Chile perseveres: A boost to its exports

Published on 23 January 2020

2019 was a tough year for the external front in Chile, which caused the reduction of its exports. The strengthening of commercial offices can support its resurgence.

The protests unleashed in October last year affected domestic demand in Chile and its GDP, which would have only grown 1%. However, this fall was not only due to reductions in consumption and investment.

The international tension caused by the trade war between the United States and China affected the price of copper, largely demanded by the Asian country (which buys 40% of metal sales globally) to feed its technology and automotive industries. The price of Chile's main export product fell from a range of US $ 3 per pound to around US $ 2.6 per pound, and only recovered until November when the talks between the two powers pointed to a truce.

Meanwhile, the supply of agricultural and fishery products somewhat eased the fall of metals. For this reason, the Netherlands, the country through which most of the food products enter Europe, had a minor fall to the rest of the destinations, with the exception of South Korea, the only major destination of raw materials that increased the value of Your purchases

In the following table, which shows the performance of the value of shipments from Chile to its main markets, you can see the contrast between the destinations with the highest concentration of raw materials and the most diversified, except the United States, where although it is sent All types of products, copper has the highest participation with 25%, followed by salmon, with 12%.

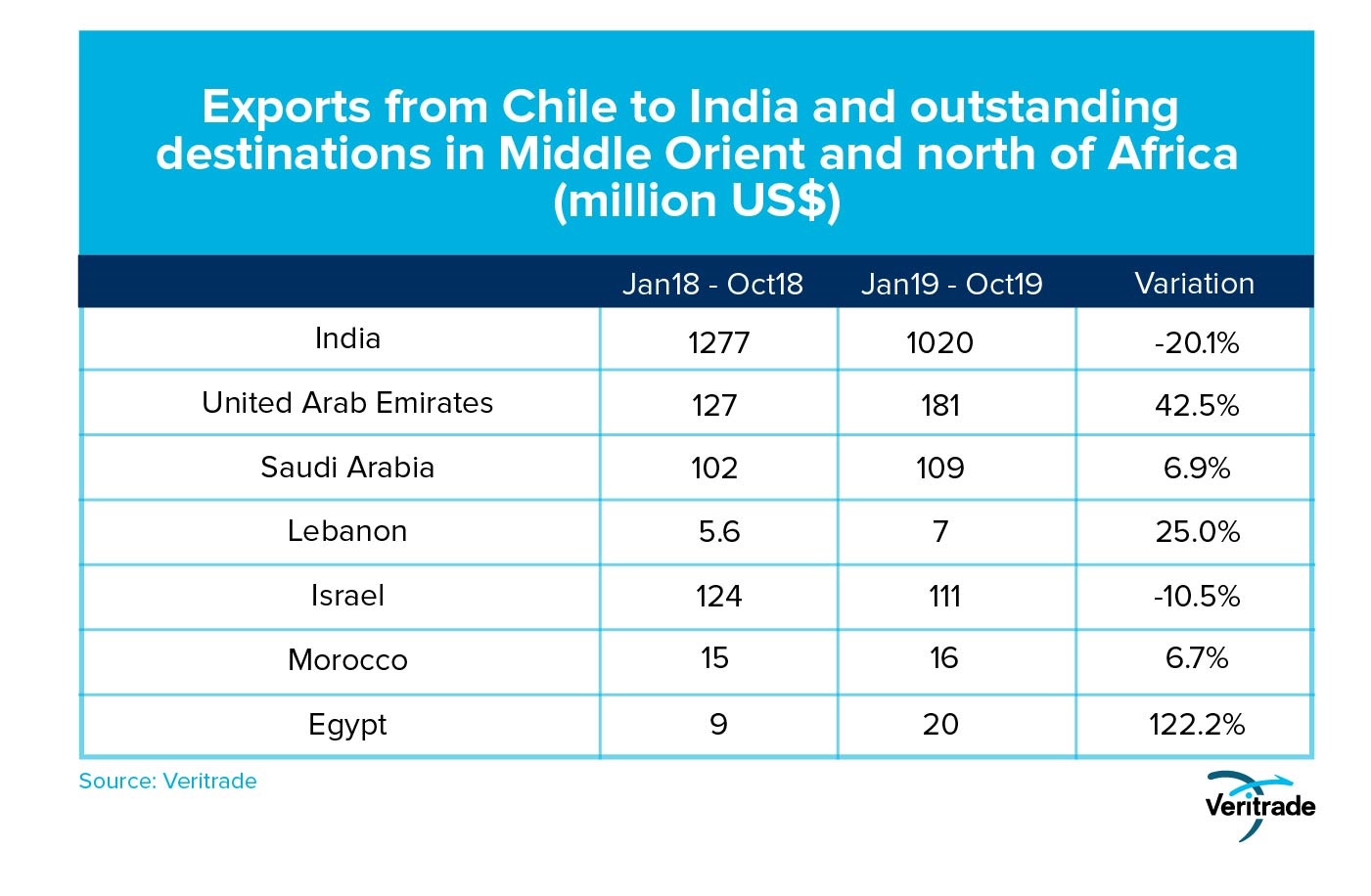

In view of the challenge that international tension has imposed, the Chilean Ministry of Foreign Affairs and ProChile have chosen to place greater emphasis on the trade aggregates of countries with greater potential for export growth, while others are closed at destinations where Prospects do not justify spending with results, such as Honduras, El Salvador and South Africa. The destinations that are going to pay more attention are India, the Middle East and North Africa, as detailed in an article in The Third.

In the table above, a different reality is seen from that of the big markets. Although except for India, they are not very representative in absolute terms, the fact of registering growth in an environment of uncertainty indicates that the Foreign Ministry and ProChile are on the right track when trying to look for value increases in alternative destinations, which although generate contributions marginal, they are opportunities for exporters, mainly agricultural and fisheries.

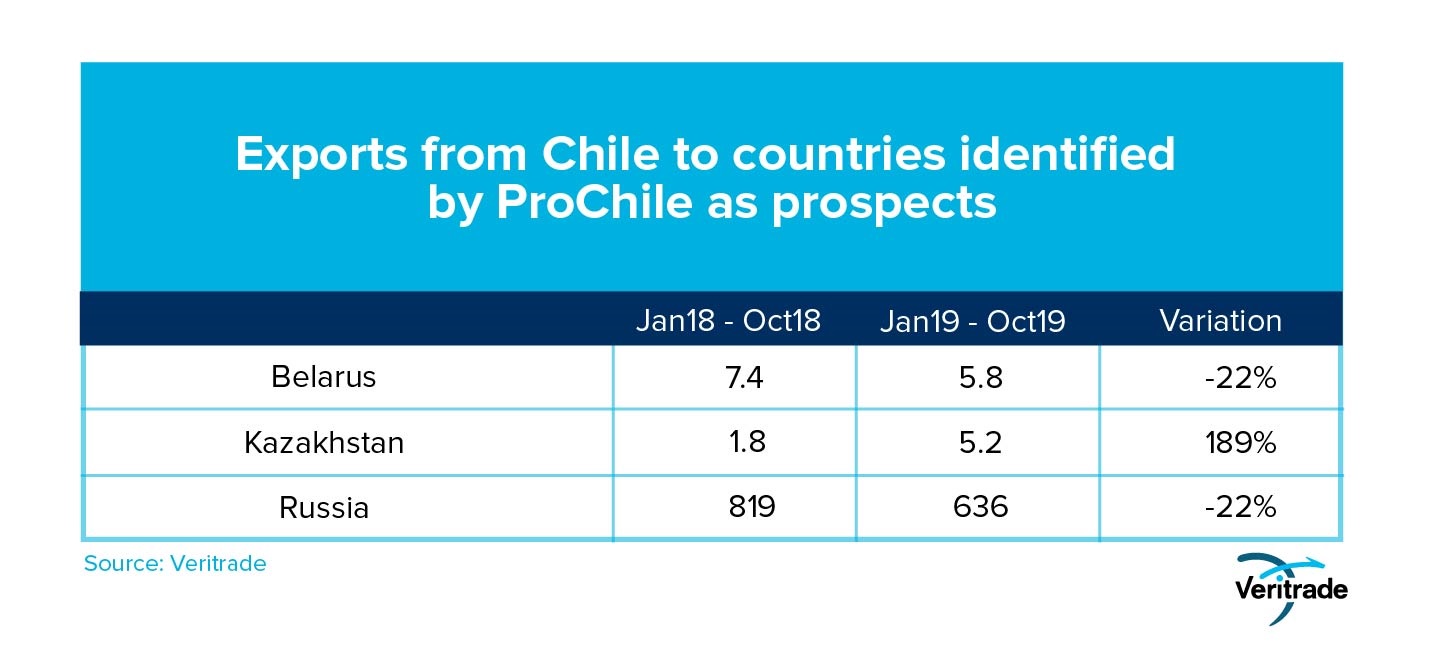

Additionally, both institutions have also seen opportunities in Eastern European markets and the border with Asia: Russia, Kazakhstan and Belarus are in the spotlight, according to the Third Note. The following table shows the performance of the shipments in the period evaluated.

Chile has a varied export portfolio and an open trade policy to take advantage of. Diplomatic and commercial work is essential to support entrepreneurs to continue expanding their offer in large or new markets and thus contribute to job creation and welfare. The work of the aggregators goes that way, and will help mitigate the challenge of uncertainty in the international economy.

For more information on Chile's exports, you can enter the Veritrade portal.

Request your free trial by going to https://bit.ly/36cQKP9