Mexican oil faces lower prices

Published on 15 April 2020

The combination of the price war between Saudi Arabia and Russia and the economic slowdown due to the coronavirus has led to a historic drop that affects the country's exports.

The current global situation is the most challenging in the 21st century, even in comparison to the financial crisis of 2008 and 2009. The stoppage of activities as a consequence of mobility restrictions to face the coronavirus pandemic has led to a freezing of demand. of raw materials, intermediate goods and capital and, of course, fuels, in view of the supply response to inactivity.

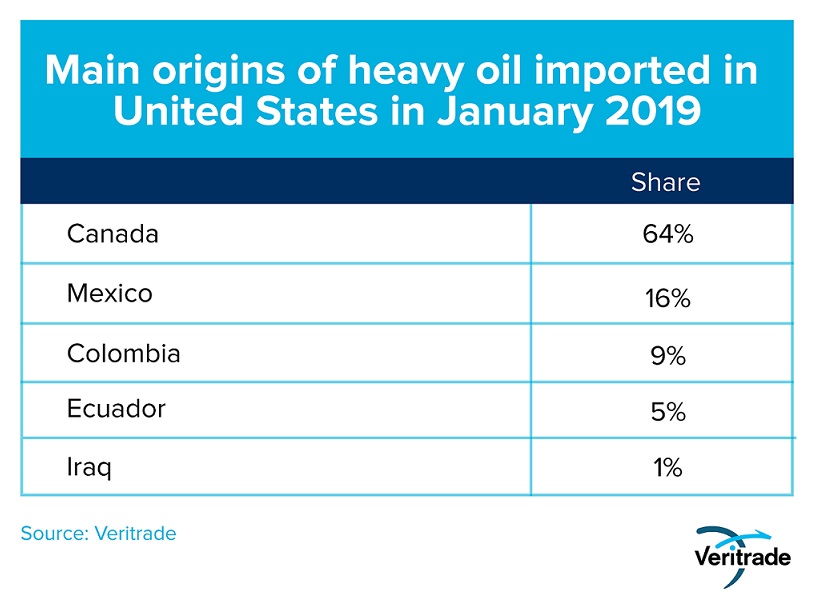

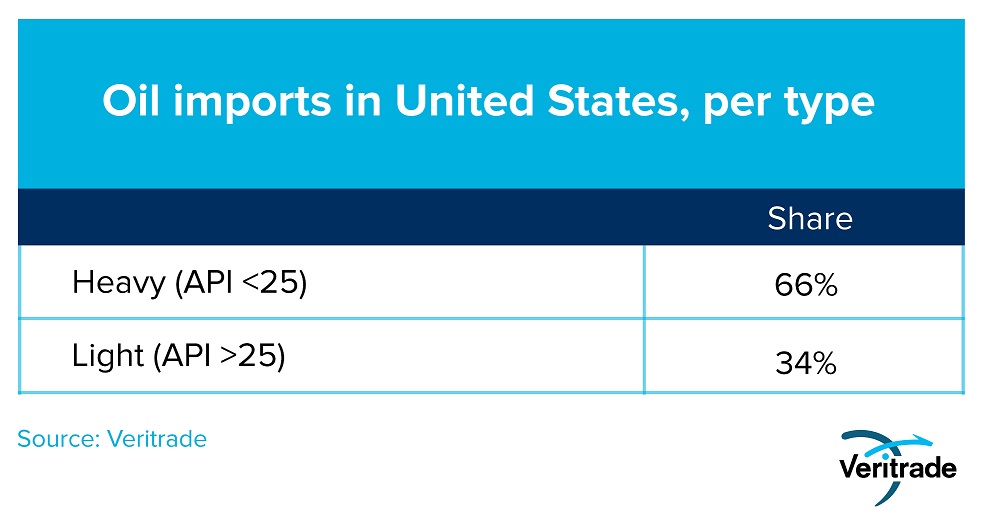

This turned out to rain on the wet for Mexico, whose GDP depends on around 2% of oil exports, but whose tax revenues come from more than 10% of that generated by state oil company Pemex. Consequently, the fall in the price of the Mexican blends category, as it is called heavy oil (that is, thick, lower-priced and used to mix with the lighter to obtain greater efficiency in highly complex refineries) from the North American country, brings concerns about the stability of the country: in the third week of March, its price fell below the US $ 20 per barrel, with a historical collapse of 22.36% on Tuesday, 17 of that month.

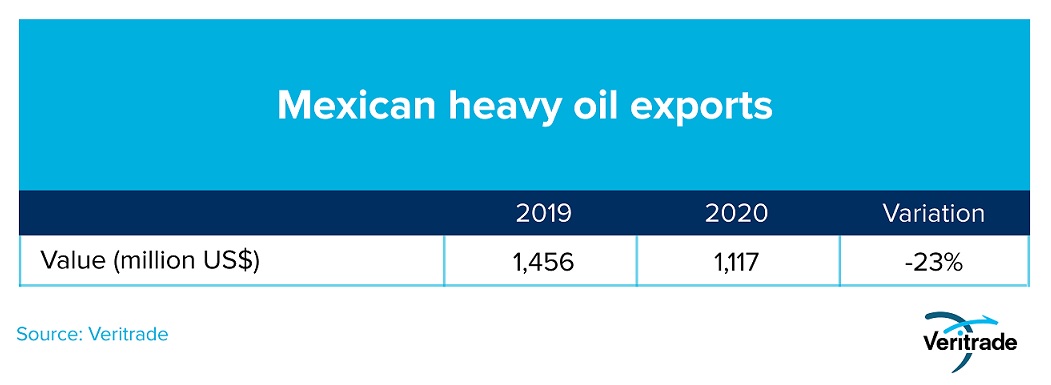

This fall reverses the momentum that had been achieved with the recovery in prices up to January of this month, in which exports had performed better than in the same month of the previous year. However, in February the effects of the international collapse began to be perceived, which does not seem to have positive prospects due to the positions of Russia and Saudi Arabia regarding their high production levels, which lead to an oversupply.

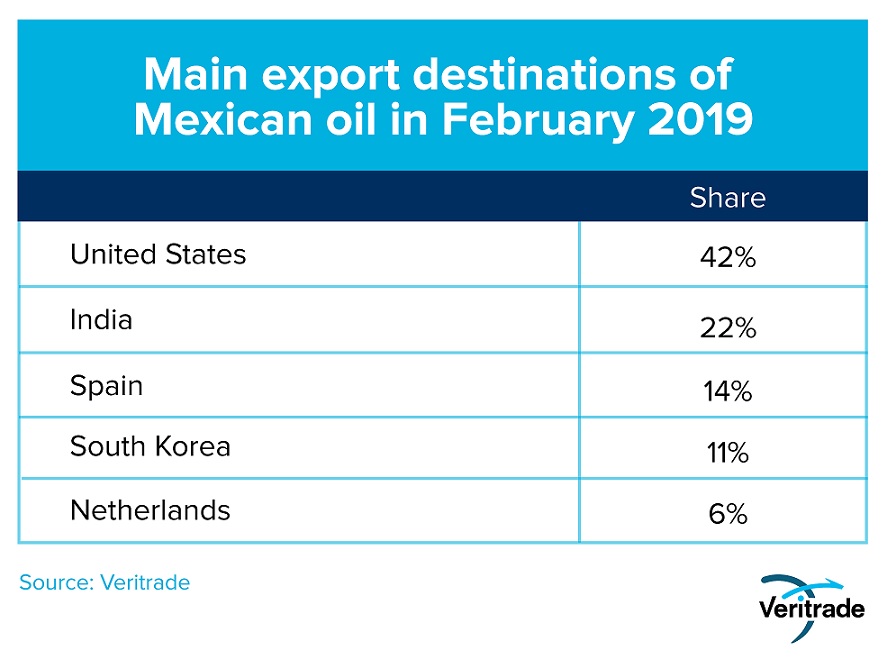

The following tables show the performance of the value of shipments in the second month of the year, as well as other relevant figures to understand Mexico's position in the global market.

Unlike other products, oil does not offer the possibility of generating natural risk coverage through market diversification and has a price that is defined simultaneously for the entire planet. For this reason, the best way out for Mexico is to find the best way to achieve the highest possible levels of efficiency at Pemex and even consider the possibility of doing it through private capital.

For more information on Mexican oil exports, you can enter the Veritrade portal.

Request your free trial at https://bit.ly/2RCBkiU