The mining industry will boost Peru's economic recovery

Published on 11 June 2020

Reversing the impact of the coronavirus on the Peruvian economy will largely depend on the revival of its mining exports, dependent on China and gold as a refuge.

Peru has been, is, and will be a mining country as long as precious and industrial metals have value. Since pre-Inca times, the most important activity, within the empire and the colony, has been accessing to gold and silver mines.

From the colony, the export became the base of the economic development of the country. Then, after independence, it was possible to take advantage of the resources to generate income for the State for the benefit of its citizens. This dependence continues to this day, and the entire evolution of the country depends on the indirect impact of shipments of minerals abroad.

58.9% of export earnings in Peru during 2019 came from mining, which also generated 9% of its GDP. In this way, it is the most important item for the country's foreign trade, in addition to the most important specific productive activity, after general items such as trade and services.

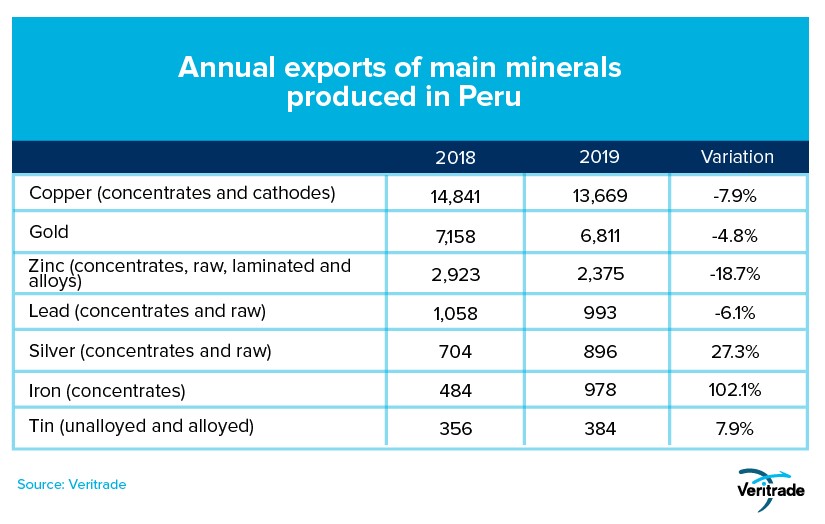

2019 had been a difficult year due to the reduction in prices as a result of the trade war between the United States and China. The following table shows how most metals had a reduction in the value of their shipments, while gold did not become consolidated as a financial refuge despite a significant rise in the first half of 2019, due to the fact that the dollar remained solid despite reductions in the benchmark interest rate by the United States Federal Reserve.

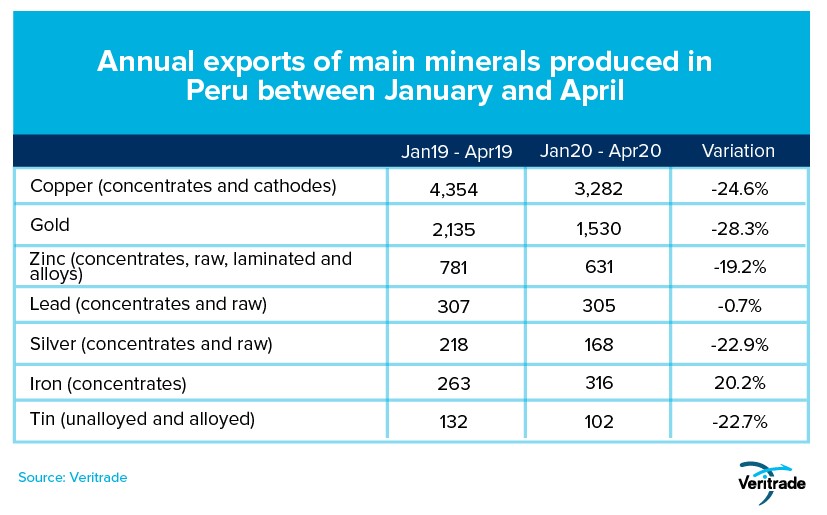

But if the trade war had a significant impact, the COVID-19 pandemic has been more devastating. The first four months of 2020 have brought negative results for almost all metals. The following table shows the figures so far:

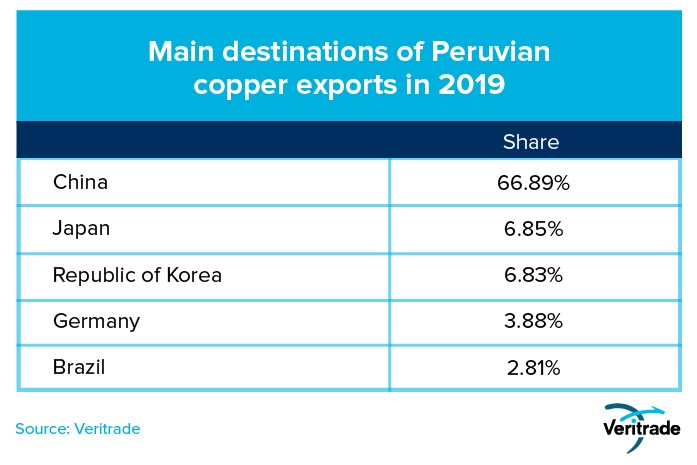

Given the complications of recovering domestic demand due to the impact of quarantine on the labor market, the most credible way in which the country would recover would be through a revival of the mining sector. This has two fronts: on the industrial side, copper and other industrial metals will continue to be demanded by the expected public investment stimulus in China, while precious metals offer parallel coverage during the stabilization of the financial market. At the moment, gold has already had a period of rising during the pandemic explosion and the dollar has reduced its value so that the next export contracts could be expected to result in higher values.

In other words, Peru is largely covered, compared to countries that lack such products in such a significant proportion. It should be borne in mind that the results of 2020 will be affected by the stoppages of operations during the most critical months of the quarantine, so that 2021 should be, with all the more reason, a year of bouncing upward in the value of shipments.

The fate of the Peruvian economy depends largely on China's ability to execute its projects, the revival of global industrial demand, and the search for gold and silver as safe-haven assets. This will depend largely on the uncertainty generated in the financial markets, but in any case, that investors do not come to need them would rather be a sign of strength for the rest of the economy.

The governments of the countries must work to offer conditions in which private investors can work efficiently and sustainably, in order to distribute the benefits of the available resources. The case of mining in Peru can be replicated in agricultural and forestry, fishing, biological, and energy products elsewhere.

For more information on Peruvian exports, you can enter the Veritrade portal.

Request your free trial at https://bit.ly/3hkw0f5