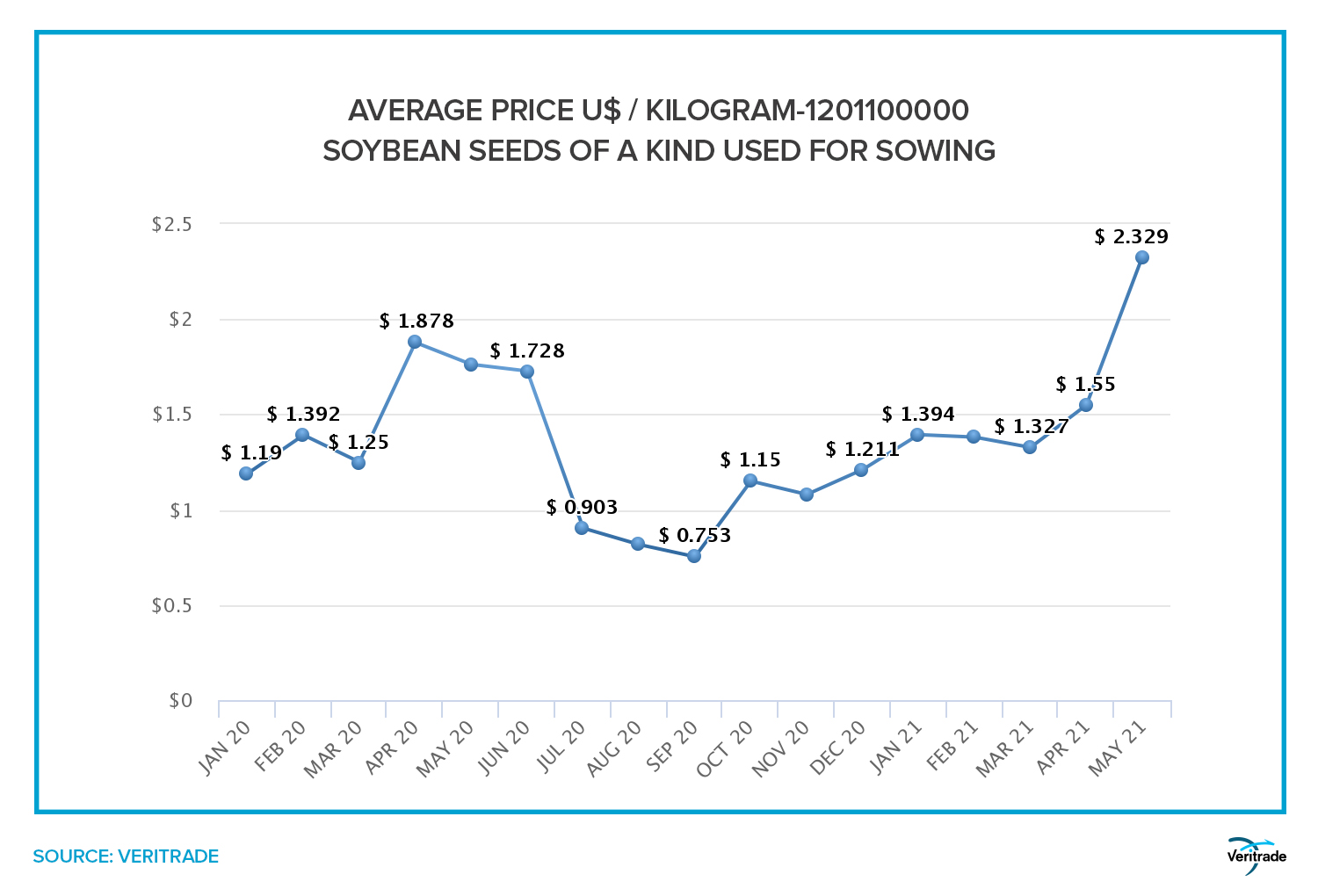

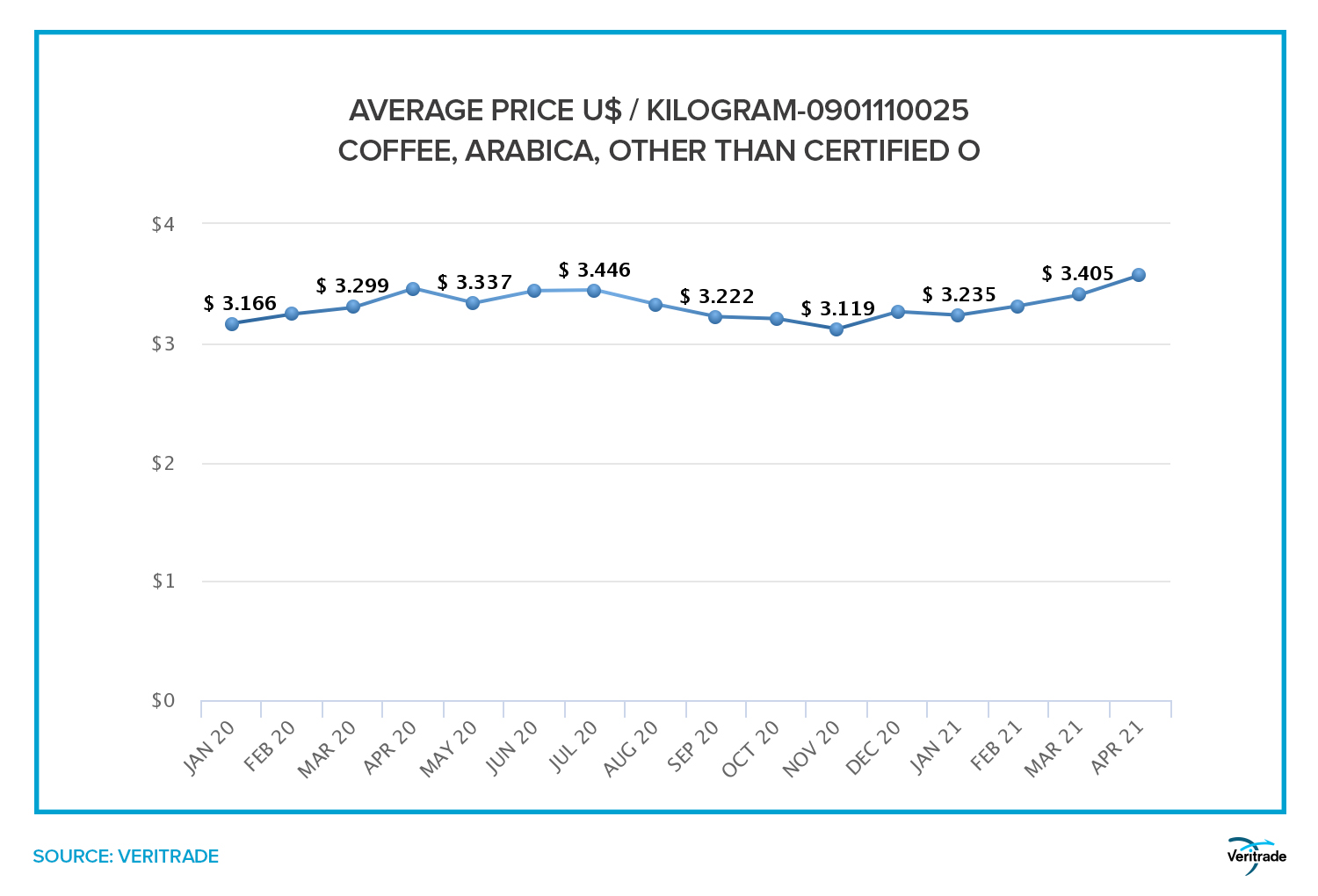

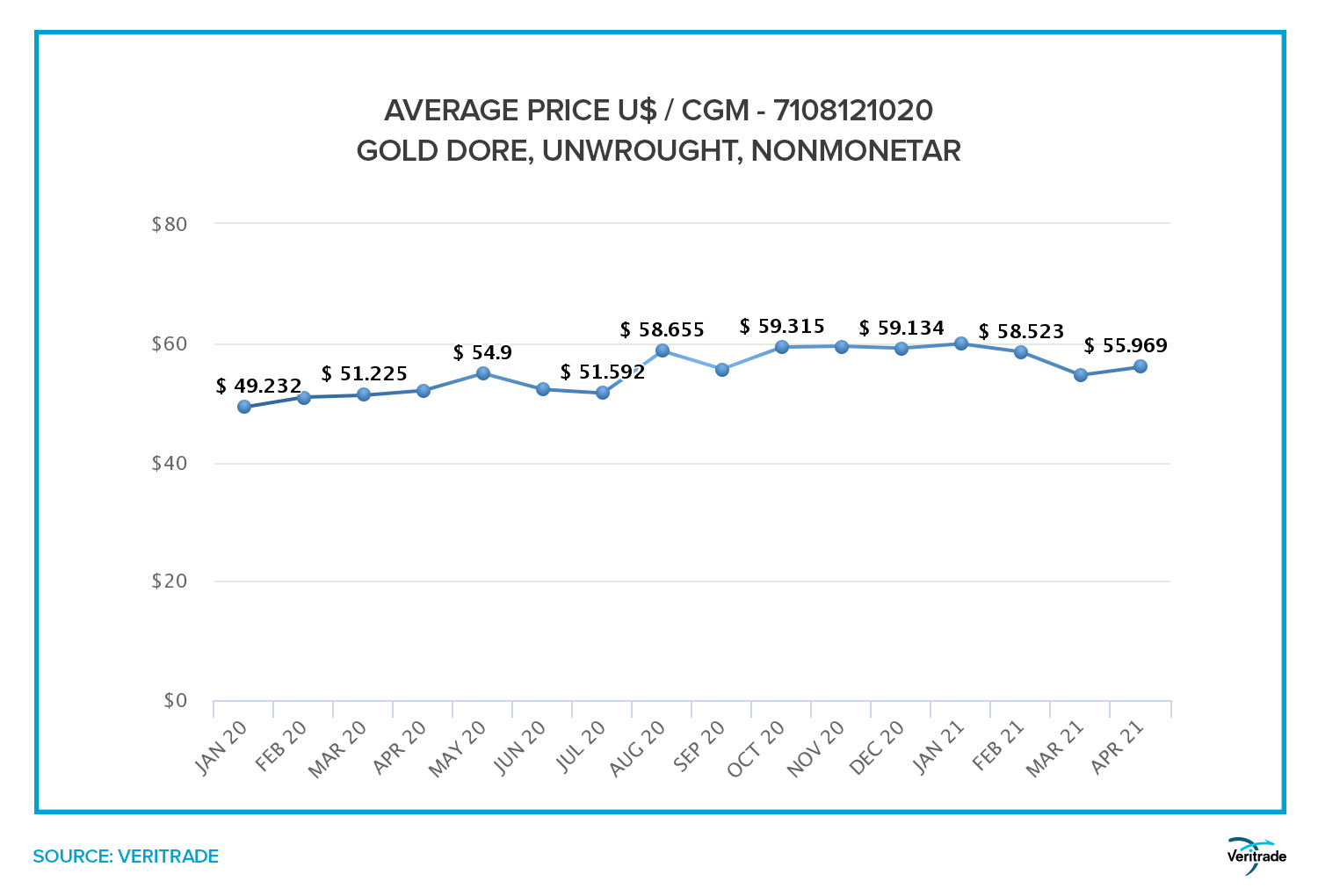

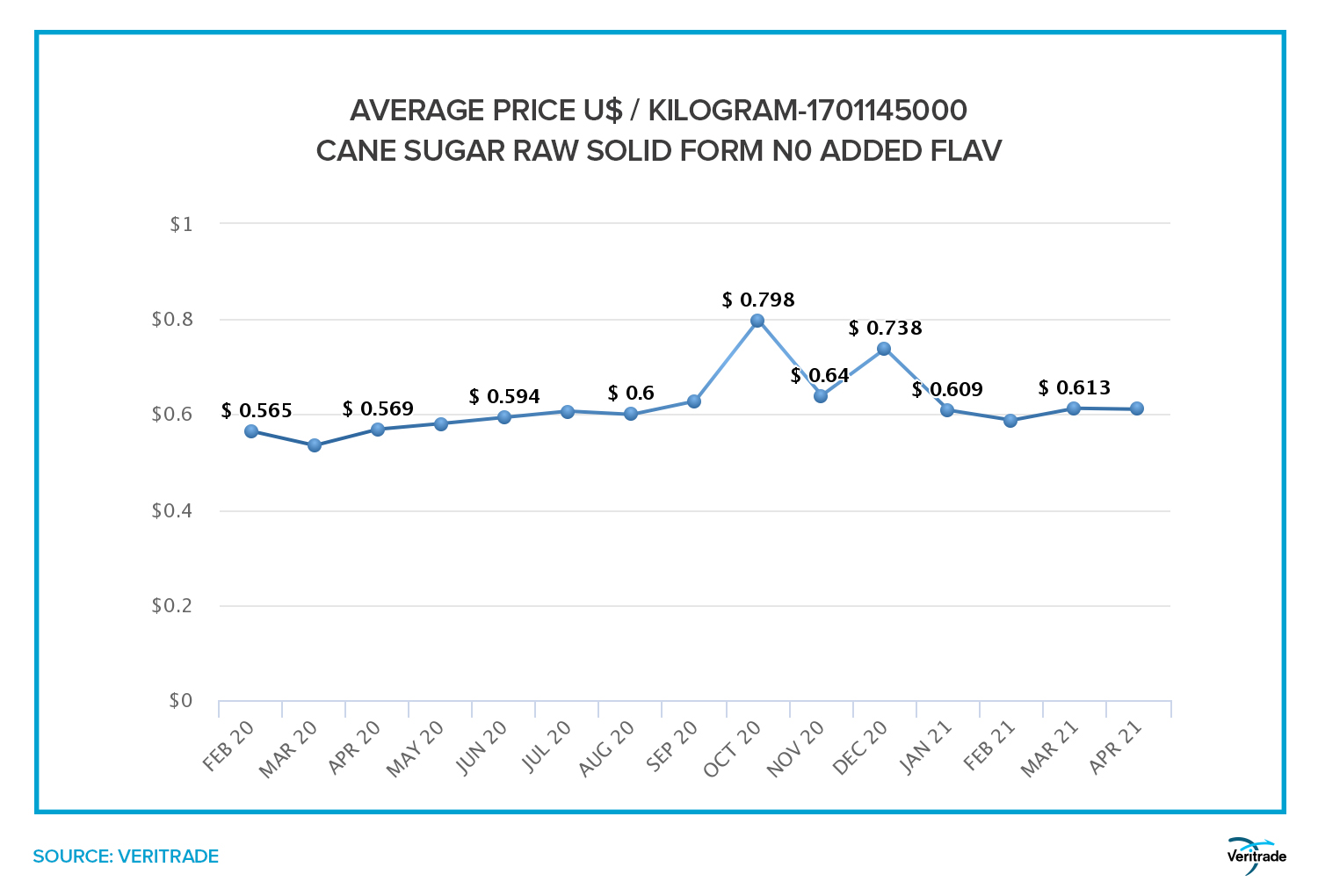

The difference occurred because the rebound in expectations led prices to recover ahead of demand. The following two graphs clearly show this trend, with levels even higher than in the months prior to the pandemic, which is repeated for other products.

More sales in the first quarter

Expectations finally materialized this year as progress was made in immunizations to end the pandemic. According to the IDB report, the value of the region's exports grew 8.9% in the first quarter compared to the same period in 2020 as a result of higher commodity prices. In fact, some of the main products did not register an increase in the movement of goods abroad.

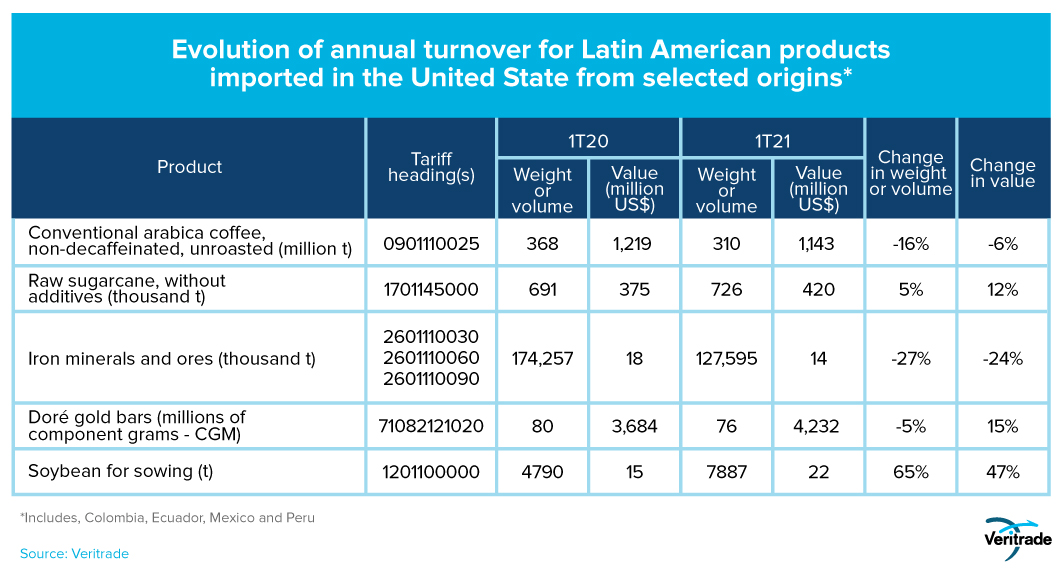

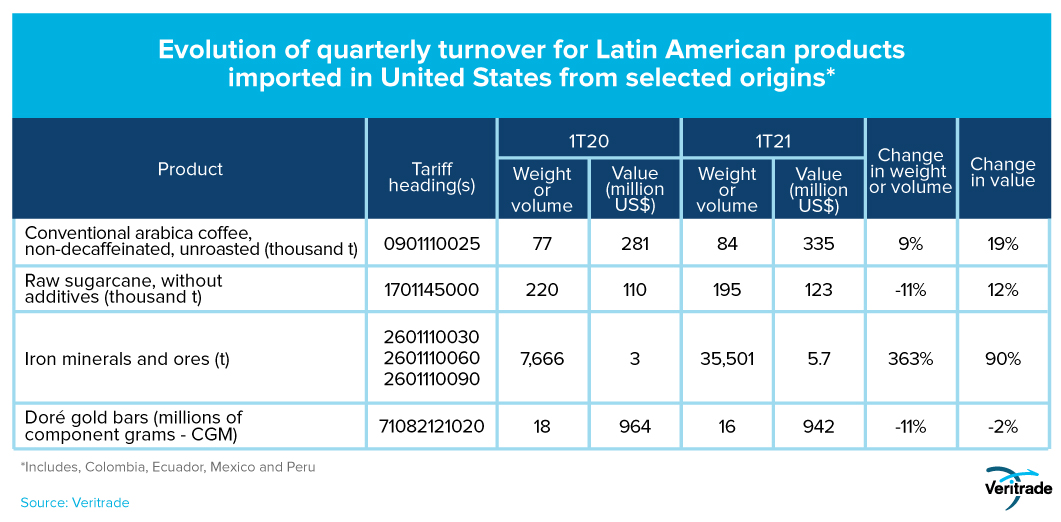

The following table shows the results for the main commodities imported into the United States from Latin American Pacific countries.

The figures in terms of quantities may give the impression that exports would not have performed well in the first three months of 2021. However, the improvements in prices contrast the cases, and except for the fall in gold demand due to the decrease in financial uncertainty and inflation fears, the trend is to keep raw materials for sectors such as metallurgy and technology on the rise. Thus, the coffee, sugar, and mining industries related to the U.S. construction industry, steel and electrical conductors, may have good prospects. The following graphs can give an idea of the trend when comparing each month with the same period of the previous year.

Opportunities in sight

There is now an air of optimism in the U.S. market. Inflation fears have been allayed and the way is paved for a smooth recovery. In this situation, it is timely to review the ways in which we can take better advantage of the situation, and Veritrade may be the best tool to do so.

As an example, if the aim is to export coffee, it is enough to insert the heading 0901110025 in the search engine to find the information for each destination point within the country. The portal will allow the information to be broken down by port of arrival and country of origin to obtain data such as the value, weight and date of each shipment.

For more information on the evolution of commodity exports from Latin America, request a free 5-day trial by registering here https://bit.ly/VRTFreeTrial