Chile: How did the main exports evolve during the pandemic?

Published on 12 October 2020

In this article we will review the elements that stand out the most in their export portfolio and their behavior in this atypical 2020, where we find pleasant exceptions to the fall of the global economy.

The COVID-19 pandemic has shown the importance of diversifying destinations and products. This statement is supported by the review of statistics for the first seven months of the year compared to the same period in 2019, made possible by the Veritrade platform. As an interesting point, not only non-traditional products have gone against the tide, but also raw materials have responded to China's recovery.

Two questions to answer before starting the research are what are the main export destinations for Chilean products, and how much value do shipments to each of them generate. In this way, it is possible to order by magnitude, and thus have an idea of the potential that each of the destinations has to affect the economy of the South American country, whether positively or negatively.

Where does Chile export?

The following table shows the figures for 2019, for which the figures for exports of services, included in the classification of foreign sales provided from Chile, were excluded.

In general, the connection with the two main economies of the world stands out. Then, a great variety of destinations can be observed, such as countries of the region and the presence of several countries of Europe, Asia and North America. This is the result of four decades of work in the opening of Chilean foreign trade, based on the development of private capital, with the exception of the mining giant Codelco.

What products does Chile export?

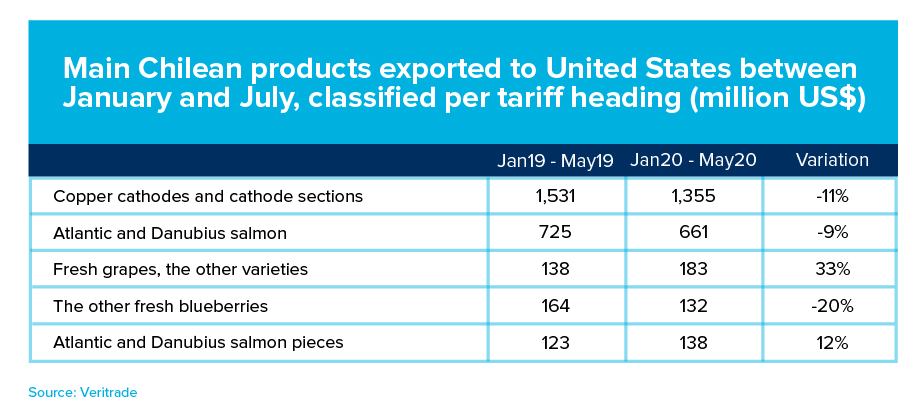

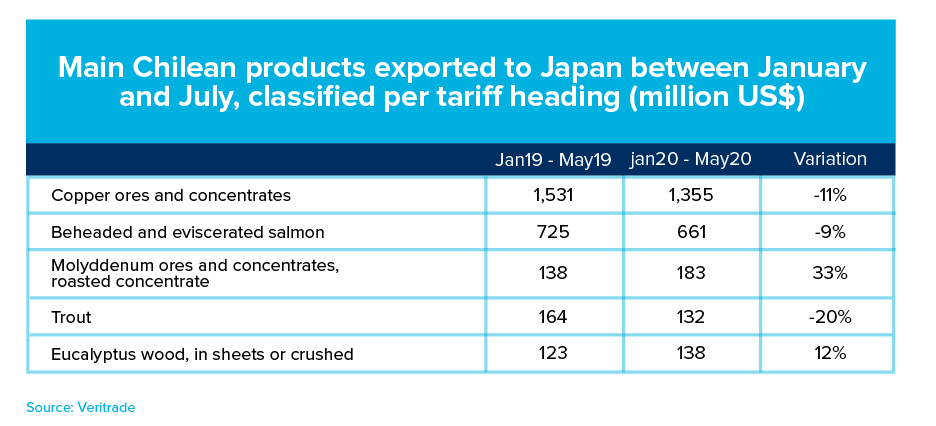

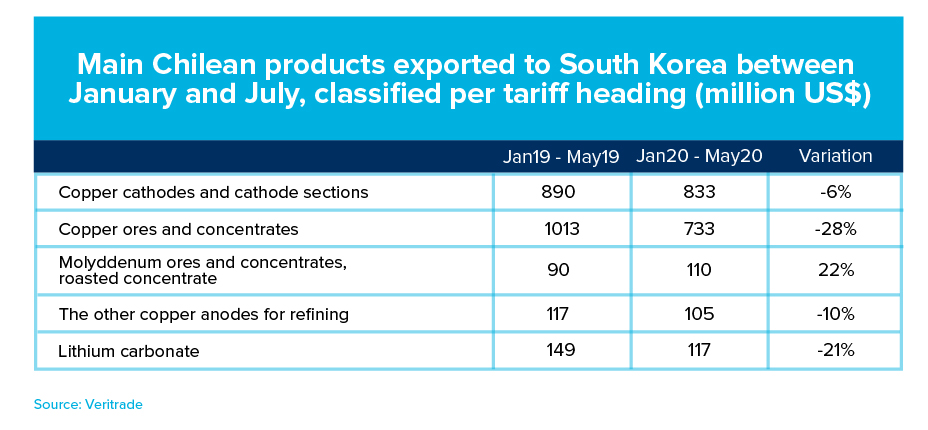

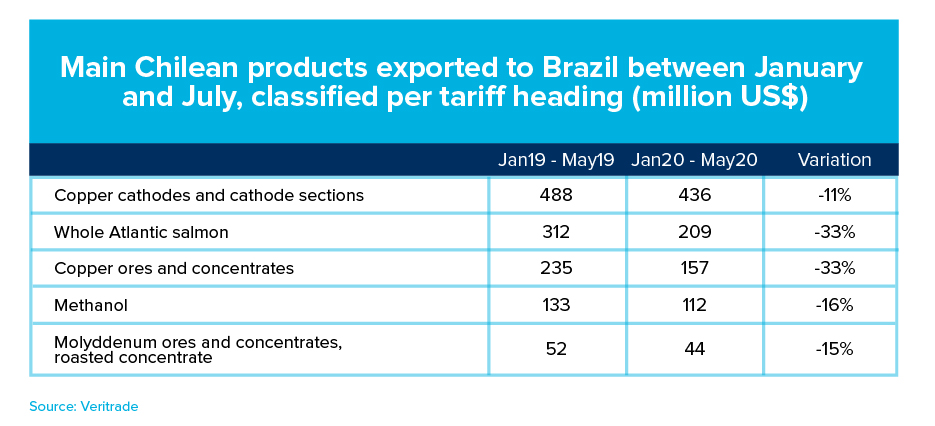

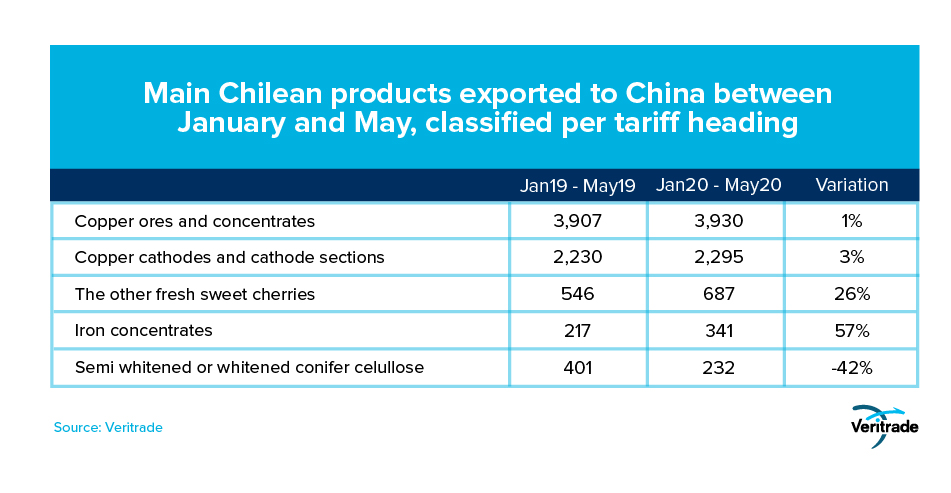

The second question to be answered to get an idea of the impact of the pandemic, is the value of exports by product to each relevant destination. For the purposes of this analysis, the performance of the value generated by shipments to the five main destinations was reviewed up to the last month for which information is available (July, except for China), as can be seen in the following tables.

In the case of China, there has been a recovery in the price of copper since mid-March, when it reached a minimum of US$ 2.19 per pound and generated an absolute reversal of the last cycle that began after the last minimum of US$ 2.02 in January 2016. Currently, the metal is trading around US$ 2.90 per pound, compared to the downward trend during 2019.

Meanwhile, several agricultural and aquaculture products have performed well. Except for Brazil, where demand has been strongly affected by the pandemic. These have been a clear example of how diversification makes it possible to face the crisis. Even in the United States, the country with the highest number of COVID-19 cases, the evolution has been positive.

What will happen with Chile?

According to Chile's Undersecretary of International Economic Relations (Sunrei, by the Spanish acronym), the US$ 71 billion generated by Chile's exports as of July this year is 12.5% less than that of 2019. However, since June there has been a sustained monthly improvement over the same periods last year.

Stimulus packages and gradual control of the pandemic are expected to allow this path to be maintained. For the time being, Chilean exporters are dependent on several factors, both at the consumption and investment levels. While food producers are attentive to indicators of contagion and employment, mining, logging and industrial companies maintain the focus on industrial activity, especially in China and the United States. What happens next may still be uncertain, but everything seems to indicate that there are reasons to remain optimistic.

For more information on Chile's exports, you can enter the Veritrade portal.

Request your free trial at https://bit.ly/3nKTzRk