Imports of Chinese products: prediction indicator for the Christmas campaign

Published on 17 December 2020

This note presents an analysis of the introduction of Chinese products to Latin America during the third quarter of this year. It is surprising how resilient technology is.

The Christmas campaigns are an untimely race to run out of stock in less than two months. Importers fill their warehouses with merchandise ordered in advance according to the expected demand, which also responds to the situation. Considering what the world has gone through during the year 2020, one would expect a more conservative scenario compared to the previous year, but this has not necessarily been the case.

This article shows that shipments of technological products have continued, while for other elements less prone to pressure because they are up-to-date, and even unnecessary, there have been reductions. The following is a breakdown by country during the third quarter, chosen as the reference period for the campaign's supply.

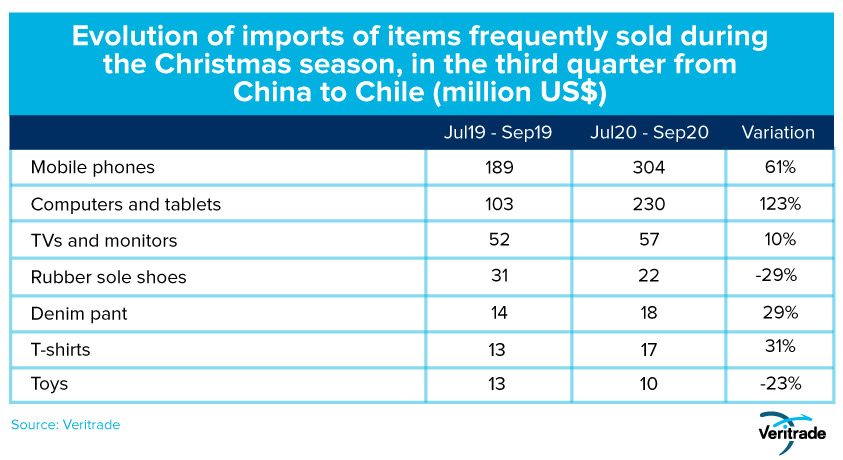

Chile

In the case of Chile, the results show that technological products have remained in demand. The main reasons that could explain this are the need for updating, the useful life cycle of the devices and, in the case of televisions and computers or tablets, the fact that confinement to the home has meant greater dependence on interaction and audiovisual entertainment, as well as remote work and education . Meanwhile, it is surprising that clothing has not been completely affected, probably because of the need to replace worn-out clothing or even the possibility of having a viable consumer and usage experience under current restrictions. On the other hand, the drop in toy imports is a clear sign of an expected pragmatism in the choice of expendable products and their replacement by lower-priced o

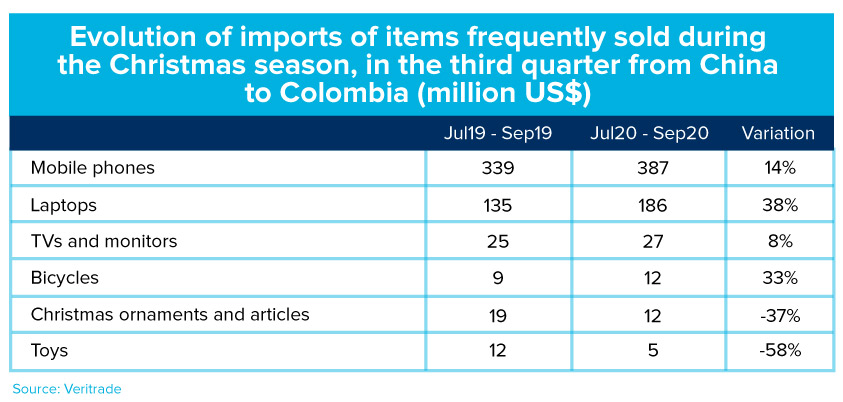

Colombia

In Colombia, the pattern is repeated. Two interesting facts are the importance of bicycles due to the country's cycling culture, and the absence of large consignments of ready-made clothing, in a country with a strong textile industry that generates protectionist pressures. However, fabrics and other inputs for clothing do record relevant figures, although they are not included because they are strange to the dynamics of the campaign analyzed in this piece.

On the other hand, as in the Chilean case, the value of imported toys has been reduced, in the same way as that of Christmas decorations. This occurs despite the fact that decoration may be part of the viable experiences during the confinement of the pandemic, presumably because they are considered unnecessary goods.

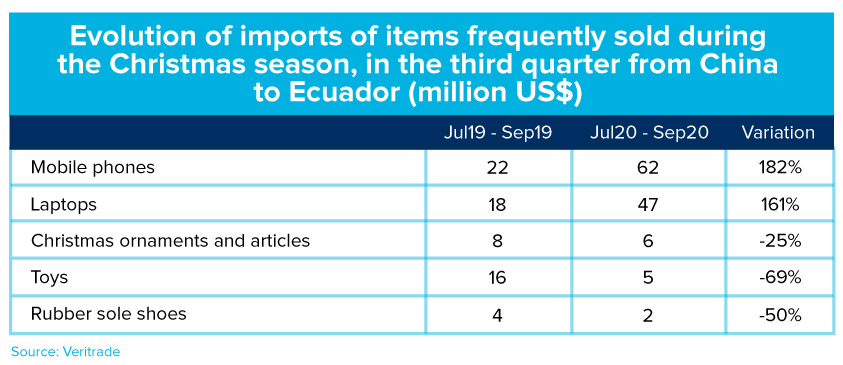

Ecuador

The picture is also no different in Ecuador. However, it is important to highlight the magnitude of the growth in sales of technological products. It is understandable that the expectation of extended confinement until the first and even the second quarter of 2021 has led to consideration of such acquisitions. In contrast, imports of toys and Christmas decorations also show drops that can be explained by the fall in purchasing power and higher uncertainty.

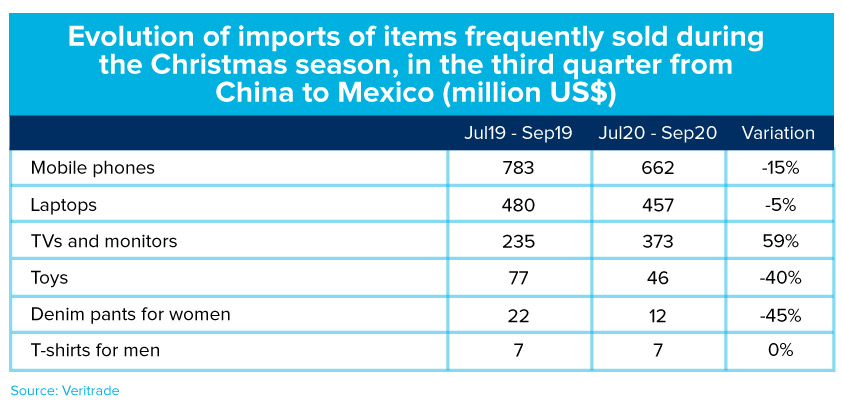

México

The Mexican situation is peculiar. Technological products have not registered the increase in the value of imports observed in other countries, probably due to the availability of stocks in warehouses. As it is known, several brands have assembly plants in the American country, mainly to supply the United States. However, confinement did not cut demand for televisions and monitors in the quarter prior to the campaign, which suggests that the predominance of Asian brands and assembly for desktop computers are the two most important reasons for keeping their shipments on the rise.

Perú

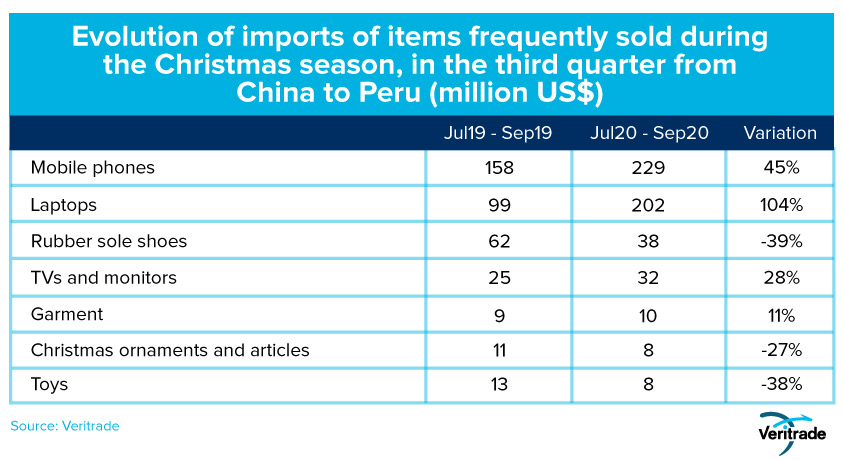

Finally, the evolution of imports has also been, on the one hand, favourable for technological products; on the other hand, unfavourable for more dispensable elements such as high-value toys and Christmas decoration items, and slightly positive for clothing. It should be noted that together with Chile, Peru is the only country of the five analyzed that has a free trade agreement with China, so there are fewer barriers to protectionism in textiles, without leaving aside the defense mechanisms against cases of dumping covered by international law.

A different campaign

The impact of the COVID-19 pandemic on the economies of all countries is unprecedented, but things are not negative for all segments. It is likely that many consumers will use their new computers to have a virtual celebration this holiday season, where they may even have their new purchases of clothing or shoes bought through e-commerce or even an outlet to be part of the limited capacity of shopping malls.

For more information about importing Chinese products to Latin America, you can enter the Veritrade portal.

Request your free trial at https://bit.ly/3mprr4n