What products will drive the Latin American economy in 2021?

Published on 18 March 2021

Exports of food, flowers and minerals enabled Latin American economies to survive the pandemic, and are now the basis for recovery projections.

The various economic growth projections for 2021 are clearly more optimistic than last year's and represent at least a rebound, if not a recovery, from what was lost in 2020. Among the key sectors, trade and services account for the largest fraction of the loss caused by mobilization restrictions to prevent COVID-19 infections. However, the forecast for reactivation of activities related to these segments is volatile. Exports, on the other hand, are much more predictable.

Latin America is a region that is highly dependent on international commodity prices. This is mainly driven by the economic activity of larger countries, especially China and the United States. The recovery of the first since the second quarter of 2020, and the imminent re-accommodation of the second following the progress of vaccination and the announcement of a US$ 1.9 trillion stimulus plan, have driven up the prices of most commodities. Added to this is the impact of production cuts on oil prices by OPEC.

The above arguments have led the Economic Commission for Latin America and the Caribbean (ECLAC) to indicate in its report Latin America and the Caribbean International Trade Outlook 2020 that the region's exports could increase between 10% and 15% this year in terms of value, and 7.2% in terms of unit movement, mass or volume. Within this framework, it is worth reviewing the performance of quarterly exports of minerals, hydrocarbons, food and agricultural or fishery products in general to identify segments in which the recovery of the global economy can be more effectively exploited.

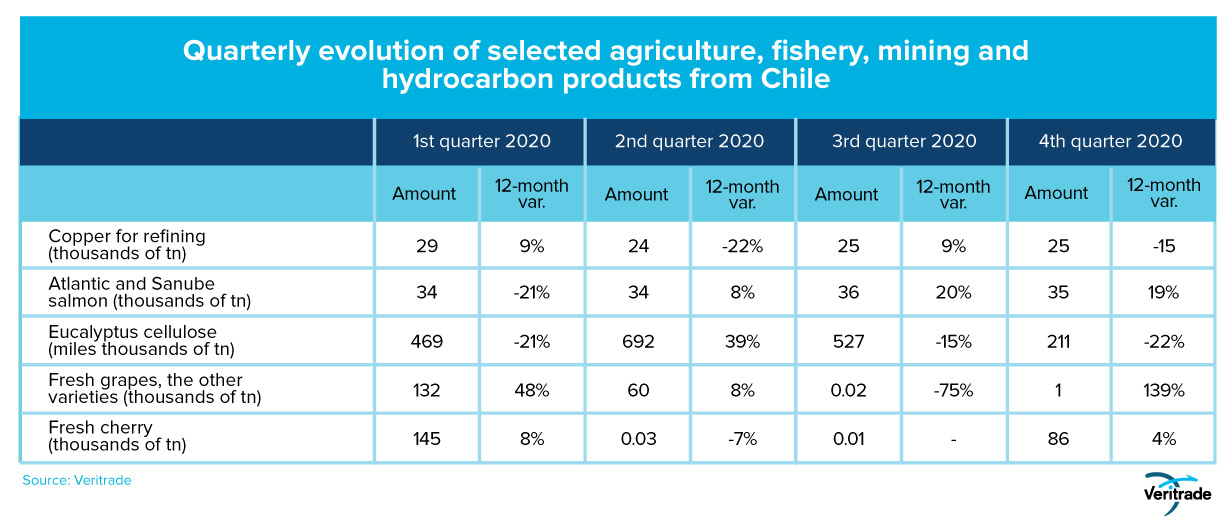

Chile

The sector products chosen for this report have maintained solid demand and were not even affected by a reduction in sales throughout the different periods of 2020, not even in the first two quarters. Only copper and eucalyptus pulp have registered temporary drops, but their industrial demand seems solid for 2021.

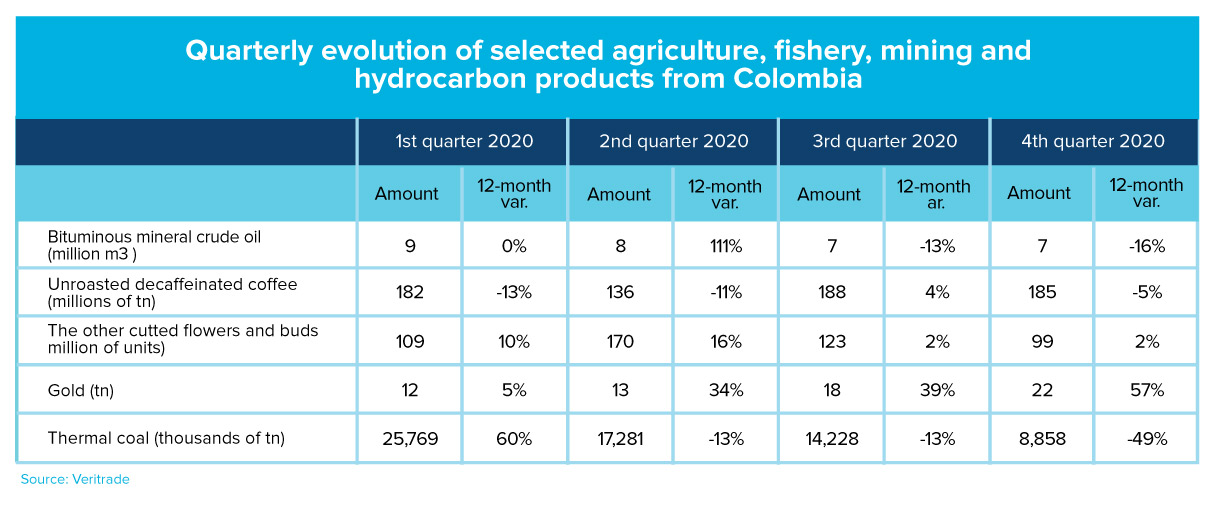

Colombia

In the case of Colombia, the most affected product has been thermal coal. The restriction of mobility reduced energy consumption and at the same time opened a window for clean energies. Both factors have led the coal-fired thermal power plants to reduce their activity and even close down. Coffee, meanwhile, did not imply a major problem for exporters due to the rise in prices in the third quarter of 2020.

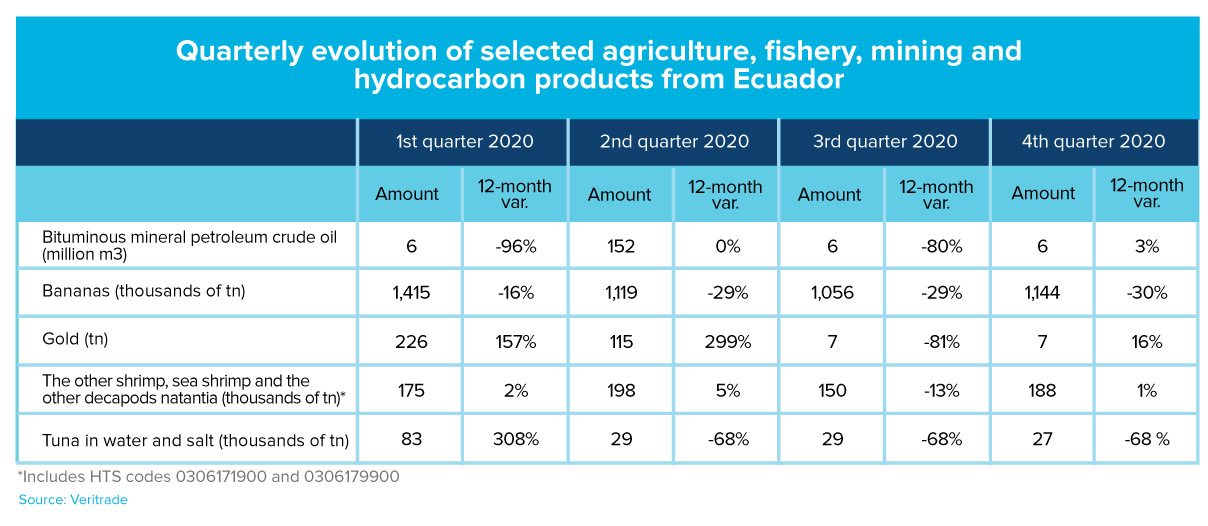

Ecuador

For Ecuador, 2021 should be by far a better year. The rupture of the pipelines through which its oil production is transported at the beginning of 2020 and low oil prices are two factors that should not and are not expected to be repeated, respectively. Meanwhile, banana figures remain high and it is considered that last year's sales of the product did not perform poorly despite what was observed in the table, and in 2021 demand should be maintained and even increase with the global recovery. As for canned tuna, climatological and biological factors are always the issue to be analyzed, while demand remains solid because it is a low-cost food with high nutritional value.

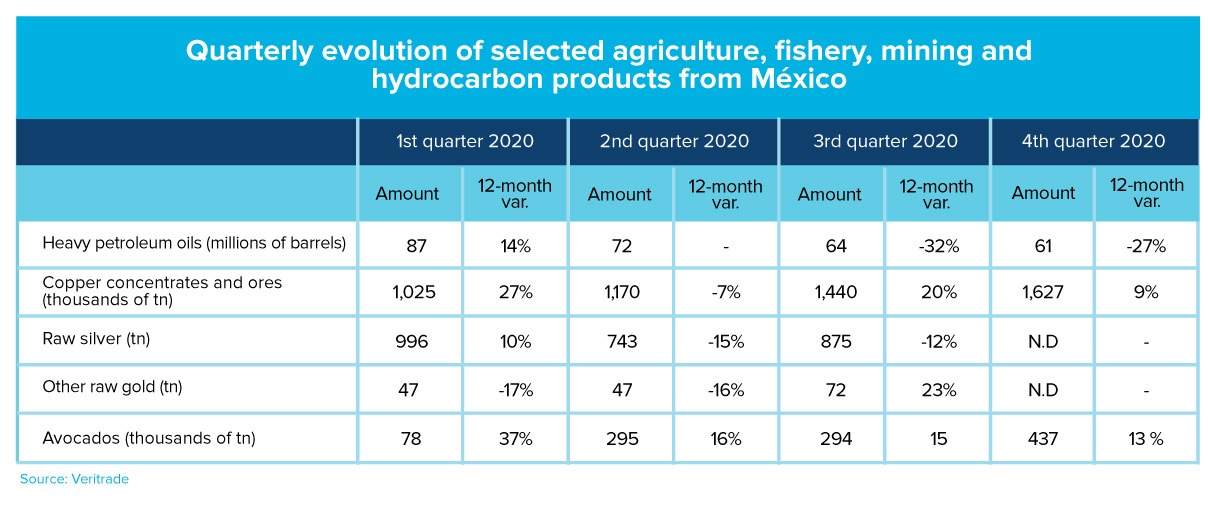

Mexico

Mexican non-industrial exports depend on the price of industrial and precious minerals and food demand. In the case of oil, everything depends on prices, which have risen, while copper also has good prospects due to the reactivation of the global industry. On the other hand, precious metals such as gold and silver could be less in demand if financial markets begin to stabilize and they are no longer sought as safe haven assets to maintain the value of savings in times of instability. Avocados, meanwhile, remain a typical example of an agricultural product for direct human consumption.

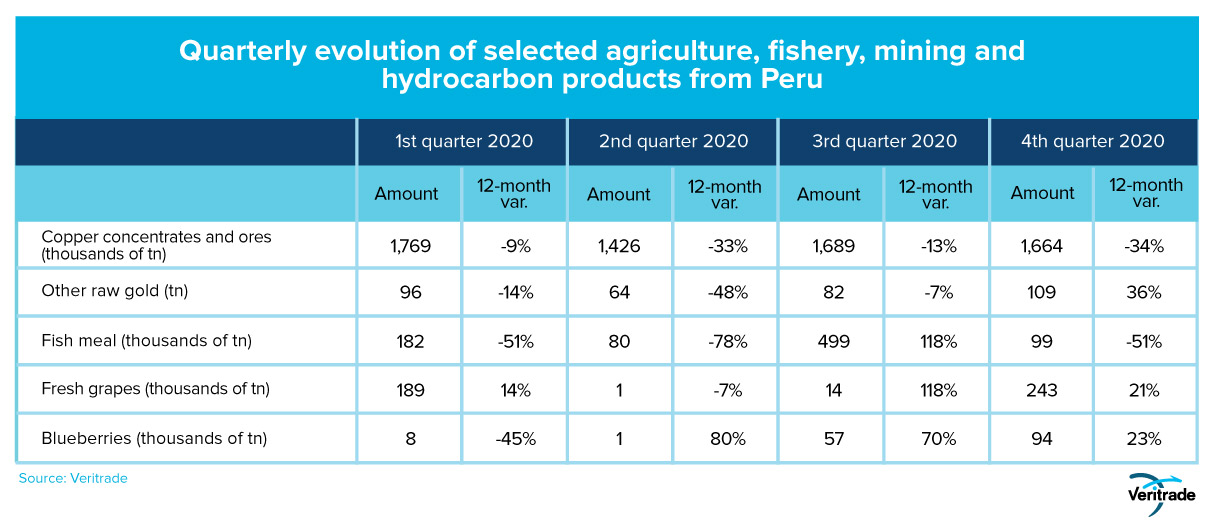

Peru

The outlook for Peruvian exports responds to factors similar to those of Mexico. Copper and gold depend on industrial and financial demand, respectively, while grapes and blueberries remain out of the crisis. As for fishmeal, the result depends on the evolution of the salmon industry and the sea temperature, so demand seems assured in the former if Chile is taken as a reference, and things should go well in the absence of alterations in the weather.

Undisputed recovery

2021 will be a year of undisputed recovery. However, the magnitudes are uncertain and the safest thing to say is that external demand from the large economies must be taken advantage of. The Latin American region has the conditions to do so, and everything indicates that its foreign trade activity will be one of the reasons why the return to economic normality will be easier.

For more information on exports from Latin American countries, please visit Veritrade's. website

Request your free trial at https://bit.ly/VRTFreeTrial