Copper, a determining factor in the recovery of the Ecuadorian economy

Published on 23 April 2021

The increase in the value of shipments of the red metal would be one of the keys to boost the return to normal production in the country. Gold will also generate value.

The expansion of mining production capacity in Ecuador will transform the country's economy. According to the Ministry of Finance, it is estimated that between 2019 and this year US $3.8 billion will have been invested in the sector.

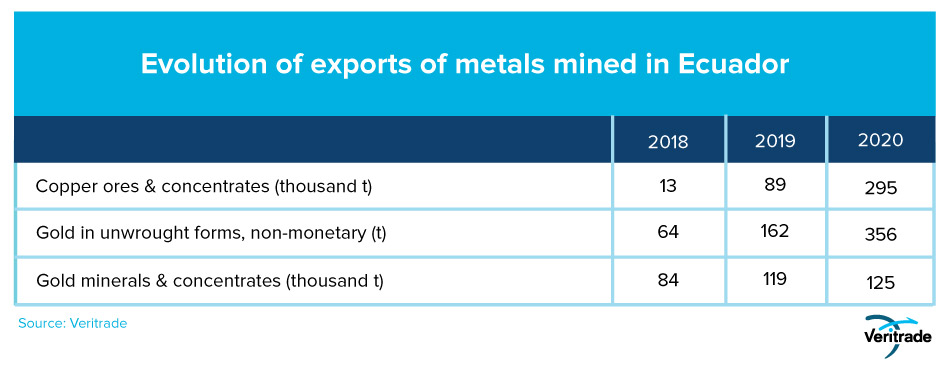

Since 2018, mining activity began to take off in Ecuador. In 2019, the Mirador and Fruta del Norte projects started operations in the country. In general, the opening to international capital, particularly Chinese and Canadian, has allowed the exploitation of the resources concentrated in the Cordillera del Cóndor, southeast of its territory. The following table shows the take-off of shipments.

The copper case: upward outlook

This incursion into the metals market coincides with an upward trend in the price of copper due to the recovery of the Chinese economy since 2020, and the prospects of improvement for other industrialized countries in 2021. According to Ecuador's Ministry of Energy and Non-Renewable Natural Resources, the trend is to reach a price of US$ 4.13 per pound this year after a floor of US$ 2.17 per pound on March 16 last year, and there could be fluctuations within a margin of +/- US$ 0.47 (i.e., the expected level for the base scenario was already reached, with a record US$ 4.14 on March 8, and the upward trend could resume).

An important factor for the upward pressure is the development of electric vehicles and renewable energy. Fortunately for Ecuador, this coincides with the implementation of the two large mines that have already started production, and in the next two years the Loma Larga (gold), Cascabel (copper) and Llurimagua (copper) projects, the latter two in the north of the country, will be added.

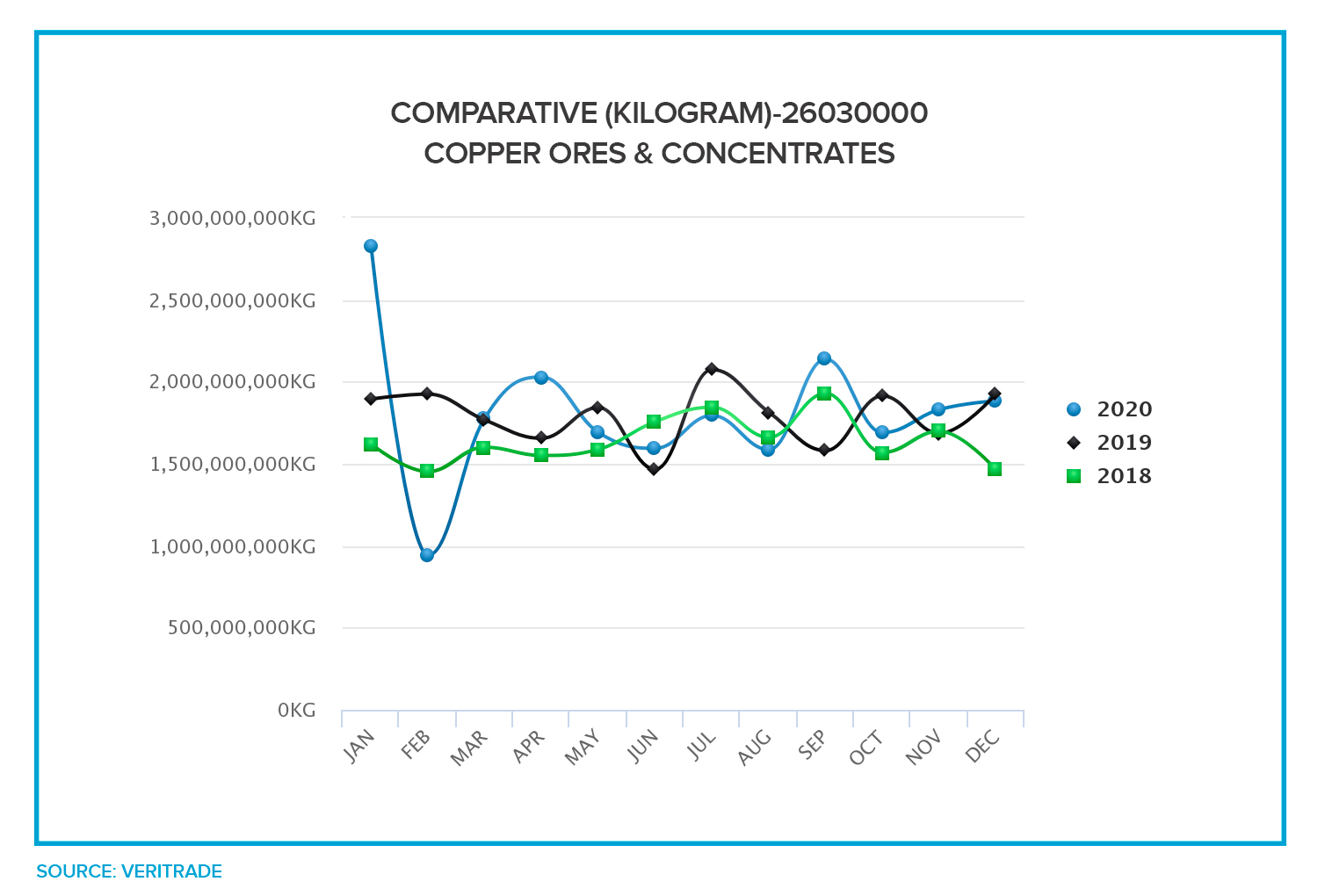

The most important market is China, which accounts for approximately 40% of global copper concentrate sales. And as shown in the following graph, after a complicated 2018 due to the trade war with the United States and a sudden drop at the beginning of 2020, copper purchases in the Asian giant have recovered.

Comparison of monthly imports of copper minerals and copper concentrates into China

Gold: the other element

On the other hand, it is worth mentioning that Ecuador's potential is polymetallic. Gold has also begun to form part of its export portfolio, and it could even be possible to add significant amounts of silver if the minerals extracted have a high content of that metal, and therefore, it will be possible to take advantage of market movements.

Among its qualities, precious metals not only have industrial use, but also function as stores of value and for jewelry, the main use in China, which is also the main destination for exports of this mineral. In times of financial turbulence, international investors liquidate riskier assets to buy gold or silver to protect themselves against possible downturns.

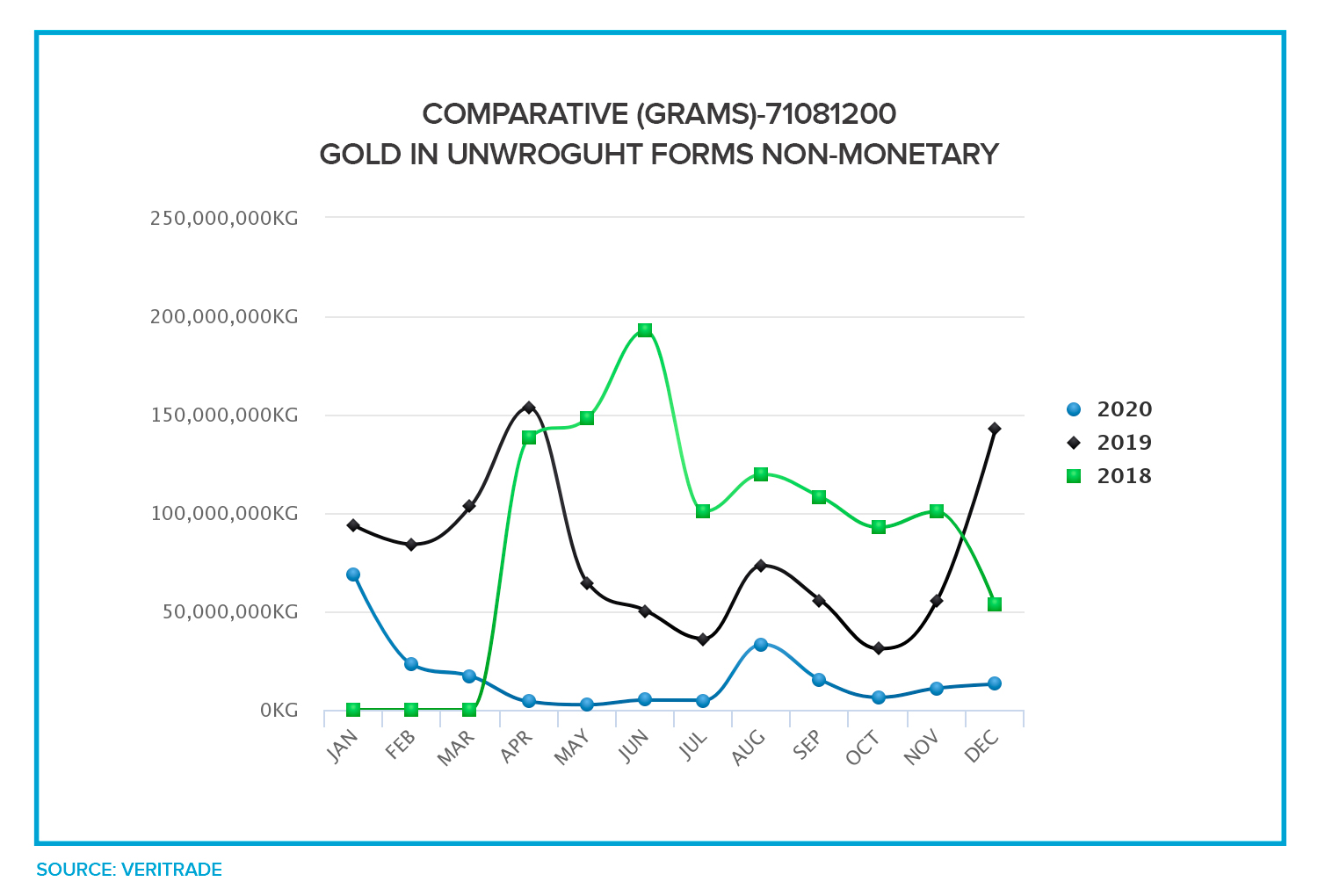

The green line in the graph shows how the trade war with the United States may show both a reduction in demand for jewelry use due to a further slowdown in the economy in the context of the trade war. But above all, both 2018 and 2019 imports were subject to import caps imposed by the Chinese central bank to prevent further depreciation of the yuan. Finally, towards the end of 2019 and the beginning of 2020, we see a financial safe-haven impact from the pandemic and leveraging the price hike under the Covid-19 pandemic. Overall, the complexity of precious metals pricing makes them a good source of diversification to reduce economic risk.

Comparative monthly imports of unwrought gold for non-monetary use in China

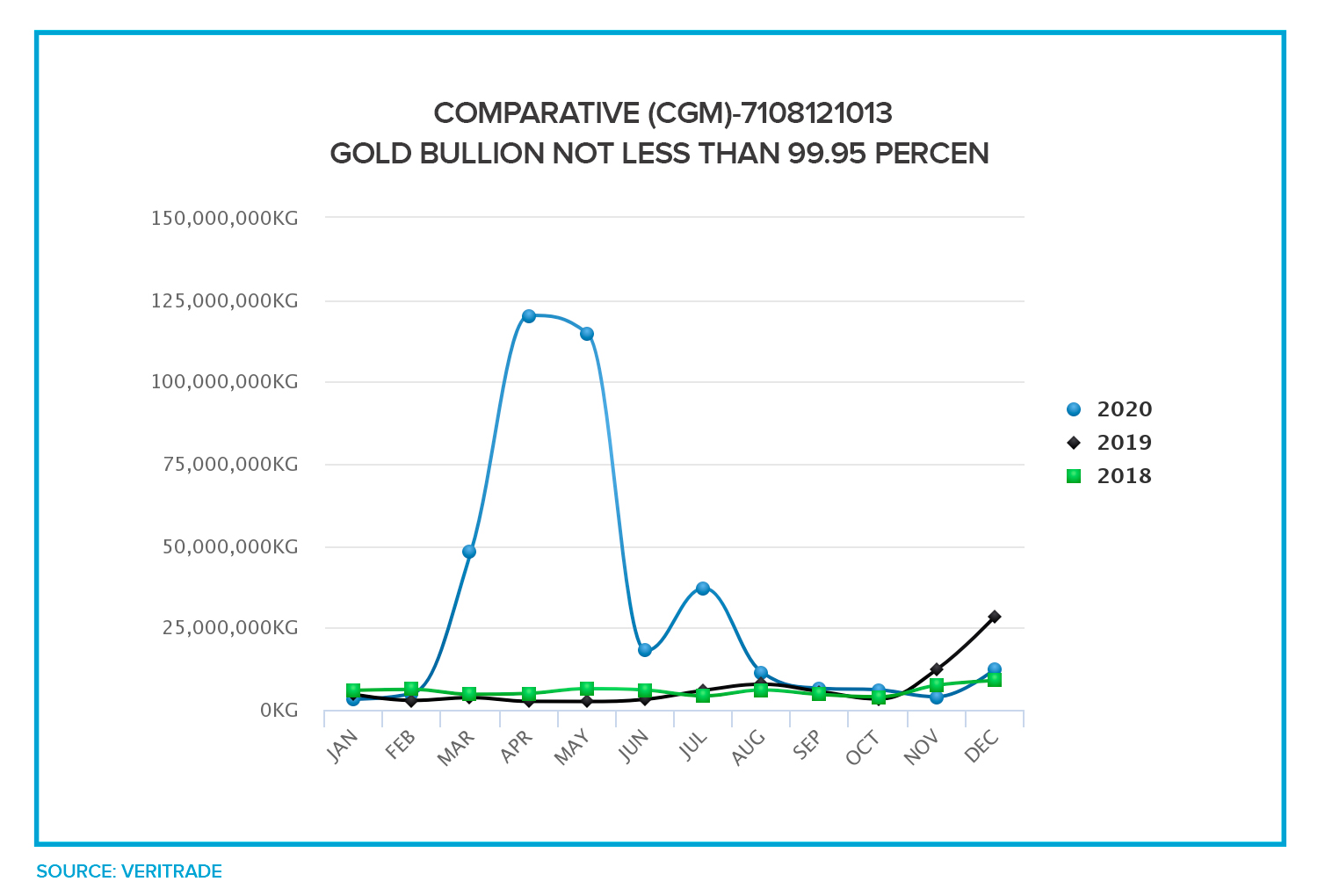

And if you move to the United States, the impact of the safe-haven quality against risk is even clearer. 2021 could be a year of positive outlook compared to 2020, but gold prices remain high and recovery forecasts are uncertain, and Ecuador will be able to take advantage of a good part of the expansionary cycle in prices, which are still at historically high levels, above US$1,700 per ounce versus a range of US$1,400 per ounce between 2014 and 2019.

Comparative monthly imports of unwrought gold for non-monetary use in the U.S.

Synergy, not competition

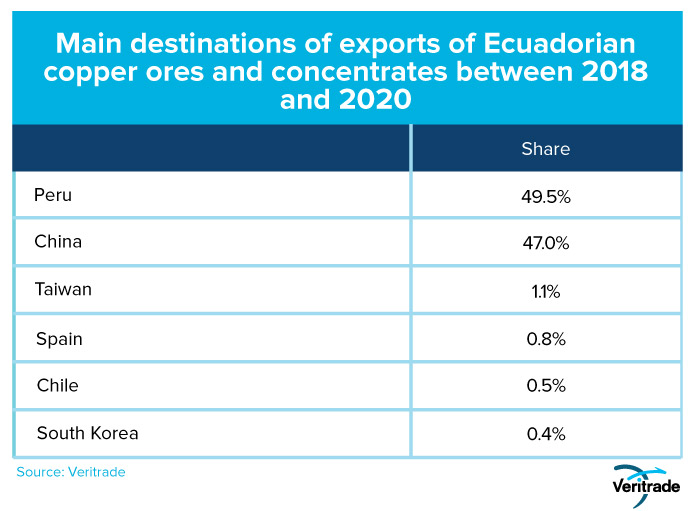

Back to copper, it is worth making an observation regarding the destination markets. The fact that it borders Peru allows exports not only to direct destinations, but also for large traders, with decades of experience in its territory, to consolidate the concentrates in their warehouses in the Peruvian port of Callao for re-shipment.

On the other hand, Peru also has refineries that could eventually receive shipments from its northern neighbor. In general, the fact that Ecuador is starting to produce copper is not a risk for Peruvian mining companies, but rather an opportunity to consolidate it as a hub.

As for new destinations, demand will depend on the interest of Chinese mining companies in selling their production elsewhere instead of supplying the industry of companies in their country. In the case of Cascabel and Llurimagua, it is expected that diversification will be greater due to the fact that the operations will be in charge of the Australian SolGold, and the Ecuadorian state-owned Enami in alliance with the Chilean Codelco (also state-owned).

A significant contribution

If the construction and production schedules are respected, what lies ahead for Ecuador is very good from the point of view of the economic contribution of mining. In 2020, the country benefited from US $430 million obtained through taxes paid by mining companies. The operations underway augur that more resources will be received that will benefit the mines and their suppliers with sales and the population with the generation of jobs, both direct and indirect.

For more information on Ecuador's mining exports, please visit Veritrade's website.

Request your free trial at https://bit.ly/VRTFreeTrial