Peru is consolidated as the main exporter of blueberries

Published on 11 March 2020

In just eight years, the producers have managed to develop -what is now- the second source of non-traditional agro-export in the country.

In the agro-export business, a fundamental factor in competitiveness is determining if geography offers favorable conditions for the cultivation of fruits and vegetables when the rest of the world needs it. If the latitude and soil conditions allow full harvest, while exporters from other countries don't or are at the initial or ends of their campaign, then if the place is optimal for the development of the product evaluated.

This was understood by Peruvian blueberry producers, who take advantage of the country's coast sales to reach high yields and access to the market when the prices were high. Only ten years ago, there were no large plots of this product on the coast, and it would be inappropriate to start to think about it.

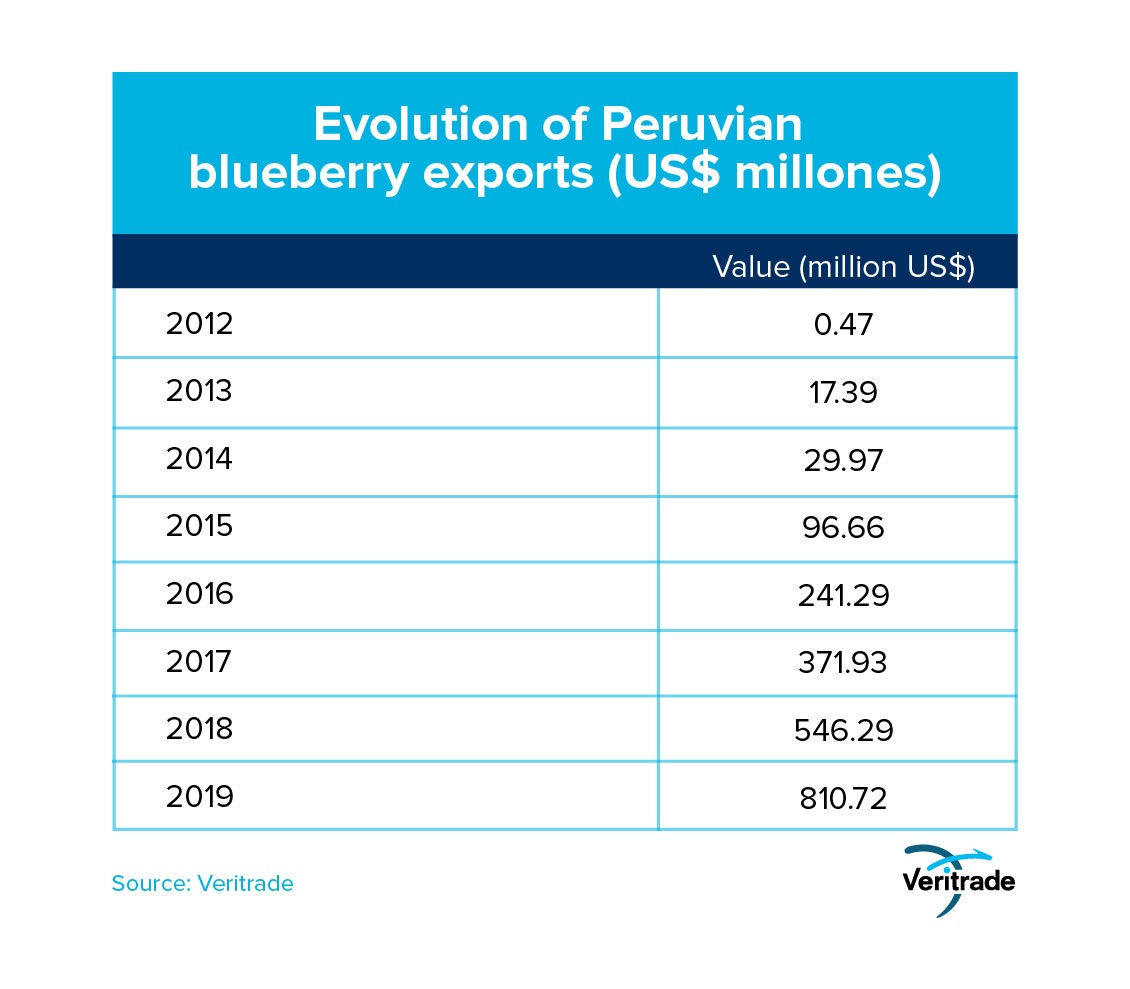

However, export figures clearly show that in Peru there was a great opportunity untapped and that it was only a matter of doing some tests on the coast to verify that this innovation was possible on a large scale. The following graphs show how, in just seven years, a millionaire industry was generated, especially based on companies with experience in other fruits of the forest, with operations in the western and northwestern central parts of the country.

The lines also show how the revenues generated during the campaigns and their extension have risen over time, which shows that not only the market has been accessed promptly but that the extension, location, and development of the crops allowed having greater production in different latitudes. As for how supply launched the demand, the following graph shows that between September and November prices reach their peak, just when Peruvian blueberries are harvested.

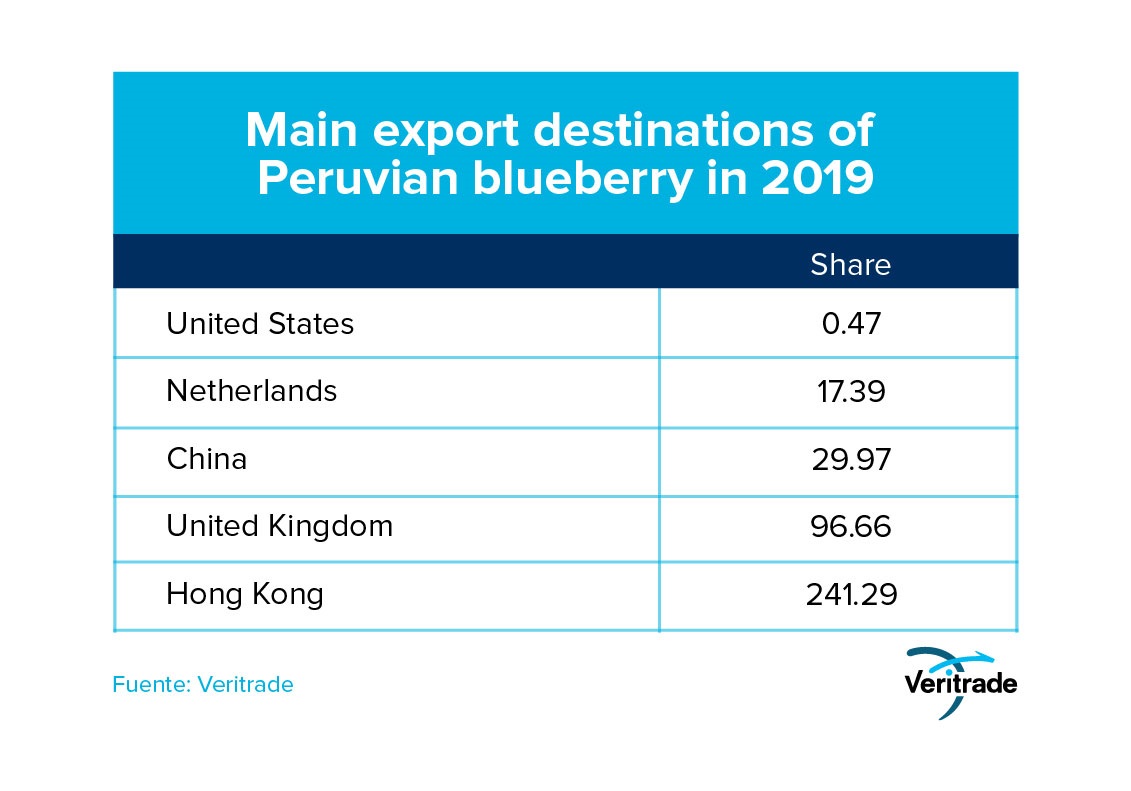

This is due to the shortage of production in the rest of the world at this time of the year, especially in the northern hemisphere. In the following table, you can see that the destinations are concentrated in this part of the planet, while Peru is not a relevant destination due to the low consumption habit and the preexistence of Chile as a producer.

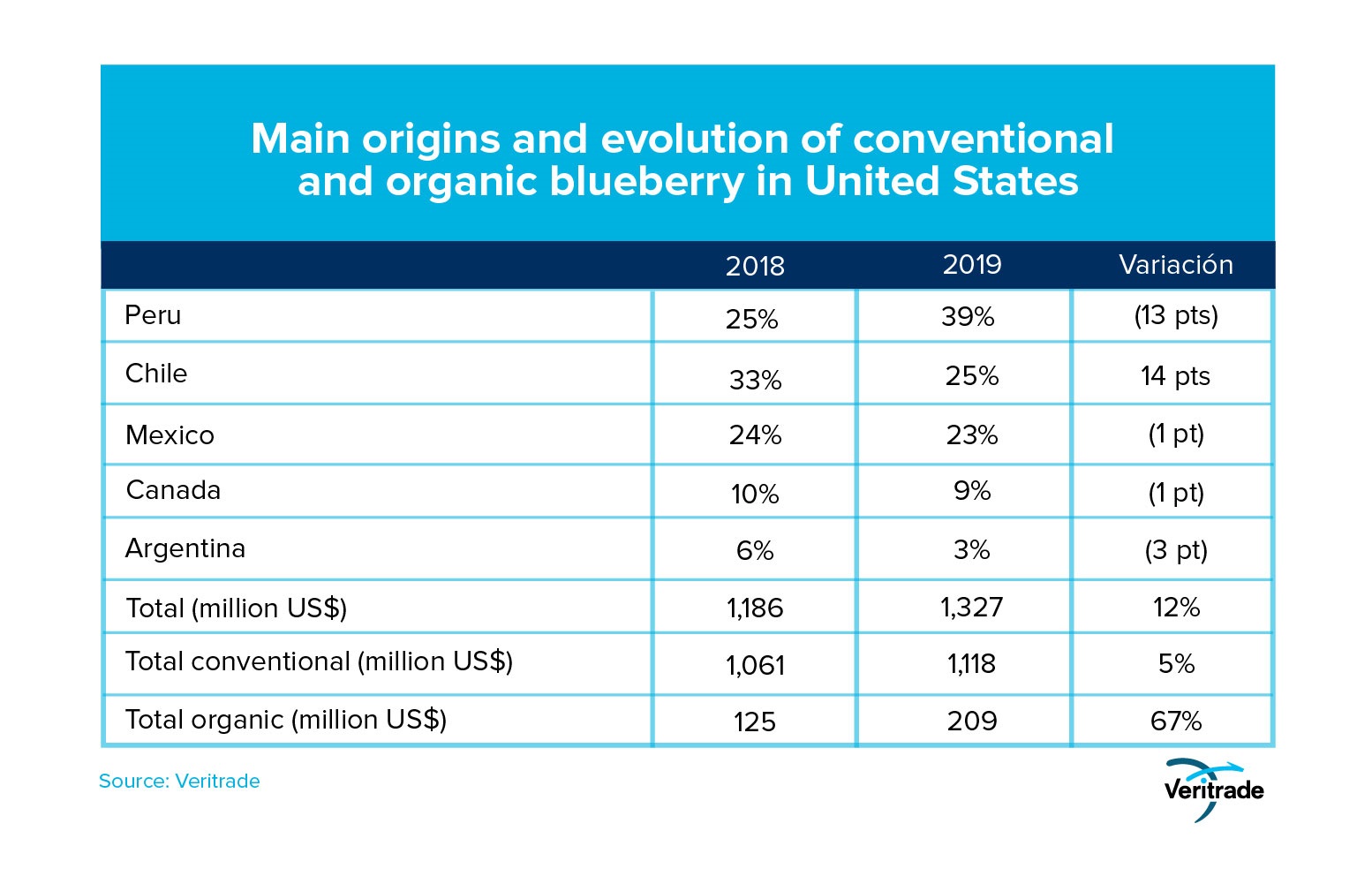

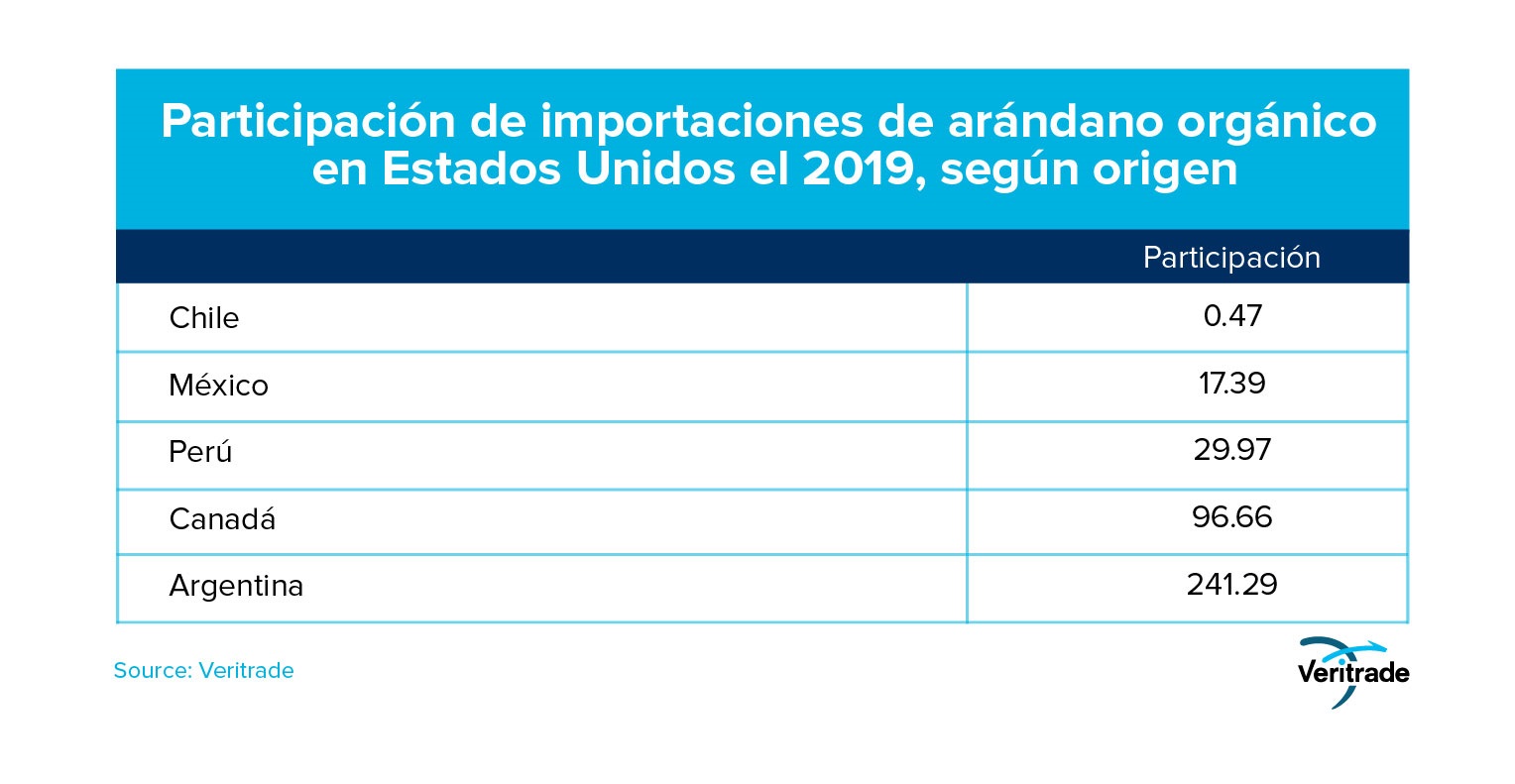

Regarding value-added opportunities, it's important to analyze the possibility of expanding certified organic production. In the case of the US market, although only 15.7% of what is imported is organic, it's in this segment that most of the growth has taken place. This data indicates that although the consolidation of Peruvian producers as the largest in the world has occurred in the conventional segment, in which performance tends to be higher and costs lower, they also have an opportunity for growth in the organic part, for which it will be necessary to devote a significant effort to commercial level and quality control.

Anyway, in any segment, Peruvian blueberry exports have a structural advantage that cannot be overcome in the northern hemisphere, and which is rather complementary to those of Chile at the time of overlap in both campaigns and, above all, in the mismatch between one and the other. Shipments from both countries are managed by the same traders and point to the same markets, so that the fluidity in shipments favors the preparation of joint contracts and, above all, the development of markets with the accumulated effort of both countries. As a next goal, we must aim to collaborate to massively reach consumers in China.

For more information about blueberry exports in Peru, you can enter the Veritrade portal.

Request your free trial at https://bit.ly/2vXWzE4