Mexican steel exports to the U.S. are still under evaluation

Published on 20 January 2021

Despite the implementation of the United States–Mexico–Canada Agreement (T-MEC), Mexican exporters must respect the restrictions to avoid tariffs.

On May 17, 2019, Mexico and the United States issued a joint statement on the consultations carried out regarding the increase of Mexican exports of pipes and semi-finished steel products. As a result, the second of these countries imposed conditions on the Mexican government to be able to export its steel products without paying tariffs, effective until June 1 of this year. In general, this happened after the implementation of the United States–Mexico–Canada Agreement (T-MEC), which replaced NAFTA in compliance with one of former President Donald Trump's campaign promises.

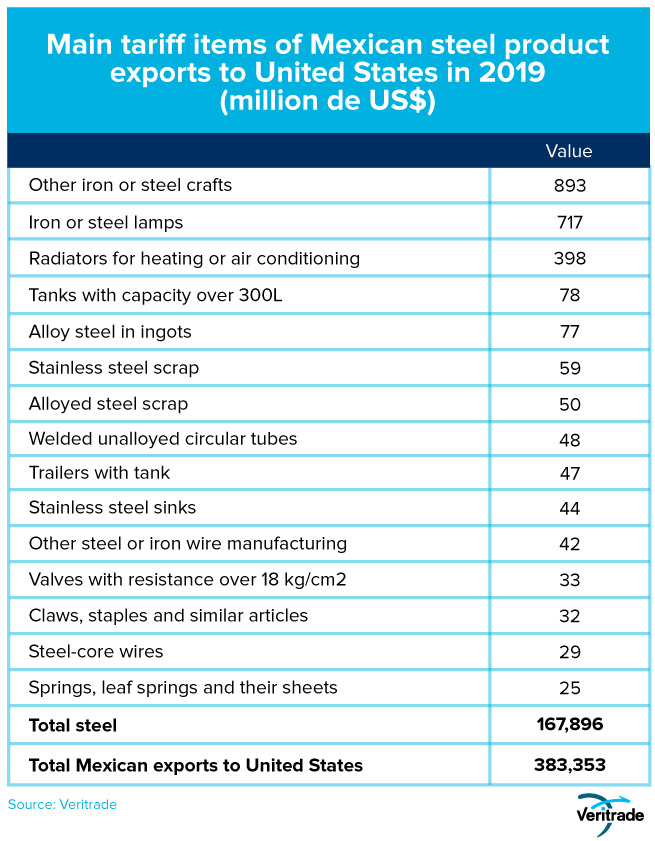

One of the concerns of the U.S. government is the introduction of steel imported from other countries such as China or Germany, which would be exported as Mexican products and accessing tariff benefits. In general terms, it should be noted that Mexican shipments of steel products to the United States contain more intermediate and finished goods than raw materials such as ingots. The following table shows the composition of the portfolio.

Mexico in the steel world

Mexico is the fifteenth global steel producer in the world, with a total of 19 million tons, which implies a stable level since 2007, when 18 million tons were produced and also occupied the same position. In contrast, the United States has gone from being the third largest global producer that year, with 98 million tons, to the fourth with 88 million.

Understandably, the U.S. steel industry has lost competitiveness compared to countries like Vietnam, China, India and Taiwan, where production costs are lower. Along the same lines, the Trump administration's state policy was oriented to stop the replacement of its production, and it has probably been more convenient from the point of view of the trade war against China to resort to the supply from plants located in Mexico, which by the way, cannot compete with the Asian ones either. Logistics, on the other hand, also play an important role and it is cheaper to import from a neighboring territory.

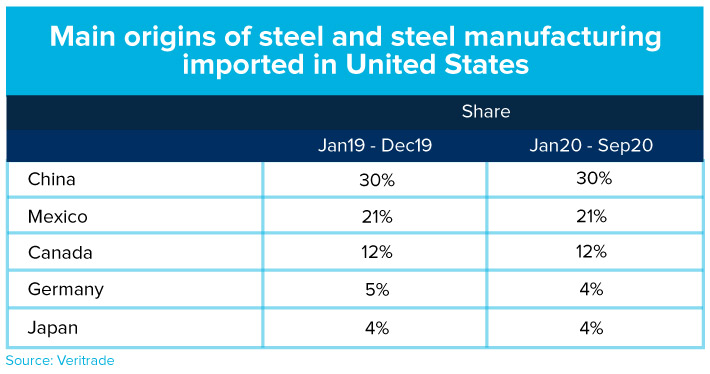

Meanwhile, the distribution of the origins of steel products has not changed in the last two years, as the following table shows.

Triangulation and accumulation of origin?

The objective of reducing the incorporation of imported steel in Mexico as a product of the country is legitimate from the point of view of justice in international trade. However, the question remains as to what extent this conversion takes place, or to what extent the demand for greater caution on the part of the regulations imposed by the United States is efficient or just an unnecessary bureaucratic burden.

After looking at the table above, one could intuit that there is reason to believe that some of Mexico's exports contain German and, above all, Japanese inputs, so that the figures for Germany's and, above all, Japan's shares, the third largest steel producer in the world, are lower than they really are. But in general terms, the best trade policy is the one that resorts to international regulations for cases such as dumping or the accumulation of origins without a common agreement between them and the destination. Imposing additional barriers on the basis of assumptions makes processes unnecessarily expensive and complicated.

Fortunately, the flow of exports from Mexico to the United States remains strong and is crucial to the economies of both countries. In the case of Mexico, the export of steel related products to the United States is equivalent to 43% of the total of what is sent from its territory to that country, and for the United States, the competitiveness of the productive matrix of its heavy industry and electronics companies depends on taking advantage of the production of parts, inputs or complete products in its southern neighbor.

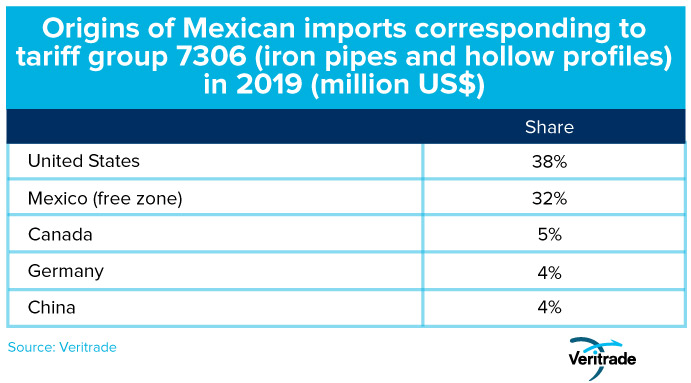

If the distribution of the origins of the steel pipes imported into Mexico is taken as a sample, there is no reason to think of an accumulation of foreign products relabeled as Mexican. From a suspicious perspective, it may be worth reviewing the specific case of the merchandise introduced into Mexico from the free trade zone, but overloading the interaction of industrial companies from both countries is a hindrance to their development, more than a reason to think there will be benefits to reverse the decline of the U.S. steel industry.

Going forward, the trade regulations of both countries can be reviewed to facilitate this interaction. Already in November, Mexican products were excluded from tariffs under section 232, related to electrical transformers and their components, and the outcome of consultations on the status of trade in relevant products between the two countries, scheduled for December last year, remains to be seen. It is expected that the Biden administration will have a less protectionist approach, although it is not known if there will be a shift towards promoting competitiveness based on greater market freedom.

For more information on Mexican steel exports, you can enter the Veritrade website.

Request your free trial by logging on to https://bit.ly/3bZdYPw