Chilean trade balance: Positive results for copper

Published on 07 December 2020

The recovery in the price of copper driven by the Chinese market has allowed the value of shipments abroad to exceed that of imports and cover the falls caused by the pandemic.

The global economic slowdown has hit all economies, but some have managed to recover before the rest and could even close the year with positive variations in their gross domestic product. In the case of China, being the first country affected by Covid-19 allowed it to recover early and, unlike most, it has not been affected by a second wave of major contagion.

This is perhaps the best news for commodity exporting economies amidst all the problems caused by movement restrictions to prevent the spread of the virus. The price of copper is already around US$3.3 per pound, the highest since the outbreak of the trade war between the United States and China, and close to the level before the financial crisis of 2008.

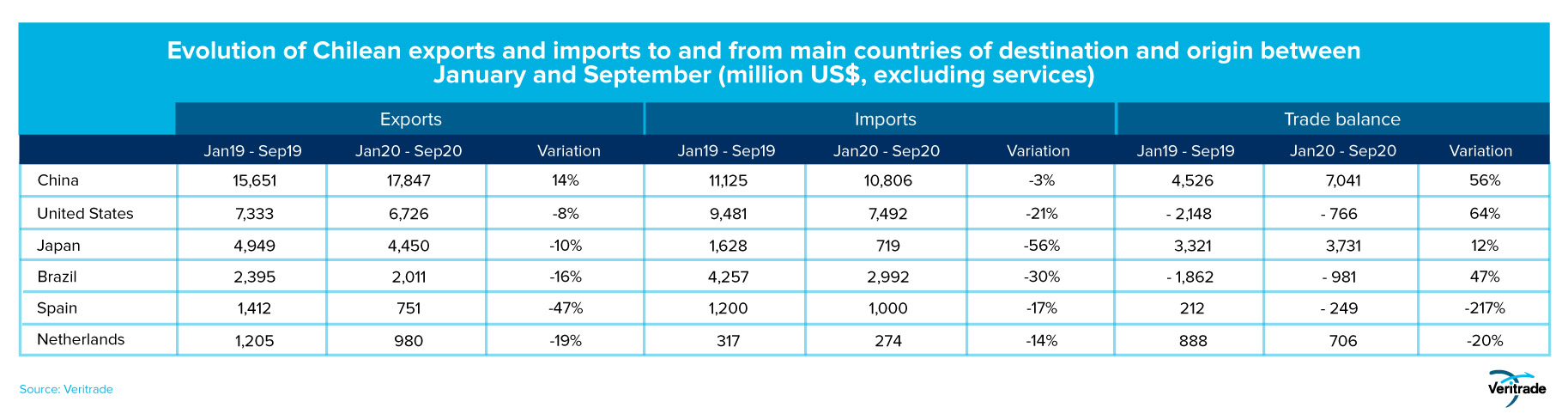

For the Chilean economy, no economic news is more important than this. As shown in the following table, the impact of the recovery of exports to China exceeds the drop in the value of shipments to the United States and the rest of the main destination countries, which are still struggling with the economic slowdown caused by the pandemic.

It is interesting to observe that until the third quarter of the year there was a relative recovery in the Chilean trade balance, which although it remained negative with respect to the United States and other countries, it became less negative. Although it is understood that the main reason is in copper, it is important to review the composition of the export portfolio to understand the full dynamics.

Products at a glance

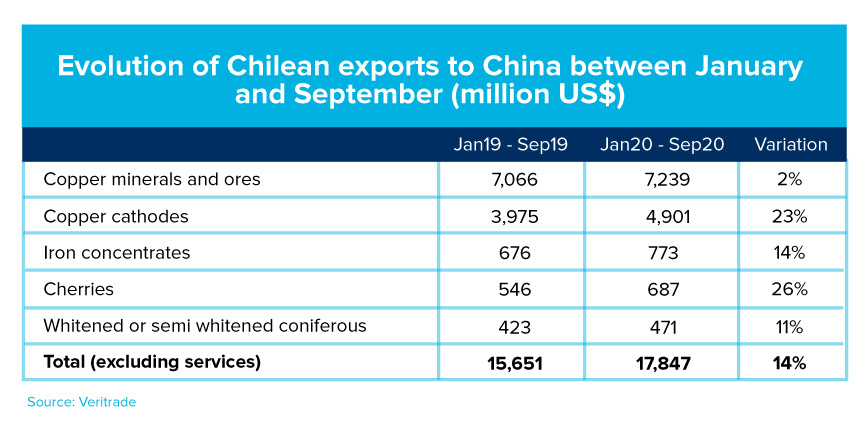

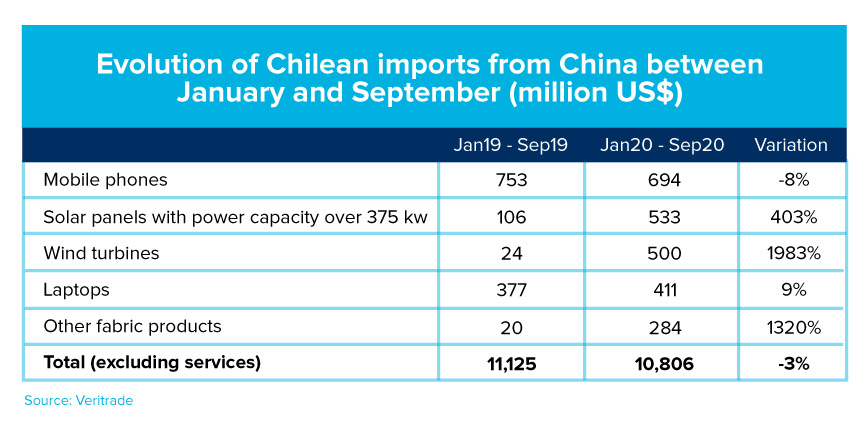

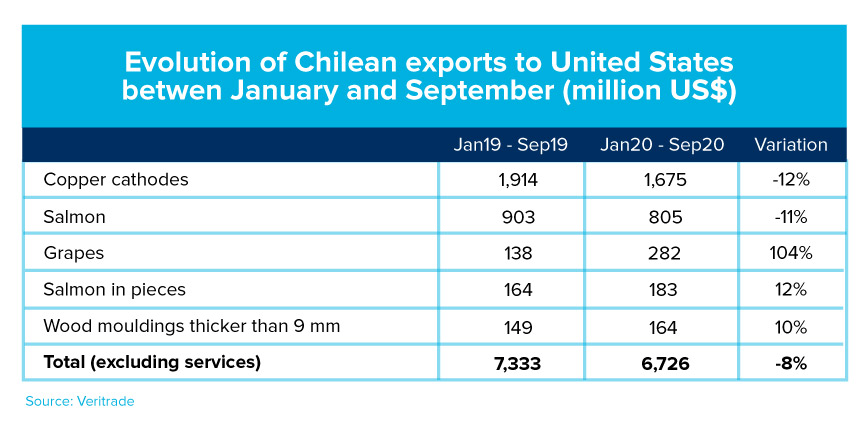

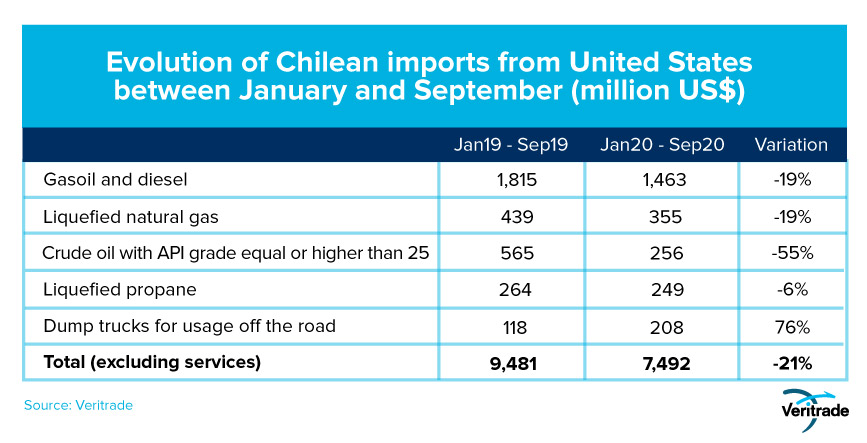

In order to better understand the situation of Chilean bilateral trade, one can analyze the list of the main products exchanged with China and the United States, by far the two markets with which the greatest exchange is achieved. The detail is shown in the following tables.

As expected, the portfolio for China as a destination and origin has a greater preponderance of raw materials and technological products, while in the case of the United States it includes agricultural, aquaculture and fuel products.

Among the aspects that determine the variations of the values, are the undervaluation of fuels resulting from the economic slowdown and the expansion of electricity generation based on renewable sources. At the same time, the resilience of agricultural and aquaculture products stands out, because the demand for food is less sensitive to, and even immune to, economic crises.

The trend would continue

The previous results are auspicious and show the relative advantage of mineral exporters compared to fuel exporters. For this reason, the Chilean economy has a solid foundation to achieve a rapid recovery after the pandemic, and in fact October is also expected to bring good results in terms of trade balance, thus accumulating foreign exchange to support recovery policies.

For more information on the performance of the Chilean economy in international trade, you can check the Veritrade portal.

Request your free trial by entering https://bit.ly/3gkvIoy