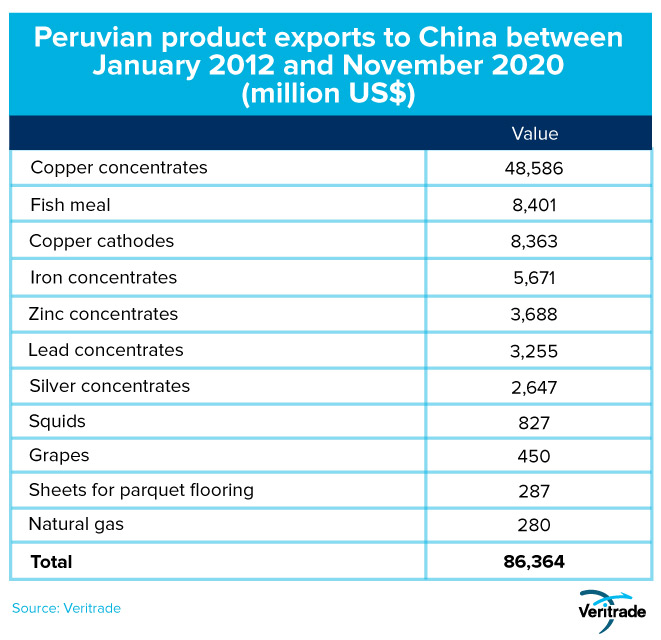

Peruvian exports to China would close a decade of more than US$ 100 million

Published on 08 January 2021

The development of the industry in the Asian country has been taken advantage of and has brought results after the implementation of the free trade agreement between both countries.

Almost twelve years ago, Peru and the People's Republic of China signed the free trade agreement that regulates the exchange of products between the two countries. Since its entry into force in March 2010, shipments from Peru have been made under better conditions, both from the point of view of costs and procedures. From this point on, the already high dynamism was accelerated.

The main element of the relevance of the commercial relationship between Peru and China is the supply of concentrates for their mineral refineries. Due to scale issues, it is more efficient to export the mineral powder than to process it in the South American country, which is not an attractive place for investors looking to process minerals. It is cheaper to do so where the production of intermediate materials such as sheet, ingots and cables, as needed, is concentrated, and with the exception of zinc sent to Brazil, no refineries have been established for the other metals.

It should be noted that since the end of the first decade of the 21st century the Chinese government began to reorient its economic model from an export base to one of domestic demand. In this way, investment in infrastructure and the consumer-oriented technology industry led to the take-off of copper and zinc, as well as lithium, which is still absent from Peru's export supply.

Yesterday and today's figures

On the other hand, agro-industry and aquaculture were also benefited by China's consumption capacity, both in terms of size and purchasing power. Even a product until recently unknown to its consumers, such as avocado, has managed to make its way and could be the next star of the portfolio.

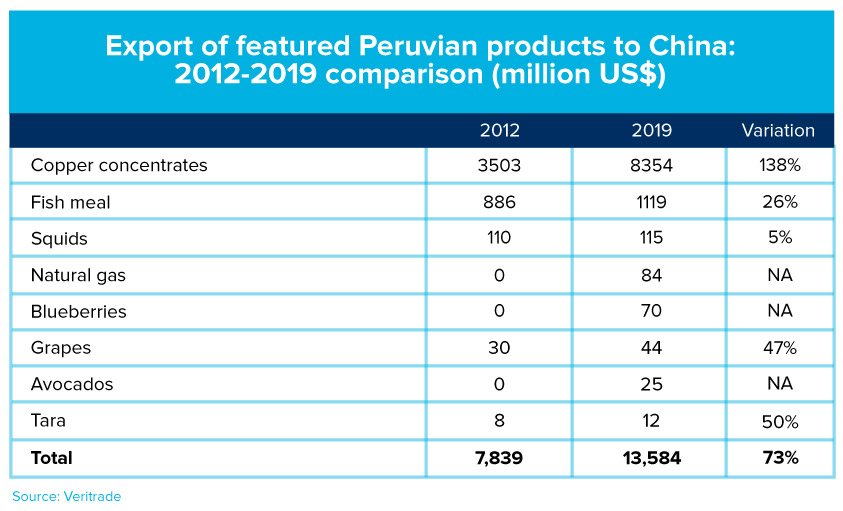

In the following chart, you can see how new products were introduced to the Chinese market. The cases of the blueberry and natural gas in particular stand out, as they had to be redirected to new destinations due to the excess supply in the United States after the mass extraction of shale gas (known as shale in English).

The introduction of natural gas was a good start which, while it may have meant assuming lower profitability due to distance and competition with Asian and Russian suppliers, represents a strong added value. In general, the capacity of a single mining or hydrocarbon product is greater than that of an agricultural product. However, it should be taken into account that natural gas exports and hydrocarbons in general have a complicated perspective, in view of the downward pressures on prices for shale deposits and for the improvement in renewable energy technology, especially solar energy.

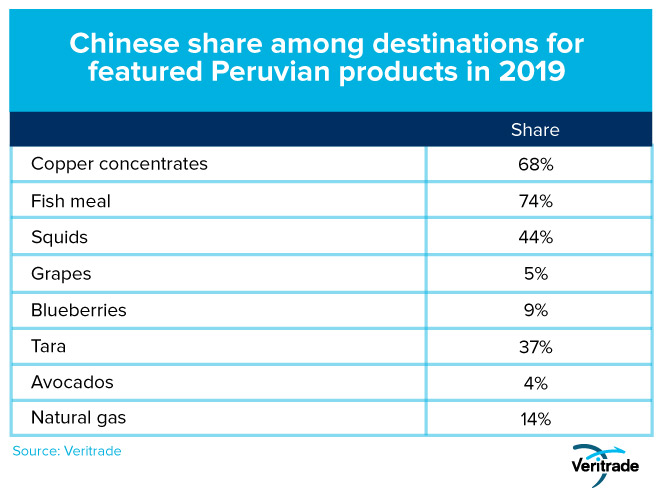

Not just raw materials

Therefore, although China is by nature the destination with the greatest potential for the export of raw materials in which Peru offers comparative advantages, the part corresponding to energy, or even some mineral that is beginning to go into disuse, requires alternatives for the long term. Agro-industrial products are undoubtedly an option that, with the exception of cases such as grapes and tare, are just beginning to be developed and in which the share with respect to other destinations is still low.

Blueberries and avocado are examples of the potential for new product development and shipments are expected to continue to increase. The opportunity for superfoods based on grains, berries and fruits in general is high, but strong work is required in commercial development, both at the product and market level.

But there is already reason to celebrate with what has been achieved. The fact that we have a strong trade relationship that has allowed exports to rise 73% in less than ten years, even though we are the main partner in terms of value, shows that good work has been done in bilateral relations and business development.

On the other hand, while 2020 has been marked by the impact of the COVID-19 pandemic, 2021 would represent the beginning of recovery based on a rebound effect, followed by greater use of what had already been achieved. Thus, Peruvian exports to China would close this year at around US$ 100 million in a decade, an omen of an upward trend that could be consolidated for longer.

For more information on Peruvian exports to China, enter the Veritrade portal.

Request your free trial by entering https://bit.ly/3qn8G4j