Gold export in Bolivia recorded high level of growth

Published on 12 June 2019

International financial conditions have led central banks to demand more gold, and highland producers have been able to take advantage of it.

Despite the variations, 2018 was a good year for the gold market, after having registered a setback in 2017 that interrupted the recovery after the rearrangement of the dollar occurred in 2015. In this way, the countries that produce the metal precious have benefited from the increased demand for central banks.

The international market has fluctuated prices according to the perception of risk in response to the performance of growth indicators, political tension and decisions of the Federal Reserve. The latter has led to less pressure on the dollar in view of the end of the rises in the benchmark interest rate, which is why many central banks have opted to increase their reserves in gold.

This latest upward trend has coincided with the seasons of marriage in India, corresponding to the periods October-December and April-May, so that the momentum has been even greater. Finally, it should be added that there has been a certain impatience with accumulation, since the price is expected to increase even more throughout the year, precisely in view of the eventual higher demand from some central banks.

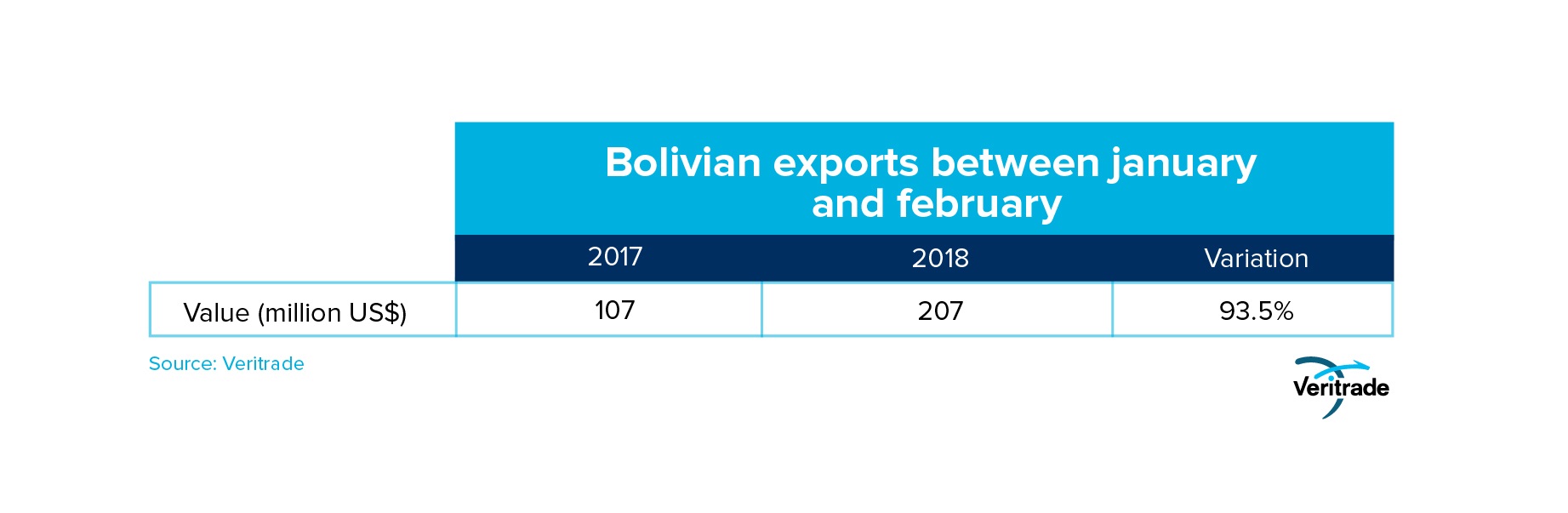

The following table shows the effect of this situation on Bolivian gold exports, and emphasizes the highest increase achieved during the first months of this year.

This increase coincides thanks to an increase in the quantity sent and the price increase, whose average was 2.3% higher in 2018. It should be noted, however, that both years had swings, and that 2017 closed with a prolonged fall , while in 2018 the trajectory was U-shaped, with an initial rise, a fall in the second quarter and a recovery in the third.

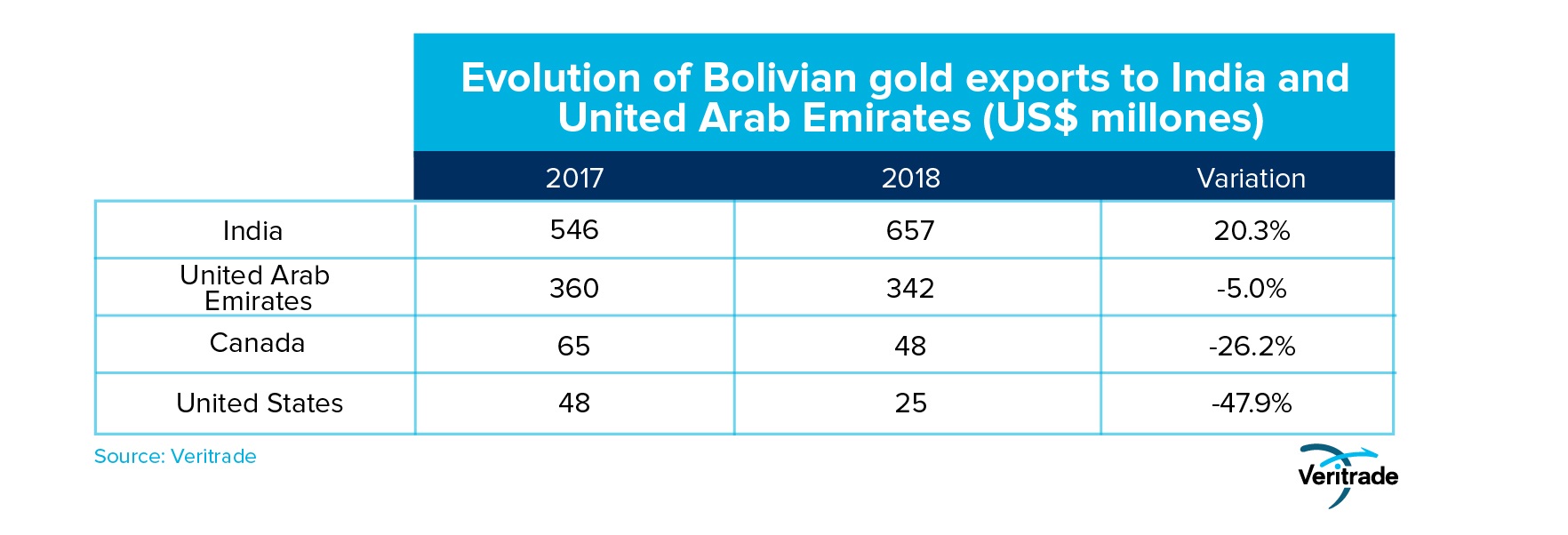

An important fact is that Bolivian exports are to markets that demand more physical gold, such as India and the United Arab Emirates, unlike Peru, which exports to markets of large refineries and storage of securities, such as Switzerland and the United States. . In the following table, you can see the distribution of the destinations.

Another important fact is that the dynamics of the markets may be different. In the following chart, it is seen how the performance of the Asian and Arab markets can be different from that of the North Americans.

In the US market, the impact of monetary policy is nil because it is the country that controls the dollar, and just trusts and binds its performance to the behavior of its own economy. Meanwhile, in Canada the demand is due to different patterns than the Asian countries and Russia, whose central bank is the main buyer of gold as a reserve.

That said, it is important to draw attention to the origin of Bolivian gold production and the demands of international markets regarding the environmental and labor conditions in which gold is produced. Their extraction in rivers usually involves the participation of small producers who still see attractive to operate under lower margins, unlike large companies that seek large-scale deposits to be exploited in open shafts or pits.

The challenge of working in balance with the ecology and respect for labor rights is great. For the rest, the international market seems to bring good winds for exporters of Bolivian gold, which will generate more foreign currency for the highland country.

For more information about Bolivian exports, you can enter the Veritrade portal.

Request your free trial by going to: https://bit.ly/31umSwn