Foreign trade will help Peru's economy recover from the pandemic

Published on 06 May 2021

The rebound in metal prices and the recovery of larger markets will help boost exports.

Peruvian exports are equivalent to approximately one-fifth of the Peruvian economy's production (GDP). Generally, they exceed imports by around 15%, so foreign sales generate surpluses and foreign trade is unquestionably favorable for the country's economy.

During 2020, the most challenging year in the history of the global economy, the value of Peruvian shipments abroad was one of the sources of resources that kept the country afloat. The country's total production fell 11.1%, while the trade balance rose from US $6,614 million to US $7,750 million.

This variation does not mean that there has been an improvement in the way in which Peru takes advantage of foreign trade, because the factor that has caused it is the greater deterioration of internal demand compared to external demand. But it is very important to highlight the importance of exports as a source of foreign currency: although industry, construction and, above all, consumption and services were strongly affected by the pandemic, exports allowed foreign currency to continue entering the country and did not generate a greater imbalance in the economy. Furthermore, it has been shown once again that the Peruvian economy is less vulnerable on the external front than on the domestic front.

The end of the turbulence?

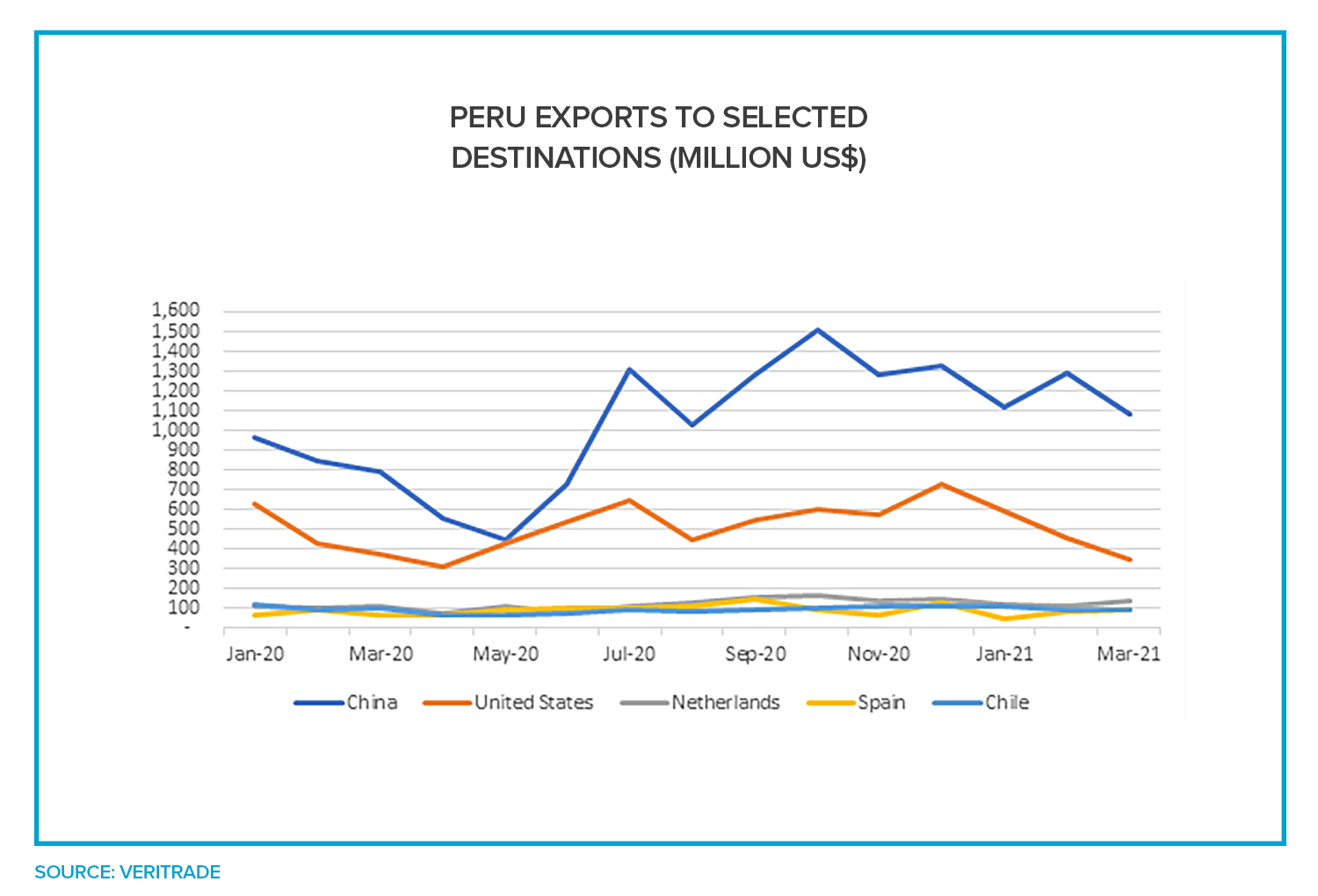

In general, 2020 has generated sharp declines in all markets, both due to the impact of lower prices and lower volumes demanded. However, since the second quarter, the recovery of the Chinese economy consolidated after an apparent overcoming of the COVID-19 pandemic, while the rest of Peru's main trading partners have also moved into a stage of recovery.

The blue line shows a clear recovery in Chinese demand, which is also not seasonal as it is mainly related to metals. In the case of the United States, the trend is a little more difficult to identify due to the greater diversity of the portfolio, which includes seasonal products such as fruits and vegetables. However, the rise in the orange line can be attributed to the rise in the price of gold, driven in the second quarter of 2020 by the uncertainty of the pandemic.

But when it comes to identifying irregular patterns, smaller trading partners are even more price-dependent. Except in the case of Chile, where the relationship is marked by oil and oil-based fuels, seasonality is marked.

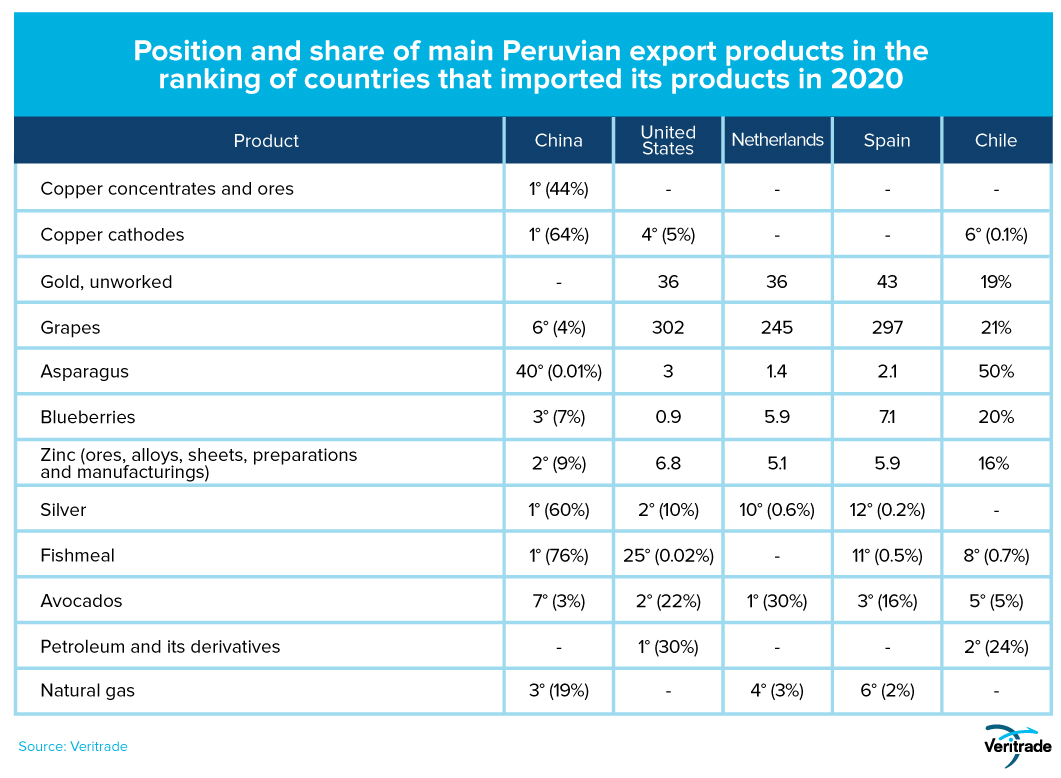

The following table gives an idea of the composition of the list of products imported by each of the main trading partners, in which the quality of China as a destination for raw materials is differentiated, compared to the greater diversity that includes agricultural products in the United States and Europe. Both the lines corresponding to Spain and the Netherlands closed the first quarter up, compared to last year's drop, suggesting that there is a clear trend towards an increase in the value of sales, regardless of seasonality.

A closer look

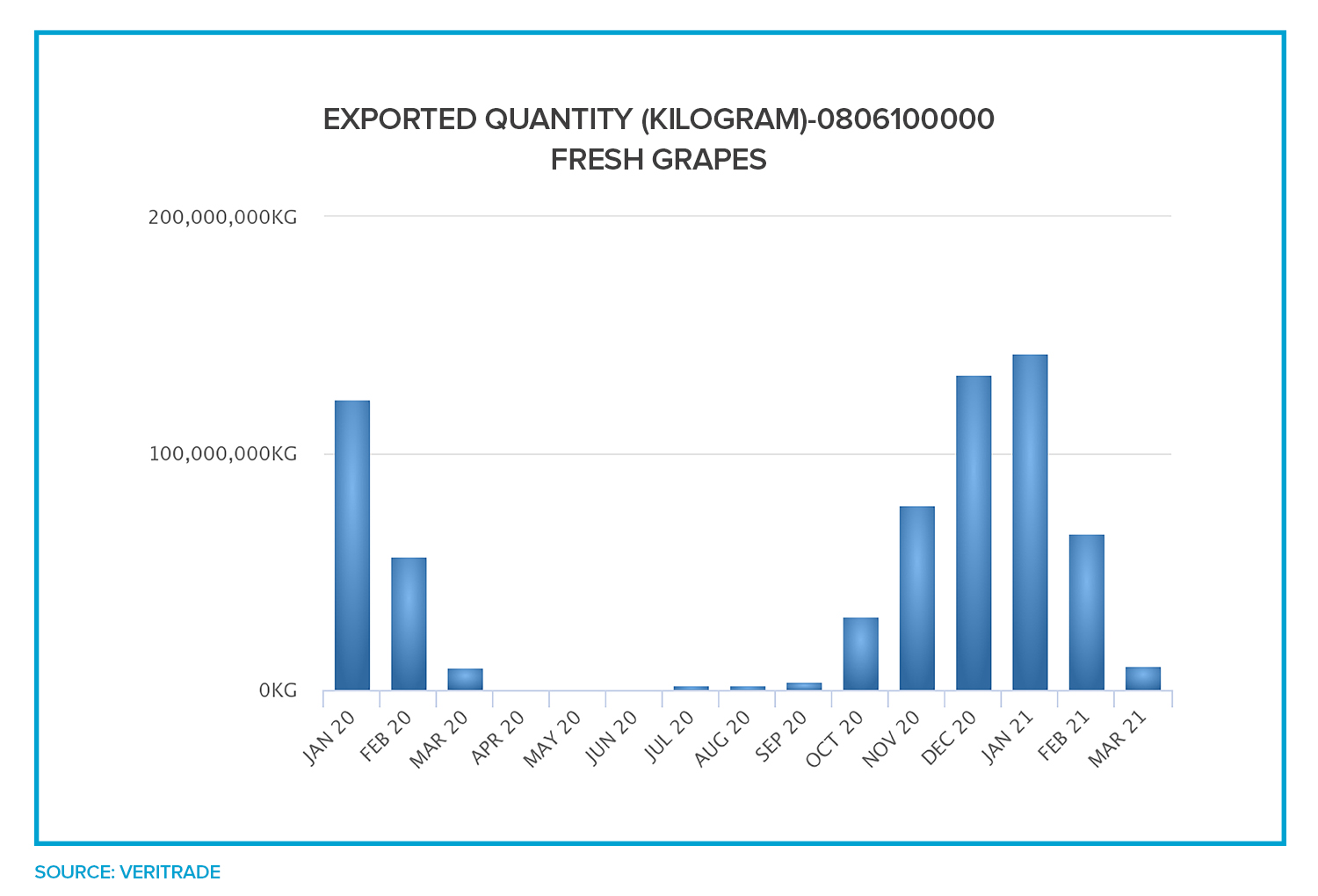

The overall picture is encouraging from the perspective of Peruvian exports. But to get a more precise idea, it is worth reviewing the three most outstanding products in the portfolio: copper, gold and grapes.

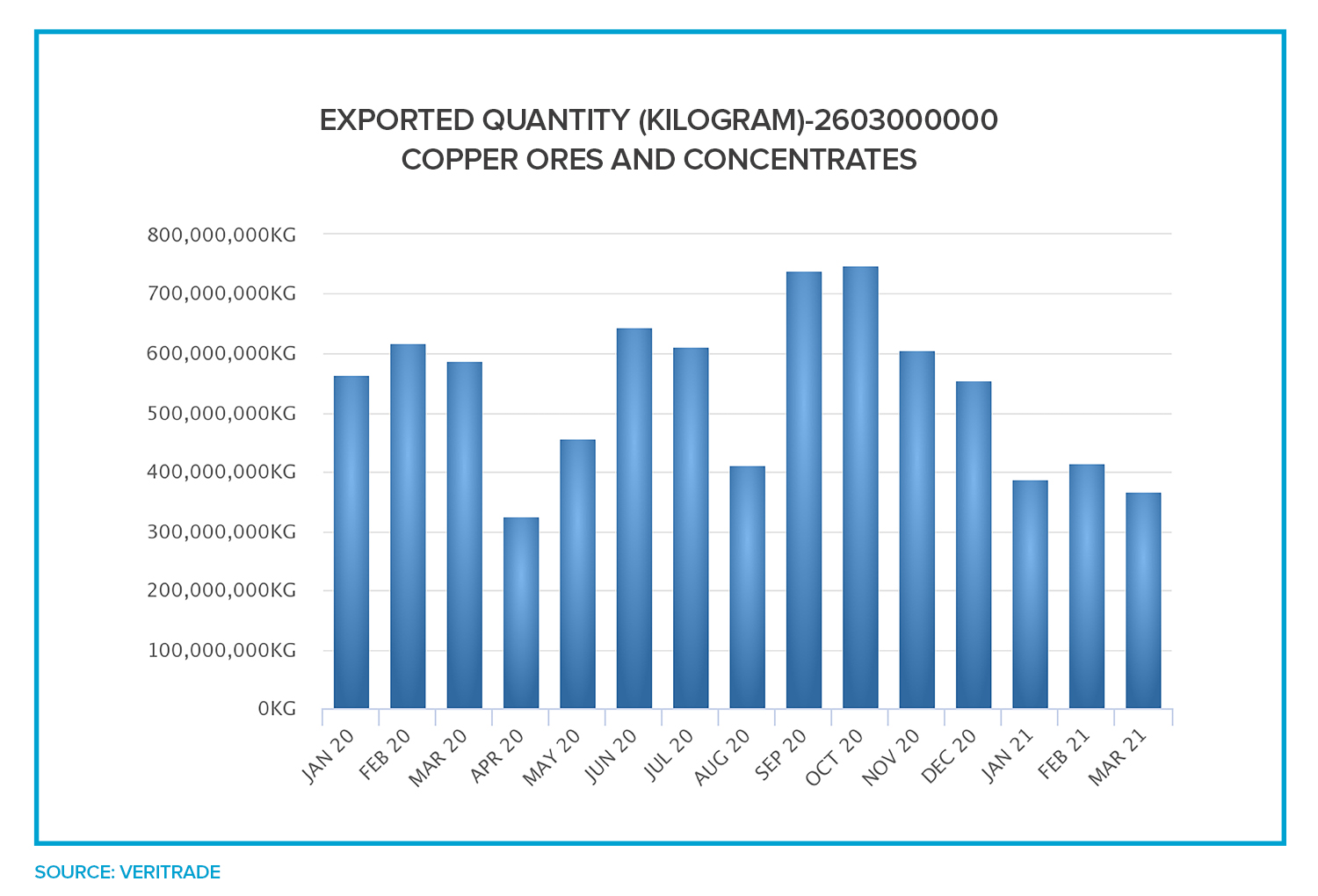

Copper had been recovering after the reduction of trade tensions between the United States and China in 2019. However, the pandemic impacted the entire market and other markets such as South Korea and Japan were affected. Despite this, the imminent recovery in industrial demand around the world points to a new upswing in demand, brought forward by the rise in price to a level close to the all-time high of US $4.58 per pound in mid-2011.

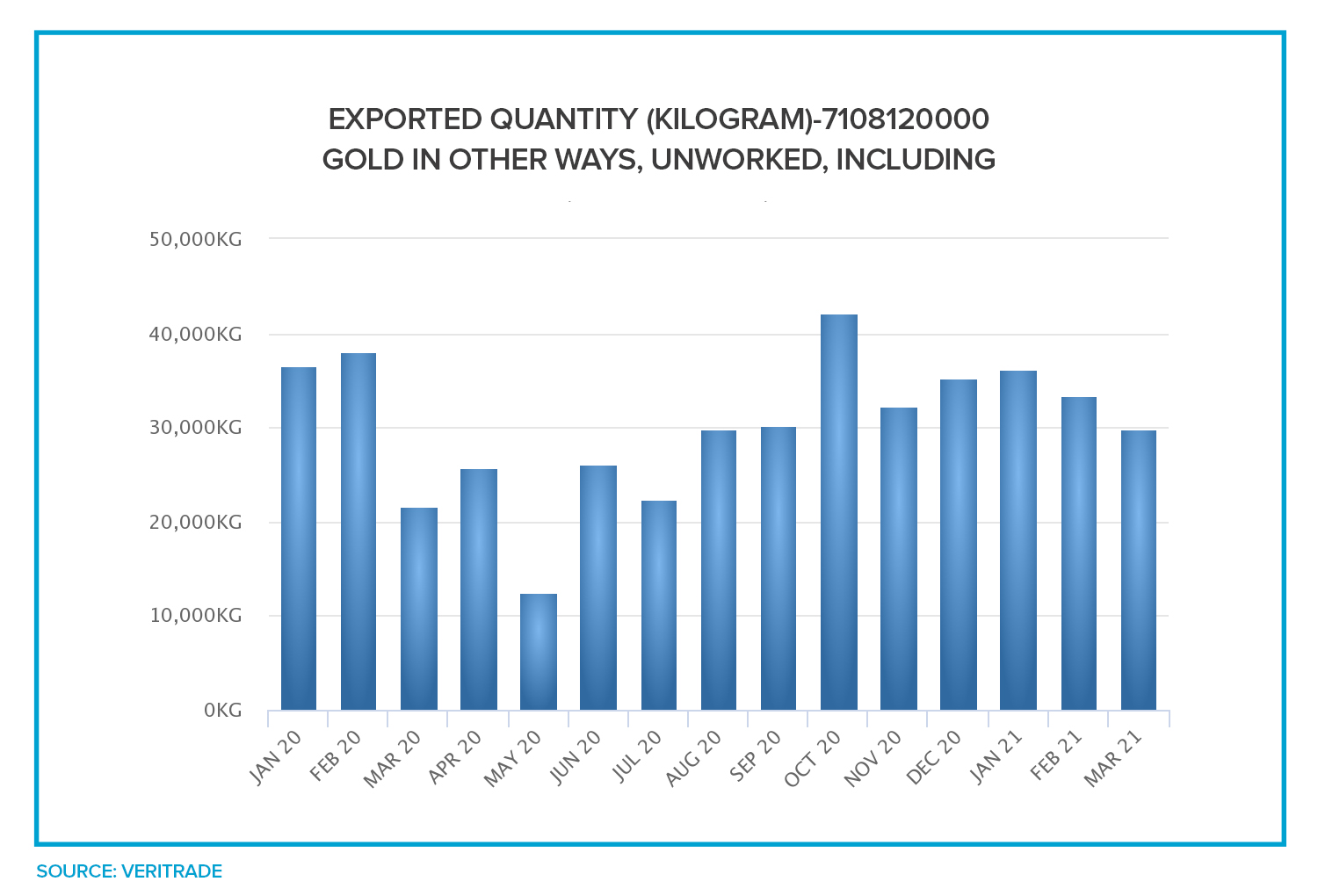

The trajectory of gold has mirrored the evolution of its prices, in response to the demand for stable assets in the face of financial uncertainty. In 2021 things will not be entirely clear and there will still be reasons to continue placing it in the market as a safe bet to maintain the value of savings. In other words, there is reason to expect that the positive effect of the gold metal as a hedge against financial turbulence will continue.

Finally, grapes are par excellence the example of how investment aimed at developing competitiveness based on comparative advantages with respect to the rest of the world allows growth even in the most adverse scenarios. As long as there is space to plant in adequate conditions at a viable cost, there seems to be no limit to the growth of grape planting, which is consumed all over the world and is produced when no other territory at Peru's latitude is in harvest. If the trend continues, one can only expect each season to be better.

For more information on how exports benefit Peru and the business possibilities abroad, you can enter the Veritrade portal.

Request your free trial at https://bit.ly/VRTFreeTrial