Copper as Chile's economic boost

Published on 24 July 2020

The fall in the price that the main export product of the South American country has had since January has recovered in July, which brings good news for its economy

The coronavirus pandemic has caused all the world's economies to paralyze. However, some have already started their recovery phase while the restrictions continue.

In the case of China, raw material purchases have resumed, it is expected to have a growth of around 3% in GDP for this year, compared to the negative rates that will be observed around the world. Although the country used to advance to 6%, the fact that it at least reaches a positive rate is good news for all exporters who have the Asian country among their destinations.

In the case of copper, of which Chile is the main producer globally, the correlation with this recovery will be evident. China buys around 40% of copper in the world, so what happens with its production has a direct impact on the recovery of activity in mining companies.

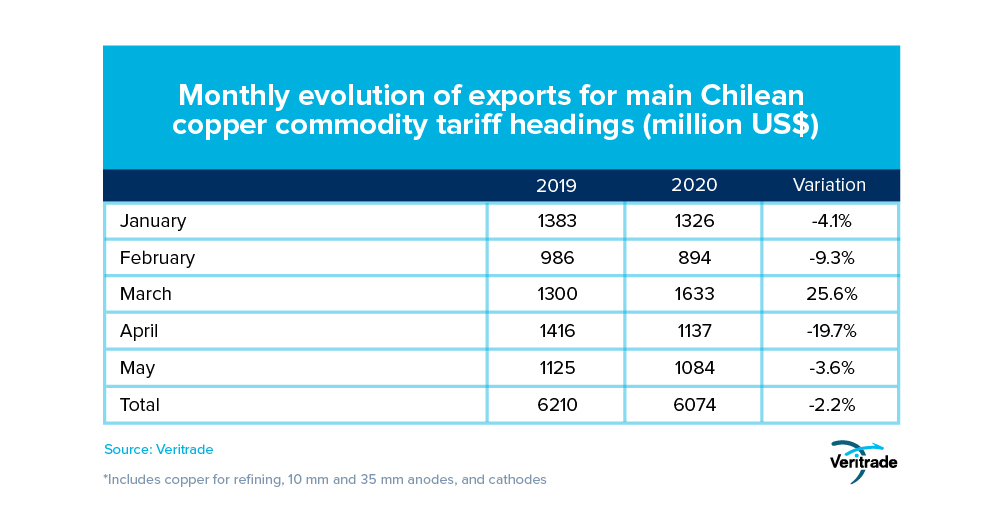

At the moment, there is only information registered until May, in which the impact of the market cooling is observed. In the following table, you can see the results

It should be noted that 2019 had already been a bad year for copper as a result of the trade war between the United States and China. For this reason, the economic blow of the pandemic was like rain on the wet for copper exporters. In the second week of July, the international price of copper had already exceeded its maximum value in a year, passing US $ 6,300 / tn, and the value was already close to those quoted at the best time of 2019, when it was he paid around US $ 6,500 / ton.

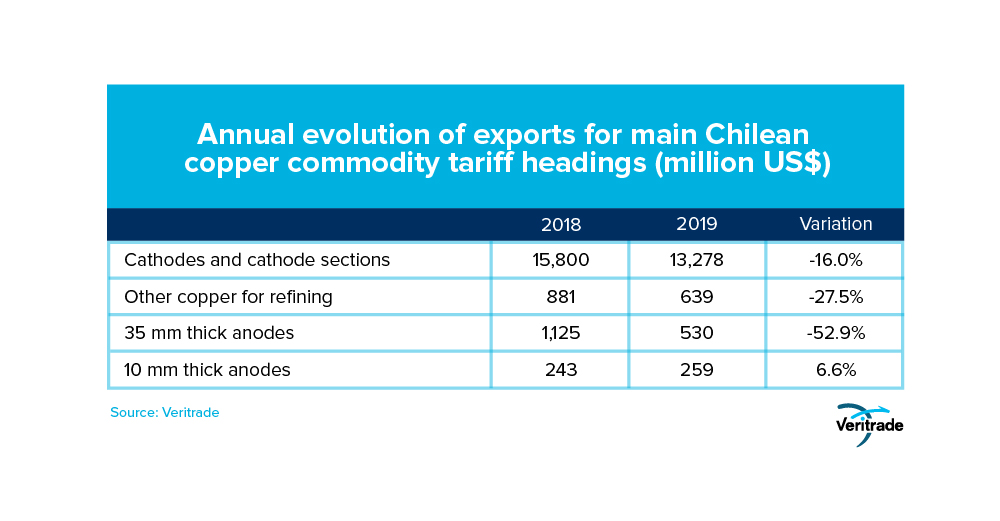

The following table shows the annual evolution of Chilean copper exports to China. It should be noted that that year, the coup was reinforced by the strike of the workers of the state mining company Codelco, which is also the main producer of the red metal in the world.

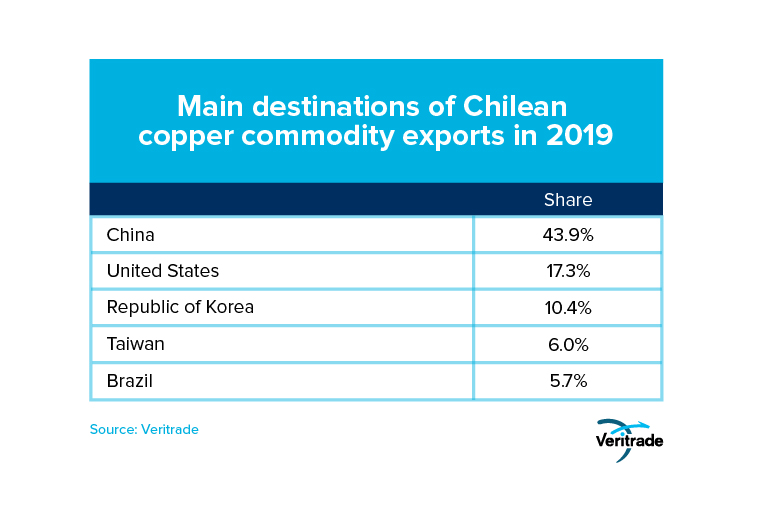

As a last point, it is interesting to note that China is not the only market in which Chilean copper exports could recover. The fact that South Korea and Taiwan are among the greatest success stories in managing COVID-19 creates the conditions for their economies to be some of the ones that will have the best recoveries in the following months.

The following table shows the importance of these countries among the main destinations for Chilean copper exports. It should be noted that for the purposes of the analysis of this article, only the main items considered raw materials have been taken as a reference, while copper wires were not taken for the analysis as they are intermediate goods with less sensitivity to international prices, at the economic expectation, to speculation with inventories, as well as for its lesser relevance in terms of value.

In general, reinforcing the good relationship with buyers from Asian countries other than China with a large technology or heavy industry and a stable health situation is a good strategy to compensate for the decline caused by the pandemic. Meanwhile, Chinese buyers should continue to be the first to look after, while the recovery of the United States, Canada and Latin America is awaited. And if inventories and expectations allow it, perhaps the price could come close to the 7,000 US $ / ton that copper used to trade in times of mining boom, between 2003 and 2014, when the slowdown in China and the The dollar's recovery began to affect it.

For more information on Chilean copper exports, you can enter the Veritrade portal.

Request your free trial by entering https://bit.ly/2WWxJyy