Trade exchange between Colombia and the United States, the mitigating factor of the crisis in 2020

Published on 19 March 2021

The good performance of exports not related to mining or fuels, especially non-traditional agricultural exports, helped to offset the impact of the pandemic.

The economic slowdown caused by measures to contain COVID-19 infections has been particularly strong for countries highly dependent on fossil fuel exports. The reduction in the price of a barrel of oil from a range of around US$60 per barrel to US$40 and even lower during the first three quarters of last year was compounded by a reduced demand for coal due to the change in power generation technology and the shutdown.

Overall, this caused Colombian exports to fall by 22% during 2020 in value terms. But there were exceptions, and products related to basic consumption or affordable luxuries, such as food and flowers, were in growing demand. According to El Tiempo newspaper, the National Administrative Department of Statistics (DANE) reported that revenues generated by agricultural exports increased 7% and reached their highest level in history.

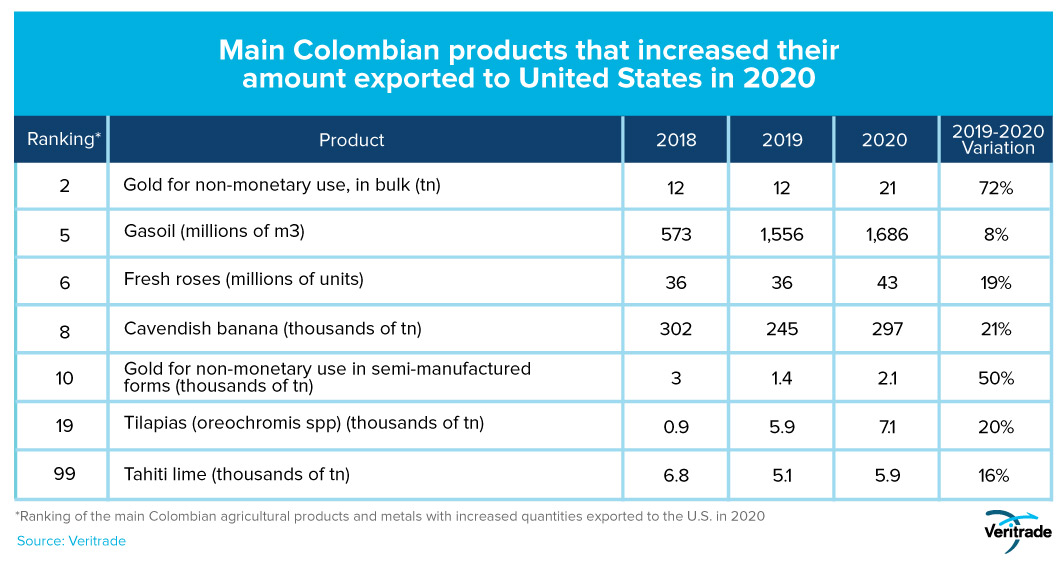

Products on the rise

The contrast between agricultural and energy or construction-related products is clear. The only case in which a decrease was recorded was in coffee, but the rise in prices compensated for it and exports totaled US$ 2.4 billion, compared to US$ 2.2 billion in 2019.

The Cavendish banana is the most exported variety of the fruit, which is also unlikely to be consumed less frequently due to its low cost and high nutritional value. The most relevant aspect in this case is production, which depends on climate variations and proper crop management to prevent pests. Despite the absence of the peak of the second quarter campaign, 2020 was a good year.

Roses also had a good year, specifically in the February campaign for Valentine's Day. The rest of 2020, sales remained strong despite the problems in the international economy, highlighting the affordable luxury quality.

Lemon and tilapia have had particularly good sales in the second half of the year. In the case of the first of these two products, the rise is the result of an introduction of new export crops: the value of shipments abroad was just US$ 6 million in 2015, and last year reached US$ 31 million.In the case of tilapia, the rise is less pronounced because the product was already consolidated, with 5.1 million tons in 2015, compared to 7.5 million tons in 2020, which generated US$ 42 million and US$ 44 million, respectively.

Finally, although it is part of the traditional portfolio, gold cannot go unmentioned. In the midst of financial turbulence, this precious metal is usually the refuge of the most conservative investors, and its demand and price grow every time there is a crisis. Along with agricultural products, it was the main element that contained the deceleration of the Colombian economy.

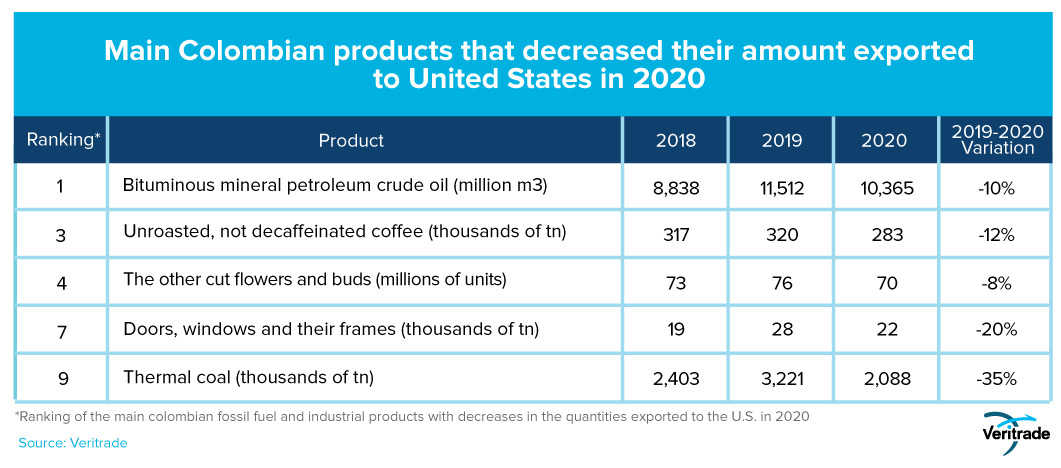

Products in decline

In contrast, as mentioned at the beginning of this note, sales of fossil fuels and construction-related industrial products performed adversely. The following table shows the most emblematic cases compared to the two previous years.

Oil and hard coal are two sides of the same coin. They reflect the fall in international demand as a result of the shutdown of transportation and lower electricity consumption, and the pressure of international politics.In the case of oil, there was an excess of production due to the battle between Russia and Saudi Arabia, while in the case of coal, the replacement of coal plants by renewable energy plants is irreversible, and therefore the downward trend is more sustained.

Finally, also in response to lower economic activity at the industrial level, demand for doors, windows and frames was hit hard. 2019 had been a good year, but all the progress made was rolled back and it is to be expected that 2021 will not be the best year for this segment either, at least in the first half of the year. However, Colombia has a consolidated industry in this area that can recover quickly if it maintains its competitiveness.

To close the analysis, we cannot fail to mention coffee, whose drop in terms of quantity was not due to a fall in demand, which remained strong, but rather to a climatic factor that is fundamental for the performance of agricultural products. In 2020, production was 6% less compared to the previous year due to issues related to the 2019 flowering, which also led to concentrate the harvest in the second quarter.

Is the pattern repeating itself?

Everything indicates that 2021 will be a better year for Colombian exports, especially due to the recovery of oil prices. However, sales of agricultural and aquaculture export products have shown to be resilient to adverse circumstances, and this year's economic recovery should only further boost their progress.

The conditions are in place for the Colombian economy to experience the rebound it needs after the pandemic-related slowdown. But without the contribution of the non-energy component, this would be a more distant reality. It is worth noting that the United States will have a particular role, since if in the midst of the crisis it recorded a 10.3% increase in the value of its imports of Colombian non-mining and non-energy products, the highest since 2013. If those are the results in difficult times, with an economy that has received a US$ 1.9 trillion fiscal stimulus and will soon have its agents in full motion after the total vaccination, expected for July, the rise may be even higher.

For more information on Colombian exports to the United States, please visit Veritrade's website.

Request your free trial at https://bit.ly/VRTFreeTrial