Colombian avocado arrives to South Korea

Published on 18 June 2021

After obtaining the sanitary permit, the new star of the non-traditional portfolio added one more country to the list of major markets for its sale abroad.

After a long process, Hass avocado producers from Colombia obtained authorization to export these products to South Korea. The Asian country is not only recognized for its high level of development, but also for its high level of demanding standards, so this is a doubly significant advance: it makes a difference both in quantitative terms due to the size of the market, and in qualitative terms because it serves as a benchmark to take a similar step in other demanding destinations.

South Korea is an important country for the supply of high-tech products, whether in computers and telephones, vehicles or medicines. On the other hand, the wealth generated by the sophistication of its economy allows Koreans to have a high purchasing power and are prone to develop a consumer culture, as is the case in neighboring China and Japan.

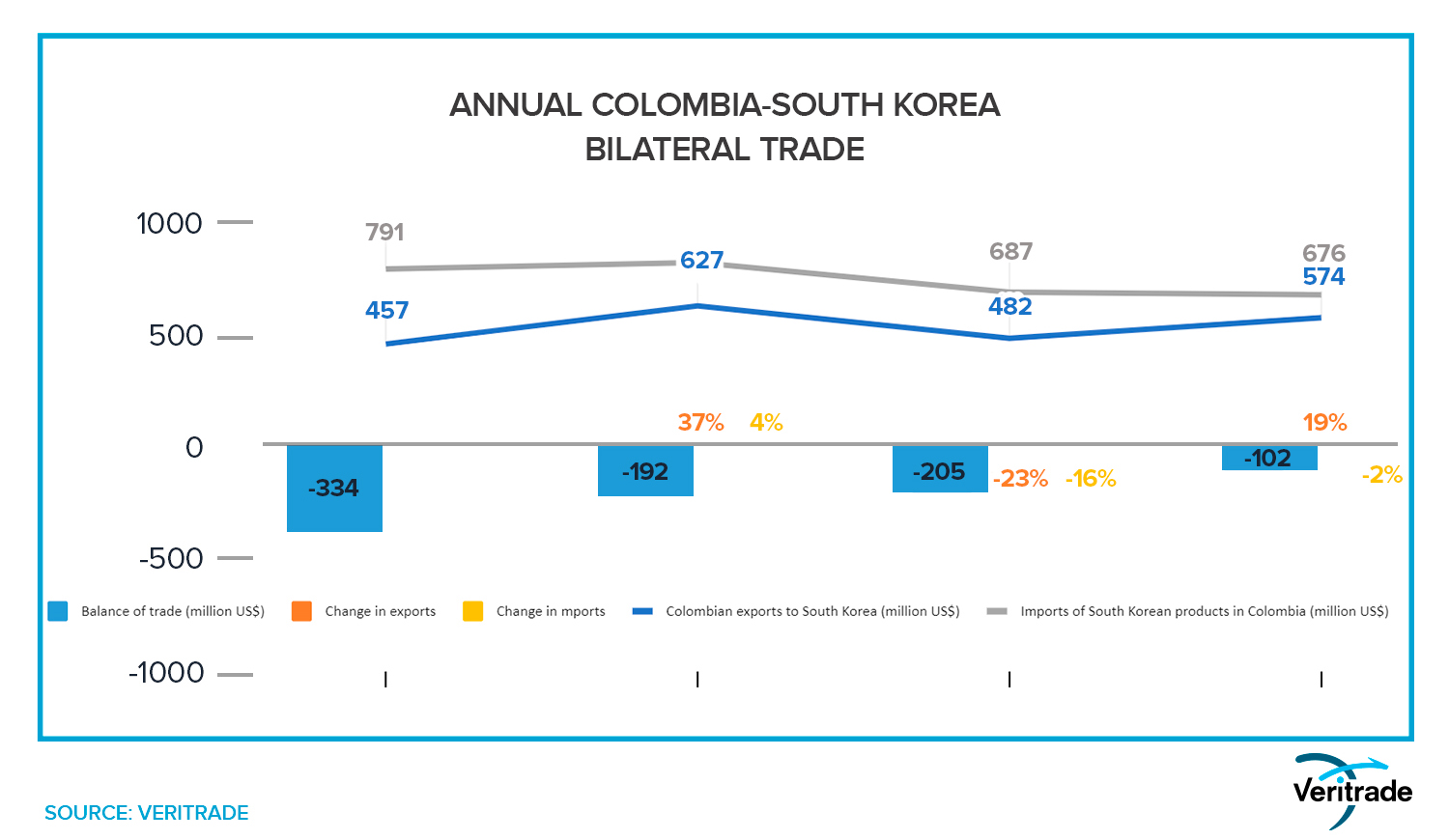

In the Colombian case, the potential for generating foreign exchange through the shipment of products highly valued in other parts of the world is high, and has been demonstrated with South Korea. The following graph, which shows the evolution of trade between the two countries, shows the contrast between the fall in imports as a result of the pandemic and the rebound in imports despite this context. The reduction of the trade deficit is a clear sign that the diversification of the portfolio is paying off for a country exposed to the loss of value in coal and the volatility of coffee.

In general terms, South Korea is a very important trading partner for Colombian development. Its case is similar to China's, with an exchange of primary, intermediate and final goods that includes raw materials, food and technological products.

Colombian avocado history

The Colombian avocado is a timely addition to the export portfolio. Unlike Chile, Peru and other producers in Africa, Asia and Europe, farmers who grow Hass avocados in Colombia are able to harvest throughout the year. This is only possible in Mexico, whose exporters are highly concentrated in supplying the United States.

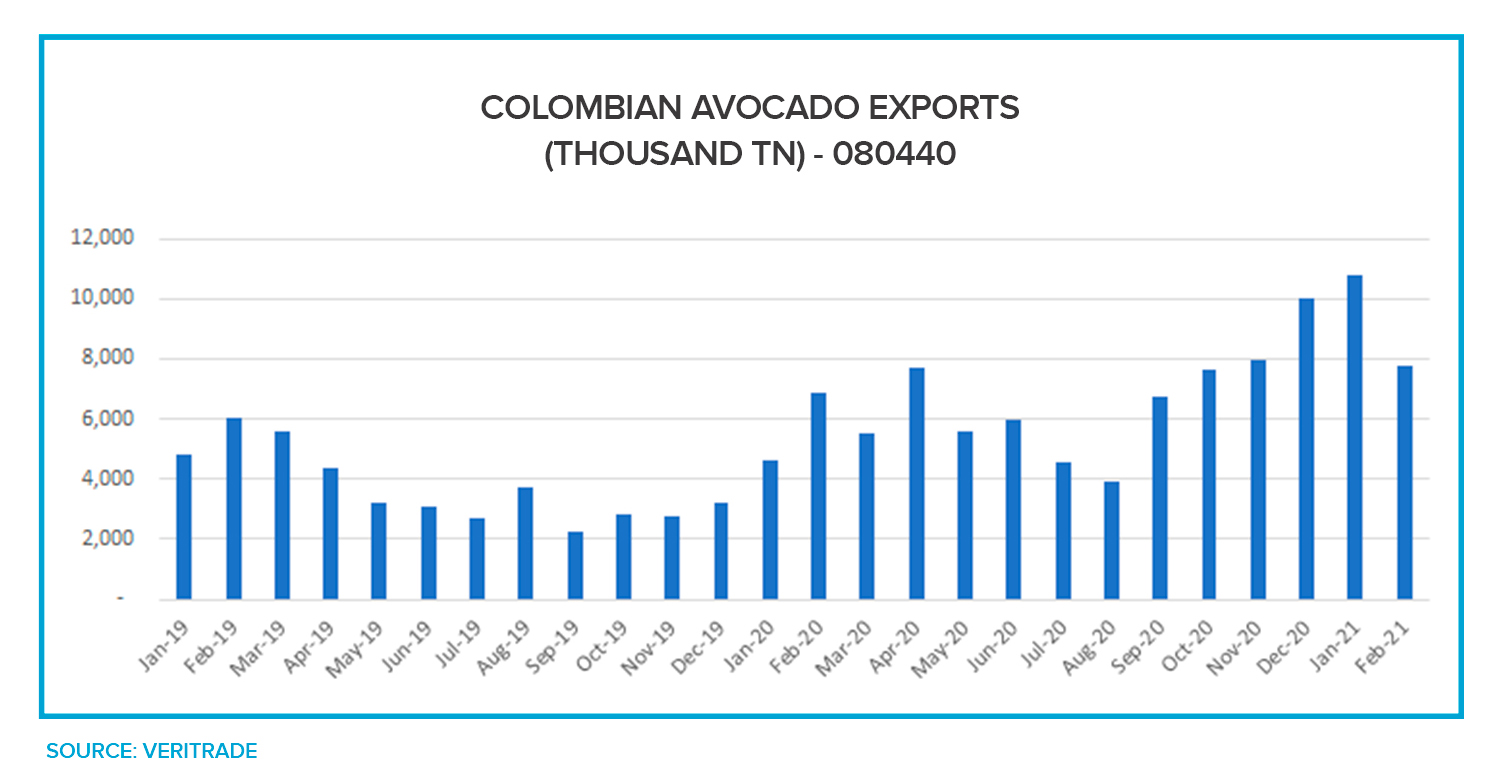

The following graph shows the monthly evolution of shipments over the last few years. The upward trend is clear, and evidences a recent and intensive work to take advantage of the qualities of the land and climate in Colombia, as well as the high demand for the product.

The peaks in Colombian avocado exports have doubled, tripled and quadrupled in 2017, 2019 and 2020 compared to 2016. An important point is that the maximum level of shipments coincides with the end of the Chilean campaign and the beginning of the Peruvian, in such a way that a window of opportunity is generated to cover the gaps that this transition generates in the market. The results in the first two months of 2021 show that this condition would continue to be exploited this year.

South Korea's place in the Colombian agricultural portfolio

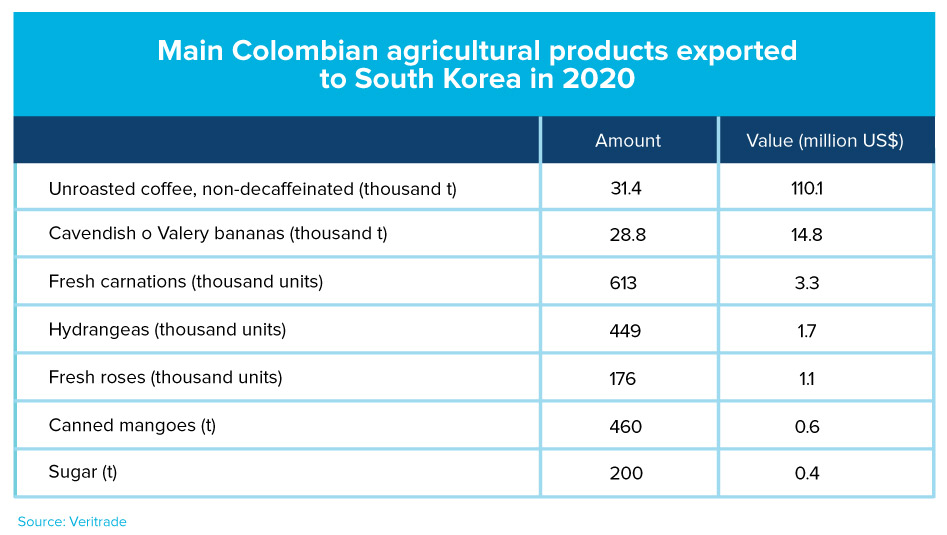

Colombia is traditionally known for its coffee production. To this is added bananas, common in tropical countries such as Ecuador and Peru. But on the non-traditional side, Colombia was only represented by floriculture, to which avocado is now added as a new crop with the capacity to generate massive employment.

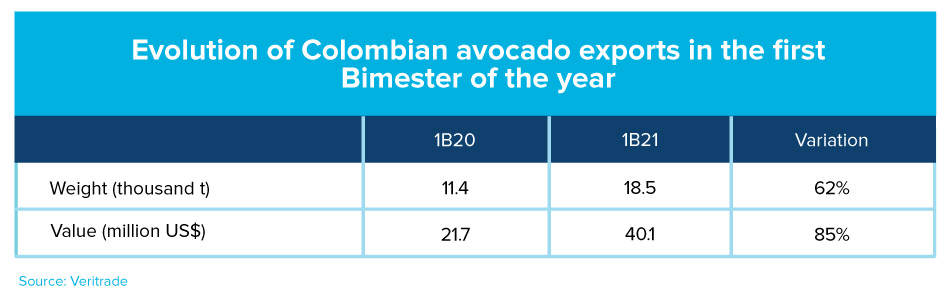

In the case of exports to South Korea, avocado may be the new star and has the scale to overtake bananas as the second main product. The first shipment, made by air, was 1.9 tons, but if it normalizes it could consolidate its place on the list. At a price of US $2,000 per ton, it would have to ship 7,500 tons to do so. Colombian avocado exports in 2020 were 44,000 tons, so this assumption would imply making South Korea the second destination, with a 14% share if total exports were to rise to 50,000 tons.

Two other important products in Colombian agricultural production are mangoes and sugar. However, avocados are a product less prone to commodity price fluctuations or protectionism like sugar, and to weather conditions or prices like mango. It is a profitable and resilient product.

If 2020 was a good year for Colombian exports despite the pandemic, 2021 could be even better, in the absence of logistical obstructions due to roadblocks. Coffee production has risen 21% in February and 30% in March, and the dynamism of the international market could help to avoid price drops due to increased supply, which would lead to better results. In the case of bananas, the projection is for a 10% increase in exports this year. Meanwhile, flowers performed well during the pandemic because they are an affordable luxury, and do not have to go against the acceleration of the world economy, while production is controlled in greenhouses.

Discovering opportunities

The conditions are in place to supply the world's demand for avocados from Colombia. The most important thing is to identify market conditions, and Veritrade allows a destination-by-destination analysis, as well as learning about competitors, prices, quantities shipped, transportation routes and customs used.

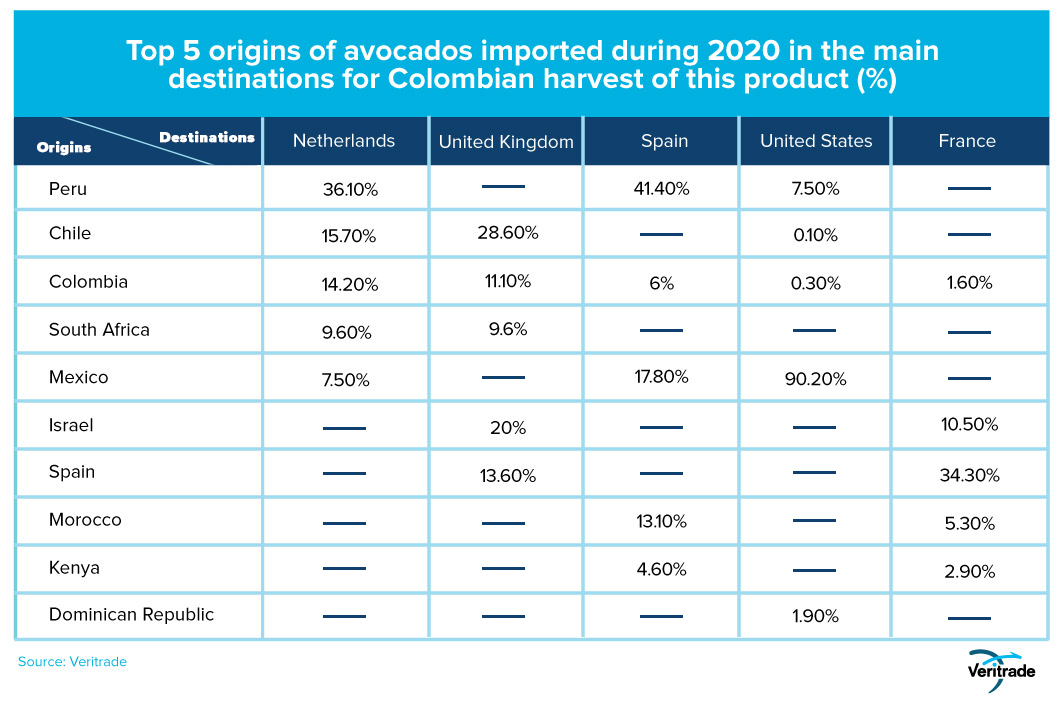

The following tables show the details of some of the data that can be obtained through our portal.

The main opportunity lies in taking advantage of the mismatch between the Chilean and Peruvian campaigns between the end of summer and the beginning of autumn in the southern hemisphere. It is possible to work together with brokers and government commercial services to generate synergies and reach the markets with the right prices, quality and shipping schedules. However, information is the most important thing to prepare the right strategy.

For more information on how to take advantage of the opening of the Korean market for Colombian avocado exports, you can explore Veritrade's website.

Request your free trial at https://bit.ly/VRTFreeTrial