Flower exports from Latin American Countries: pandemic resilient

Published on 12 February 2021

Flower demand has been stable over the last year despite the abrupt slowdown in the global economy. This note shows the evidence

In the midst of complex situations, the resilience that allows coping can be nurtured through affordable luxuries. A cup of coffee, a bar of chocolate, a bottle of wine, and why not, a thoughtful gift to a partner or decorating the house, can serve as escape valves for the accumulated pressure. And this logic seems to have been applied during the COVID-19 pandemic.

In contrast to high-value goods such as automobiles or others linked to outdoor use such as clothing, the demand for flowers has remained dynamic. The following tables show the evolution of the value of their shipments from Latin American countries, as well as their main destinations.

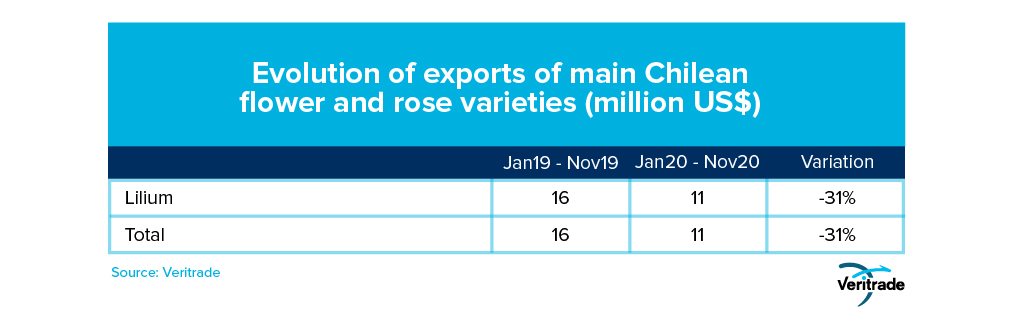

Chile

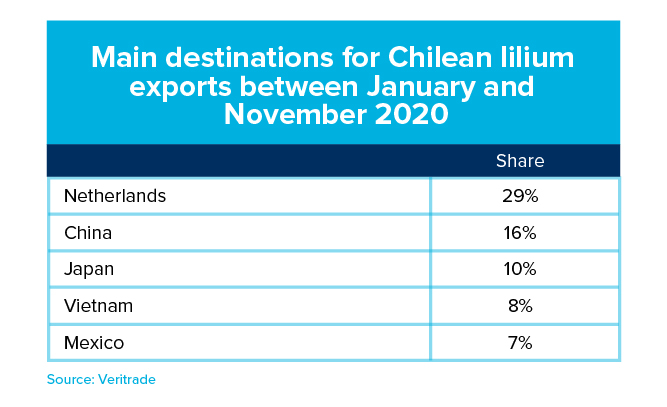

Flower production in Chile is low due to the disadvantage of being outside tropical climates and also because of the longer distance to destinations, in addition to higher labor costs. However, the country's latitude also implies the opportunity to develop tulip crops to supply the market when the northern hemisphere does not produce. Meanwhile, lilium is the only variety exported from the country.

With all this, Chile is the only Latin American country in which exporters have managed to maintain the level of their sales at a similar level to the previous year, and even grow. However, the opportunities are there to take advantage of the windows of opportunity for species that require colder climates or are of higher value. Also, the recovery of the Chinese economy may be a factor favoring recovery.

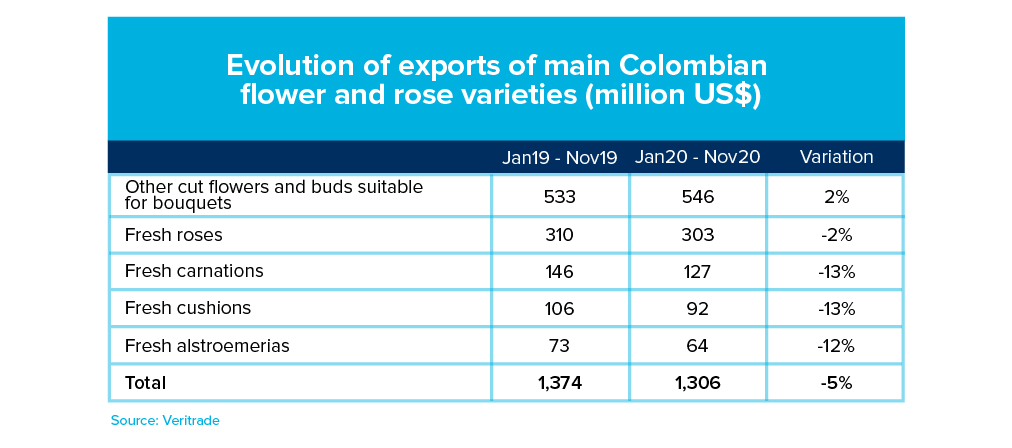

Colombia

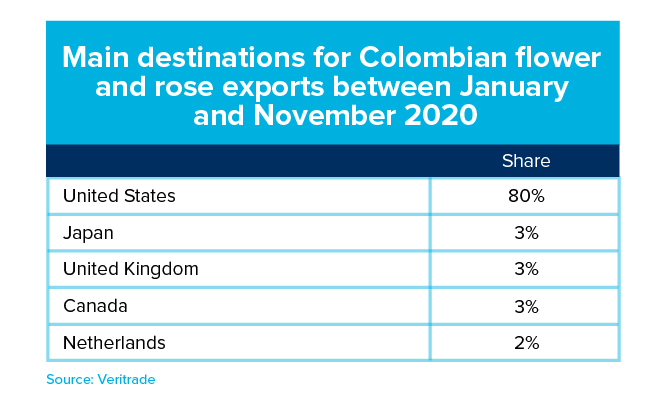

The Colombian flower supply is the second largest of the countries analyzed in this note, after Ecuador. The extension of the rainforest and the tropical climate allow high productivity, enhanced by the economy of scale achieved by the large number of greenhouses implemented.

Despite the problems in the global economy, Colombian flower growers have managed to maintain their sales and even increase in some varieties. This year shouldn't be worse than 2020 for the economy, and even an improvement is expected due to the progress in vaccination against COVID-19, there is reason to believe that this year Colombian flower exports will at least be maintained. This makes even more sense if we take into account that the United States, where most of the shipments are made, will be one of the areas where immunization progresses faster.

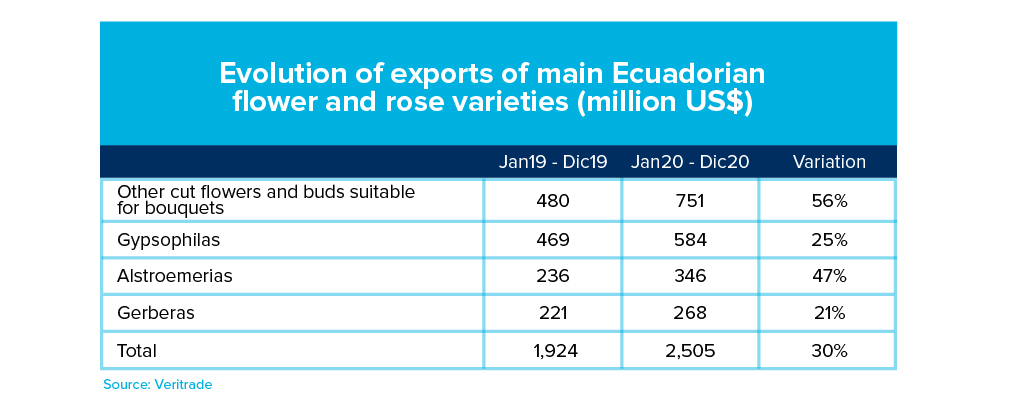

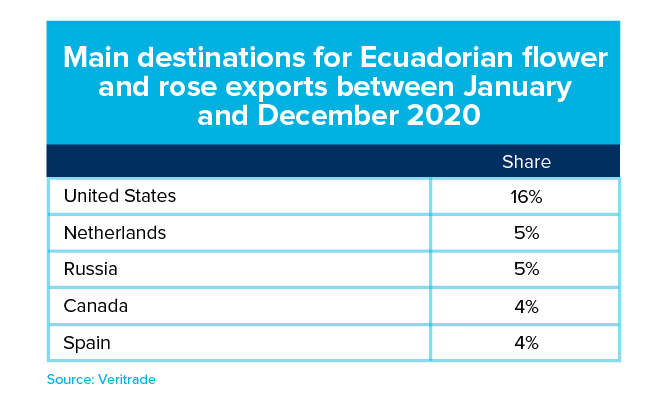

Ecuador

If in any country it is clear that demand for flowers has remained strong around the world, it is Ecuador. This resilience is supported by the diversification of destinations, which allows counteracting the problems of one economy with the good performance of another. On the other hand, being in developed countries, it is expected that the impact of COVID-19 on consumers will be lower in 2021 due to the aforementioned vaccination, which would reach high penetration more easily.

One factor that could lead to a reduction is the reversal of the presumed tendency to seek affordable luxuries if the pandemic begins to be controlled. But if that is the case, it could happen by the end of the year or even 2022, in view of the gradualness of the immunization process.

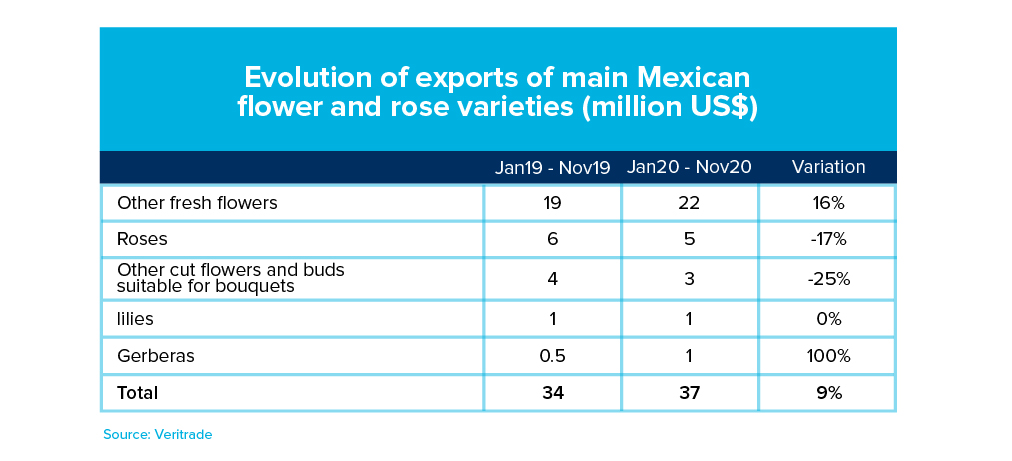

Mexico

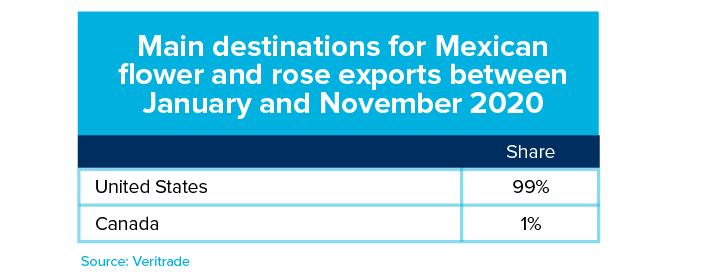

The upward trend also continued in Mexico. It is not a representative country in the flower industry, but its proximity to the United States makes it competitive as an origin.

For the above reason, what happens with Mexican exports would be linked both to the search for affordable luxuries, as well as to the increase in purchasing capacity. In view of the economic stimulus plan and the high capacity of its northern neighbor, Mexican flower growers face two forces that may act in their favor, but with a temporary mismatch: first, the apparent positive effect of the pandemic on the demand for flowers, and second, as the pandemic is subdued, the economy will recover.

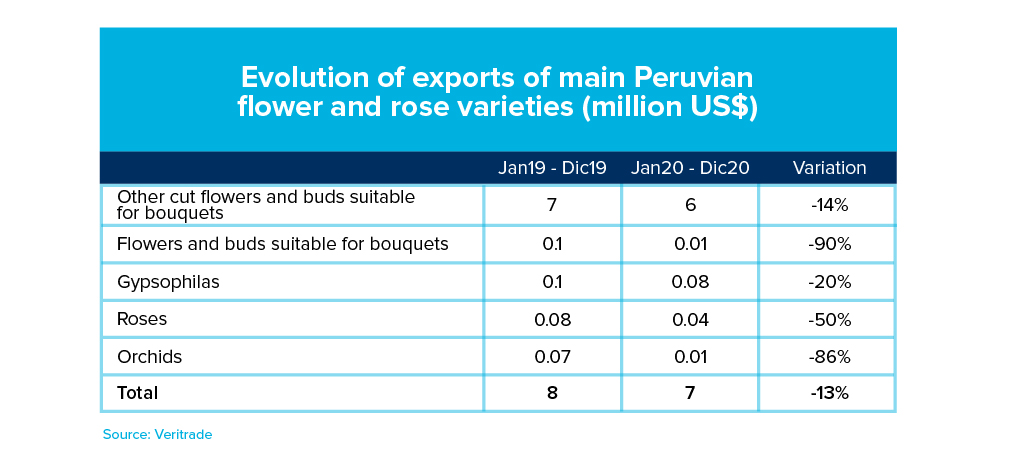

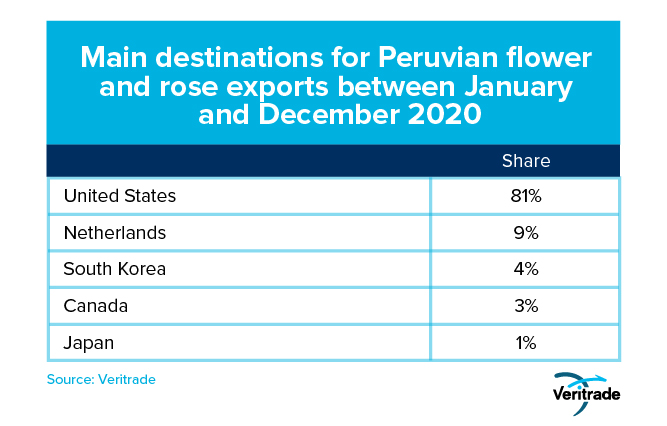

Peru

The flower export industry is small. However, the rainforest and even the coast offer good conditions to implement greenhouses. For the moment, the scale achieved by Colombia and Ecuador is far superior and leaves the question of whether entering floriculture is sufficiently attractive to investors.

The growth of Peruvian exports will depend on the ability to convert those who plant for the local market into exporters, and whether they manage to establish productive partnerships that enable efficiency, for example, in the case of orchids. If international market conditions have allowed sales from other countries to grow, then the rest depends on what is done within the borders.All other things being equal, 2021 could be another year of US$7 million in exports.

More flowers?

2021 will be a year of economic recovery full of rebound effects, mainly in the trade and services sectors. But it is not known when it will happen or in what magnitude, and consumers remain tense. In other words, flower exporters offer a product that could still serve as a palliative to help overcome the problems of the pandemic.

The biggest challenge will be to ensure that production continues to increase in response to demand, both to avoid flooding the market by detrimentally reducing prices, and to take advantage of windows of opportunity. From 2022 onwards, the focus should be on continuing to seek markets with growth opportunities.

For more information on flower exports from Latin American countries, please visit Veritrade's website.

Request your free trial by entering https://bit.ly/375V2ew