Mexico: Agreement with the United States and Canada could benefit auto parts producers

Published on 18 February 2020

The imposition of a minimum quota of components produced in the North American countries drives the perspectives of the producers.

The last three years have been characterized by international tension regarding trade policy. Among the campaign promises fully fulfilled by the president of the United States, Donald Trump, is the replacement of the North American Free Trade Agreement (NAFTA) with a new agreement, known as USMCA for its acronym in English or T-MEC in Spanish.

The main fear from the Mexican side was the imposition of tariffs, as happened with steel and aluminum, both released in May, but with a setback in the case of Mexican structural steel in September, and with pending issues in the closing of the negotiations for the implementation of the agreement, signed in November but with issues of this kind still pending resolution.

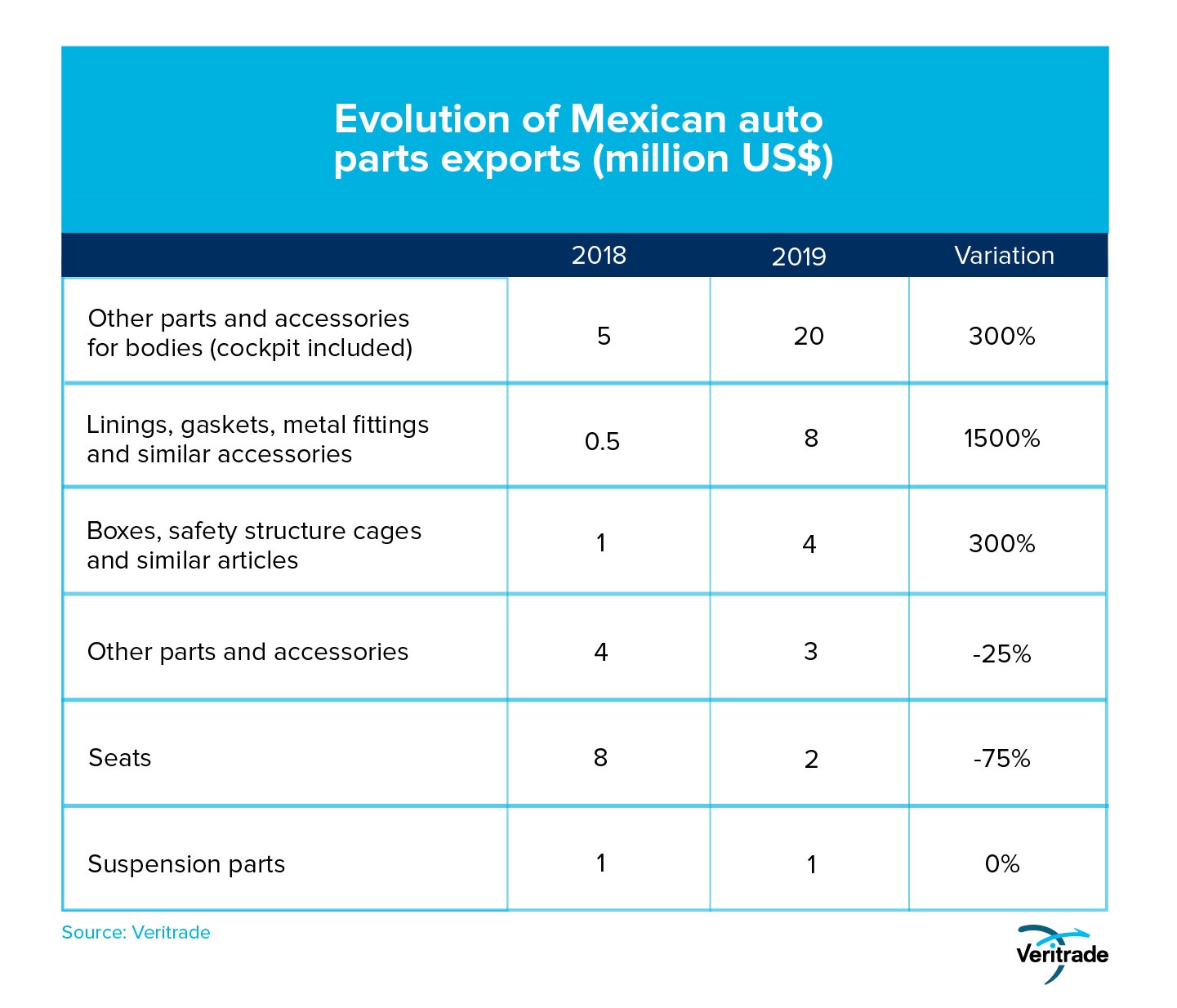

In the midst of all, encouraging news for Mexican auto parts producers is that the T-MEC forces the automotive industry in the three countries to increase the portion of parts produced in them, to reach 75% in light vehicles, compared to 62.5% current minimum. This coincides with a good result in the export of Mexican auto parts, as can be seen in the following table.

The recent norm gives an additional boost to an industry that was already on track, so the Mexican economy will have a good foundation to increase its growth. However, not everything is said, and the consumer will be the one who has the final word: in a competitive environment in which Asian manufacturers offer substitutes with recognized brands and new brands for less wealthy or demanding segments, American manufacturers face the risk of an increase in the cost of steel and components imported from China, or worse, of an inevitable narrowing of profit margins by having to bear the higher cost of inputs and regional labor.

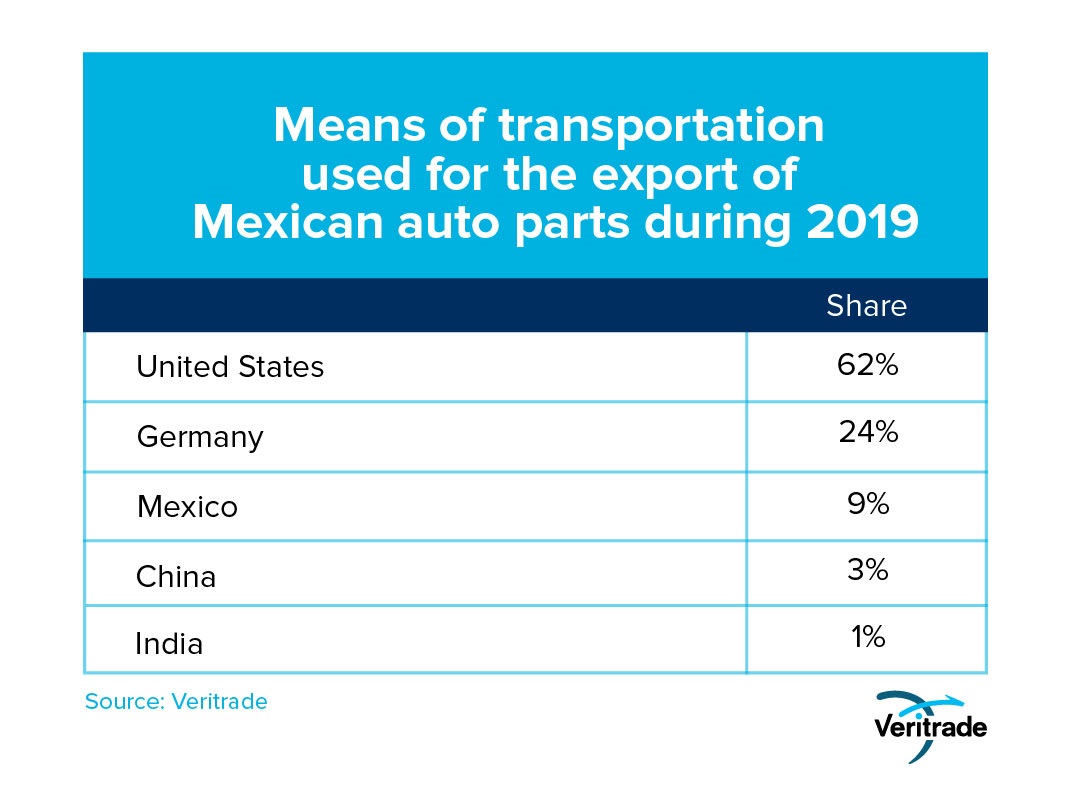

In general, what happens to Mexican auto parts suppliers will depend mainly on the US market, and this, in turn, is sensitive to competition for placing the final product before consuming. In the following table, you can see the participation of the main destinations, and the importance of the United States for Mexican sales.

It should be noted that in case the agreement strategy is unsuccessful and leads to an unmanageable loss of competitiveness compared to Asian producers, the European market could dampen the slowdown, as long as the US trade policy does not severely affect the brands of this continent, especially the German ones. In any case, diversification is always a good preventive strategy, and although it's not guaranteed success, it's at least one action usually effective among the many that can be taken to reduce the risk.

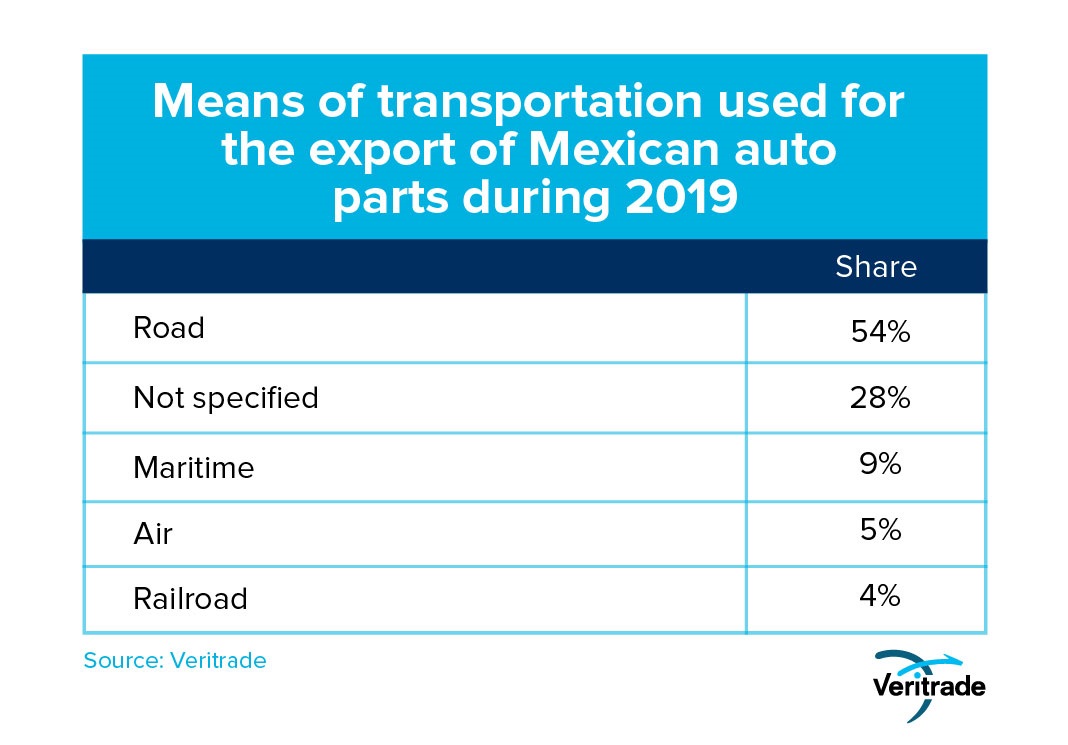

Finally, it should be noted that a favorable aspect for Mexico as an origin of auto parts is its extension from coast to coast, which allows it to serve the Atlantic and Pacific markets. The seaway is the most used, so it is a comparative advantage that gives a structural benefit to American producers. On the other hand, retailing also has an important niche, and the airway is another important channel for dispatch, as the following table shows.

Trade policy represents an ambiguous factor that can be unmanageable when larger partners take a certain path. In this case, the answer to the result of the policies imposed by the T-MEC is still uncertain, but it does not stop generating enthusiasm. The most important work will be to refine the commercial network between the three-member countries to achieve maximum efficiency in a production chain that is deployed within countries with high labor costs compared to their Asian counterparts, and with inputs that may end up expensive for the tariffs applied to Chinese imports.

For more information on Mexican trade and the countries with which you exchange goods, you can enter the Veritrade portal.