What does the United States buy from Latin America?

Published on 20 October 2020

With Veritrade, learn which main products the US imports from territories south of its border, and how their recent sales have evolved.

The American continent has the advantage of being integrated longitudinally by two oceans, and in the case of Central and North America, even by road. In this way, the proximity and accessibility to the United States are advantages for the economies of the other countries. In this article, information extracted from the Veritrade platform shows how the diversity and magnitude of purchases make it the most important destination in terms of value worldwide, despite being the second largest, after China.

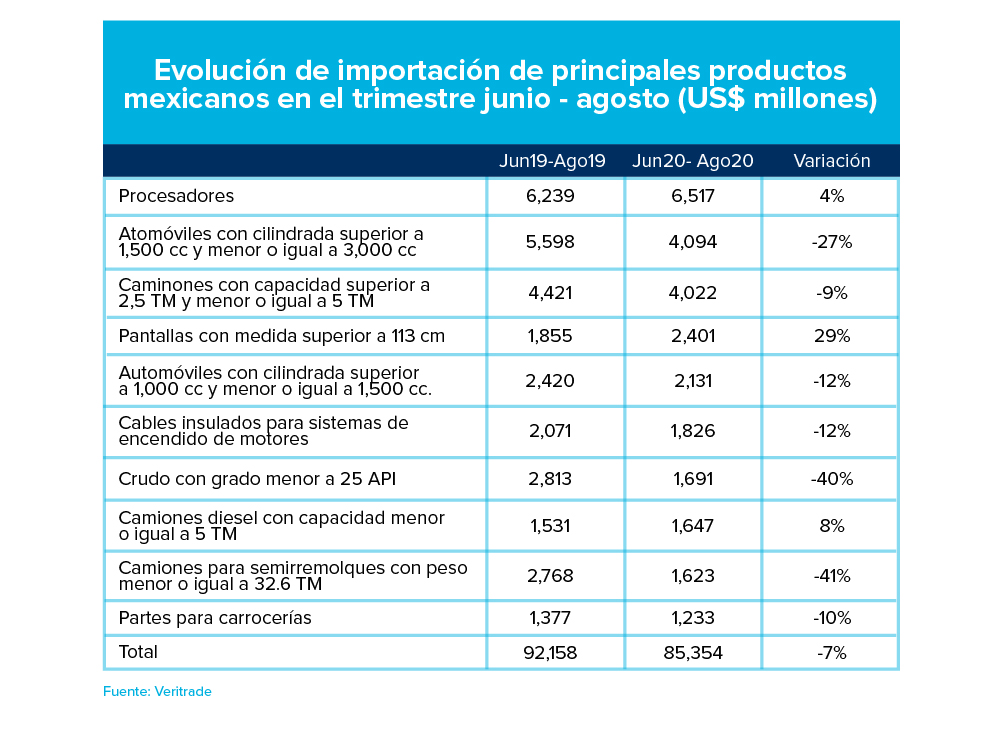

Imports from Mexico

Mexico is by far the richest country in American demand. Raw materials, intermediate and finished goods are among the main elements of its portfolio. The base comes from a mix of natural resources with the competitive advantage of a lower cost of labor.

Interestingly, the amount generated by shipments from Mexico to the United States is higher than the GDP of each of the other countries analyzed in this note. The size of the automotive industry is especially large along with hydrocarbons.

In general terms, these items have been affected by the COVID-19 pandemic, as they are closely related to consumption and general economic activity, affected by restrictions on mobility and crowding. However, the technology industry has not stopped.

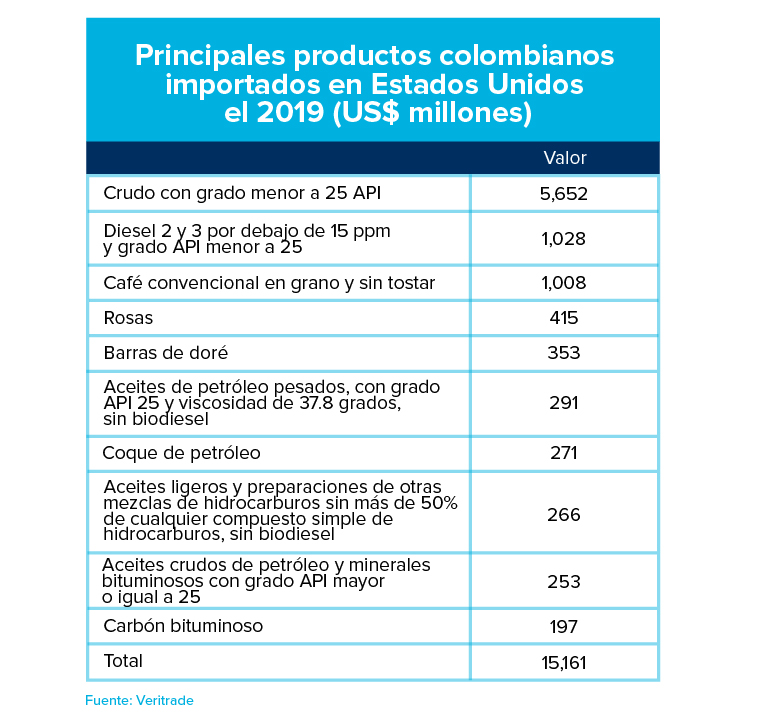

Imports from Colombia

Colombia, on the other hand, marks the geographical separation between Mexico and the other countries of the continent, which depend on their natural resources. Its geography, mainly composed of rain forests and rich in fossil fuel deposits, determines the composition of the portfolio.

The hydrocarbons brought to the United States are both light and heavy, while coal is another fundamental element in their supply. The other major non-agricultural product is gold, exported as doré bars, a gold and silver alloy used for the international transportation of the precious metal. On the agricultural side, coffee is undoubtedly the country's emblematic crop, while floriculture is an industry that has remained solid and is another example of added value and cooperation with small producers.

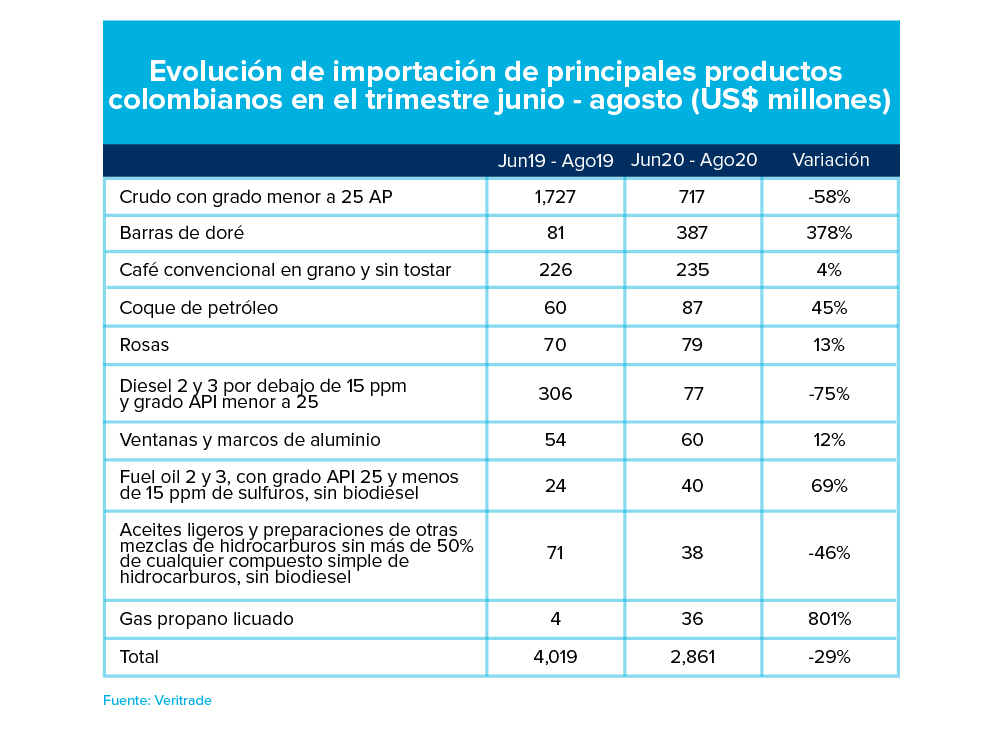

As for recent months, there is no marked seasonality in the list of the top ten, especially due to the preponderance of fossil products. It is worth mentioning that, in the case of propane, the increase in price compared to the same quarter of the previous year generated a higher value in sales. Between June and August 2019 the price fell from approximately US$ 0.5 per gallon to about US$ 0.4, while this year it remained around US$ 0.5, and at the same time the volume sent increased. This occurred even despite the eventual need to import gas into Colombia, which indicates some flexibility in the management of inventory destinations by producers, to take advantage of market windows if the lower cost of imported gas makes it politically viable. Meanwhile, gold has acted as a refuge from uncertainty.

However, these two cases have not been enough to compensate for the fall in oil prices, the lower sales of coal due to the tendency to deactivate power plants with high carbon dioxide emissions, and other products such as textiles, vehicles and their parts, plastics and industrial inputs.

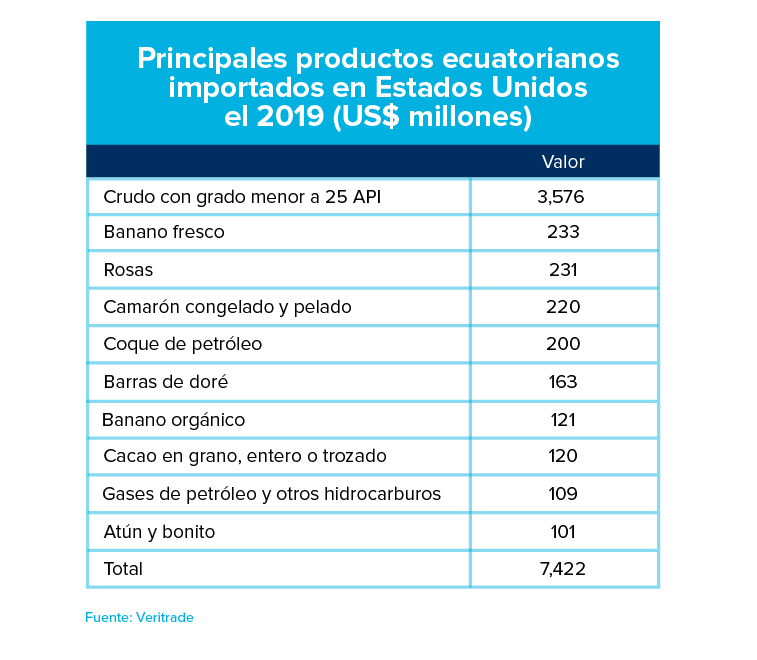

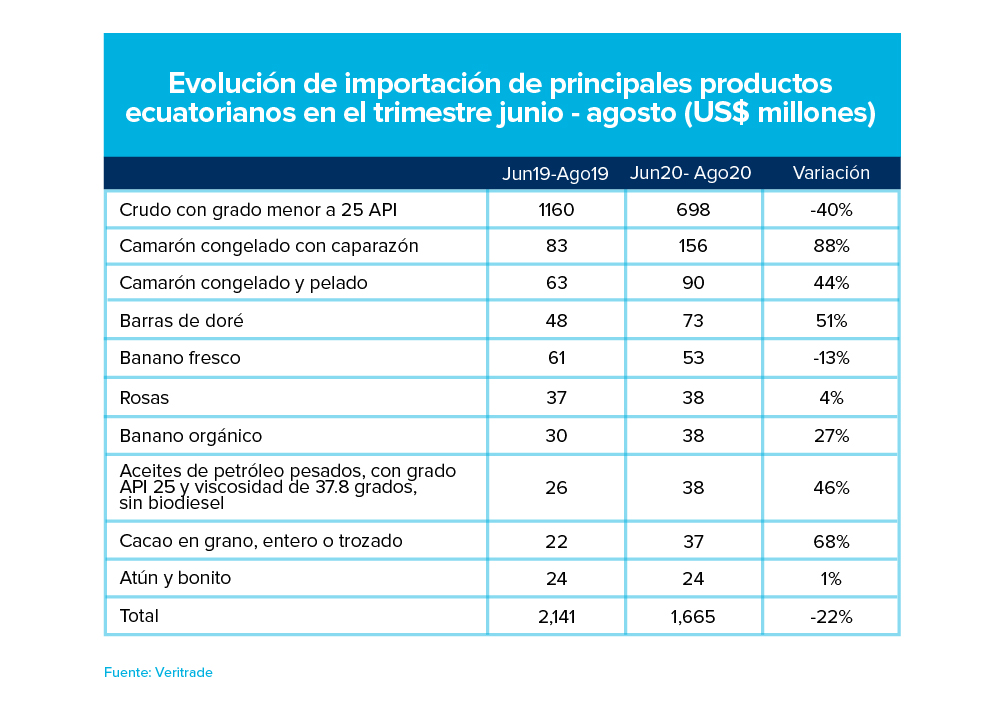

Imports from Ecuador

The Ecuadorian export portfolio is similar to that of Colombia. In the case of agricultural products, bananas are to this country what coffee is to Colombia, while aquaculture occupies a superior position only comparable to the Chilean case, with shrimp and salmon, respectively. It is interesting to note the greater relevance of the United States as a destination in comparison to Colombia: despite the fact that its GDP is three times lower, its exports are equivalent to half of Colombia's.

As for recent developments, the fall is comparable to Colombia's in terms of magnitude, but not in composition. This is due to the drop from a range of about US$60 per barrel of oil in the June-August quarter of last year to one of about US$40 in the same period this year, also as a result of the pandemic. On the other hand, with the exception of fresh bananas, agricultural products have been a clear example of the benefits of diversification and the resilience of the food industry to the crisis.

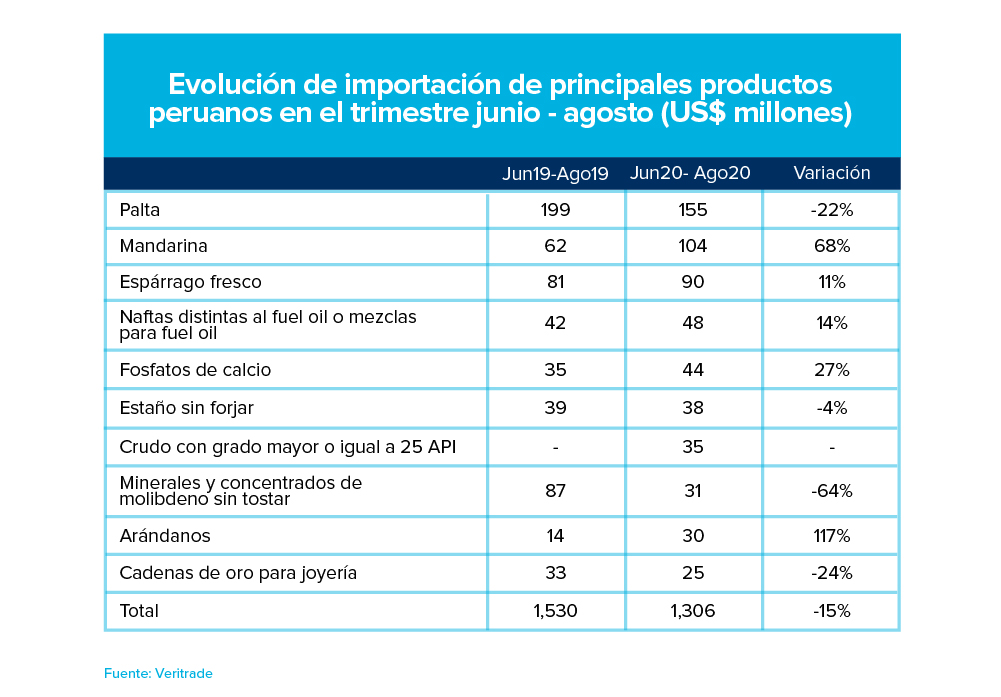

Imports from Perú

The Peruvian export portfolio shares the dependence on natural resources, yet it’s slightly more balanced between hydrocarbons, agricultural products and minerals. In the latter, copper and the other complements resulting from the polymetallic deposits in which the red metal is extracted, have a high participation. It is also important to highlight that since the 90's, Peruvian agriculture was revolutionized with high value crops on the coast, by companies working with large plots, based on Chilean and American technical experience and taking advantage of the country's geographical latitude.

The decrease in Peruvian exports is explained by the industrial metals side, related to the drop in economic activity. On the other hand, the majority of agro-industrial products have performed well, highlighting the resistance explained in the case of Ecuador. Avocados, however, were affected by a drop in prices caused by greater U.S. and Mexican supply, which does not compensate for increased production.

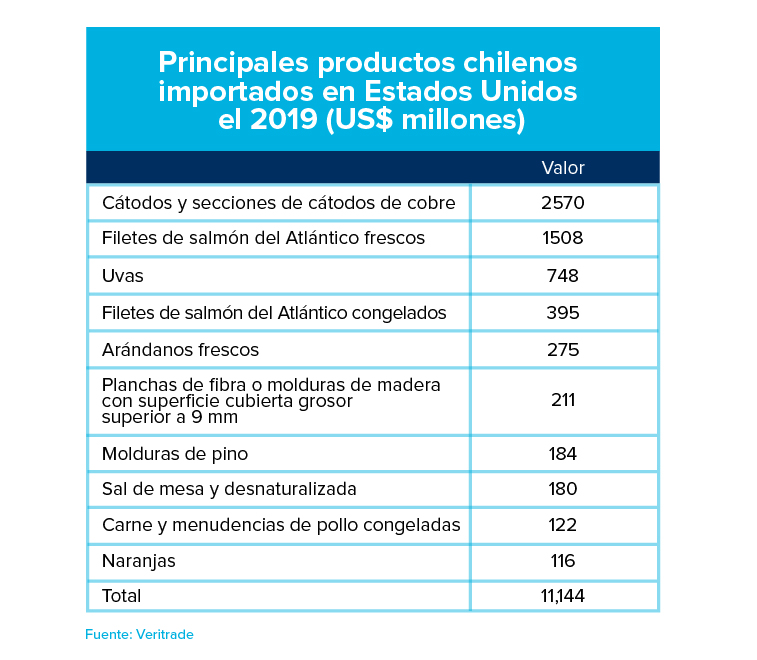

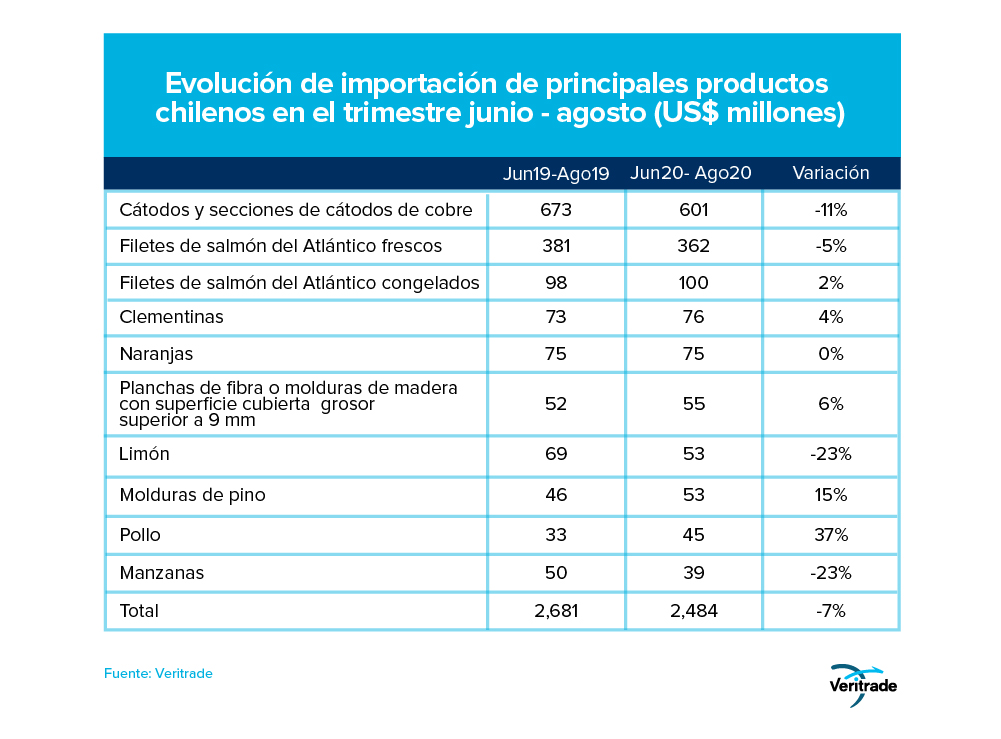

Imports from Chile

Chile has a portfolio that differs from the rest of the region because of the absence of rainforests and jungle, so there are no tropical fruits. Nor does it have a considerable supply of hydrocarbons, so its list is similar to that of Peru in the modern mining and agricultural sectors. Furthermore, it offers a different range of wood products, based on eucalyptus and pine forests, and in the case of aquaculture it focuses on salmon. There is also an important livestock component, both in birds and in pigs and cattle.

In view of the industry's dependence, Chile's export portfolio has not been immune to the global economic downturn either. However, the agricultural, aquaculture and forestry sectors have shown good results. Once again, the Chilean case demonstrates the importance of a country having an export offer that is as diversified as possible, always in line with the possibilities of entrepreneurs within a competitive framework.

Implications of the November Elections

In general, the U.S. trade relationship with Latin American countries is quite close, with the exception of Venezuela. This closeness is maintained even in the case of Mexico, after the tension caused by the renegotiation of the North American Free Trade Agreement (NAFTA) and its replacement by the U.S.-Mexico and Canada Agreement (USMCA).

For Mexico, this means that if Donald Trump wins the election, there will be no need to take a protectionist stance towards its industry, as happened in the 2016 election. What is at stake this time is the type of adjustment that the international market will have as a consequence of three factors: the trade war with China, energy policy and the tax framework.

If Joe Biden is elected president, fossil fuel exports will be affected by lower prices due to the Democratic Party's commitment to renewable energy. In contrast, this would be compensated for by improved relations with China that could drive industrial metals up, benefiting Chile, Peru and Mexico.

Meanwhile, the performance of consumption and investment in infrastructure will be the other two variables to be taken into account in order to know what will happen with the demand for food and intermediate goods, respectively. This will depend, first, on the management of the economic stimulus to recover the country from the COVID-19 pandemic, followed by the capacity to implement infrastructure projects and the revival of investor trust.

But if anything, the magnitude that each movement will have as a result of the actions of the different political positions is even more uncertain. In the meantime, exporters will have to work on adapting to each scenario, taking advantage of or resisting in the best way possible according to the circumstances in which their products are sold.

For more information on U.S. imports, you can visit the Veritrade website.

Request your free trial by entering https://bit.ly/2T8kf0y