Exports from Latin American countries exceeded one trillion dollars in 2018

Published on 05 March 2019

The figure is the highest in six years.

The evolution of exports depends on both external and internal factors. In this sense, a country can be benefited or harmed by variations in the prices of commodities, the economic situation of the countries to which the merchandise is sent, or the global political situation. On the other hand, the work of governments to open new markets, achieve certifications or improve port infrastructure, as well as investment in new production facilities by companies, may be the other factor that drives the value of a country's shipments as a result of the greater amount exported.

At the international level, 2018 was marked by the rise in the price of oil, the stable performance of copper, and an incipient trade war between the United States and its main trading partners, especially China, which still does not end up being an fact about which there is certainty in terms of magnitude and duration.

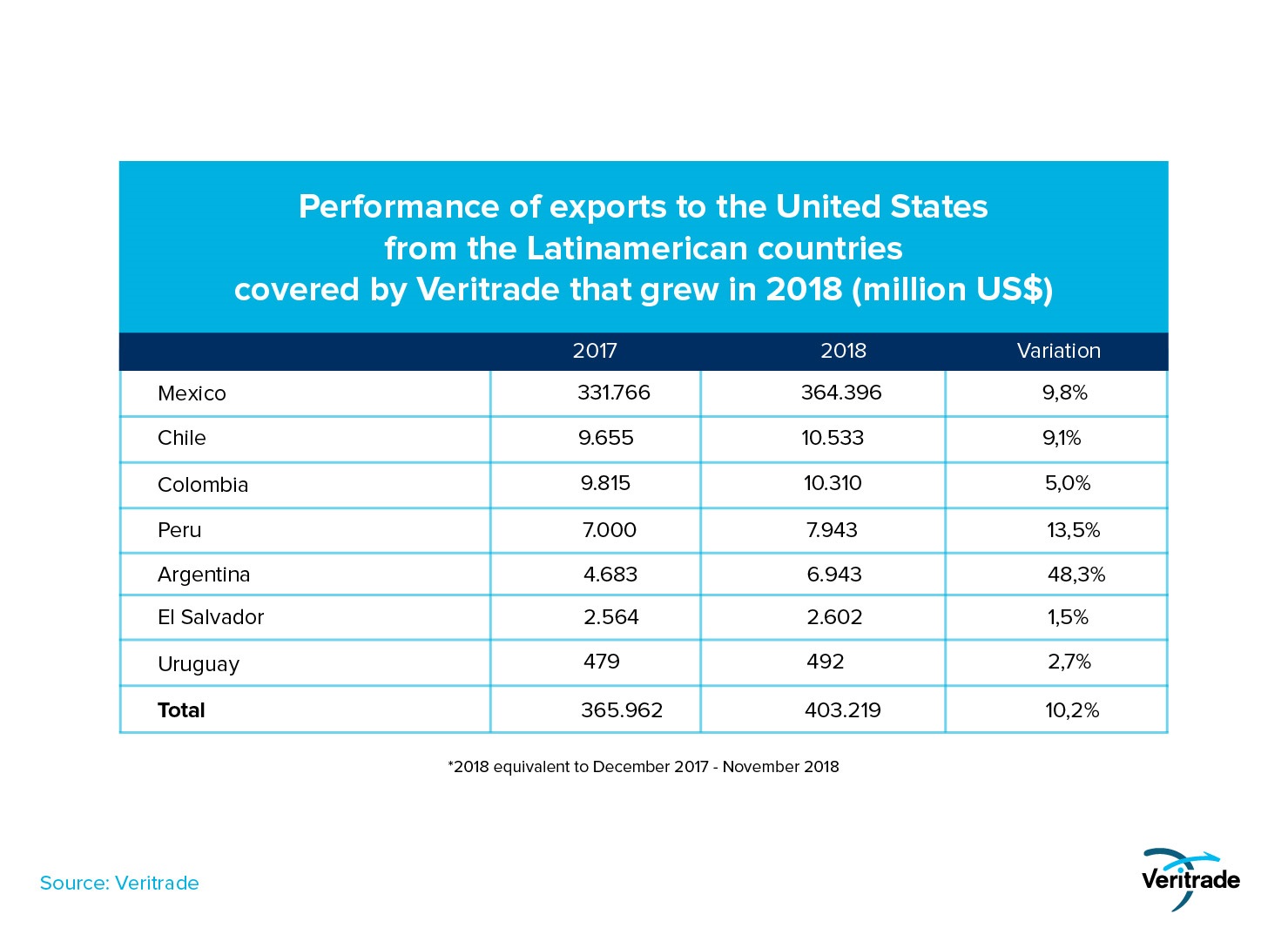

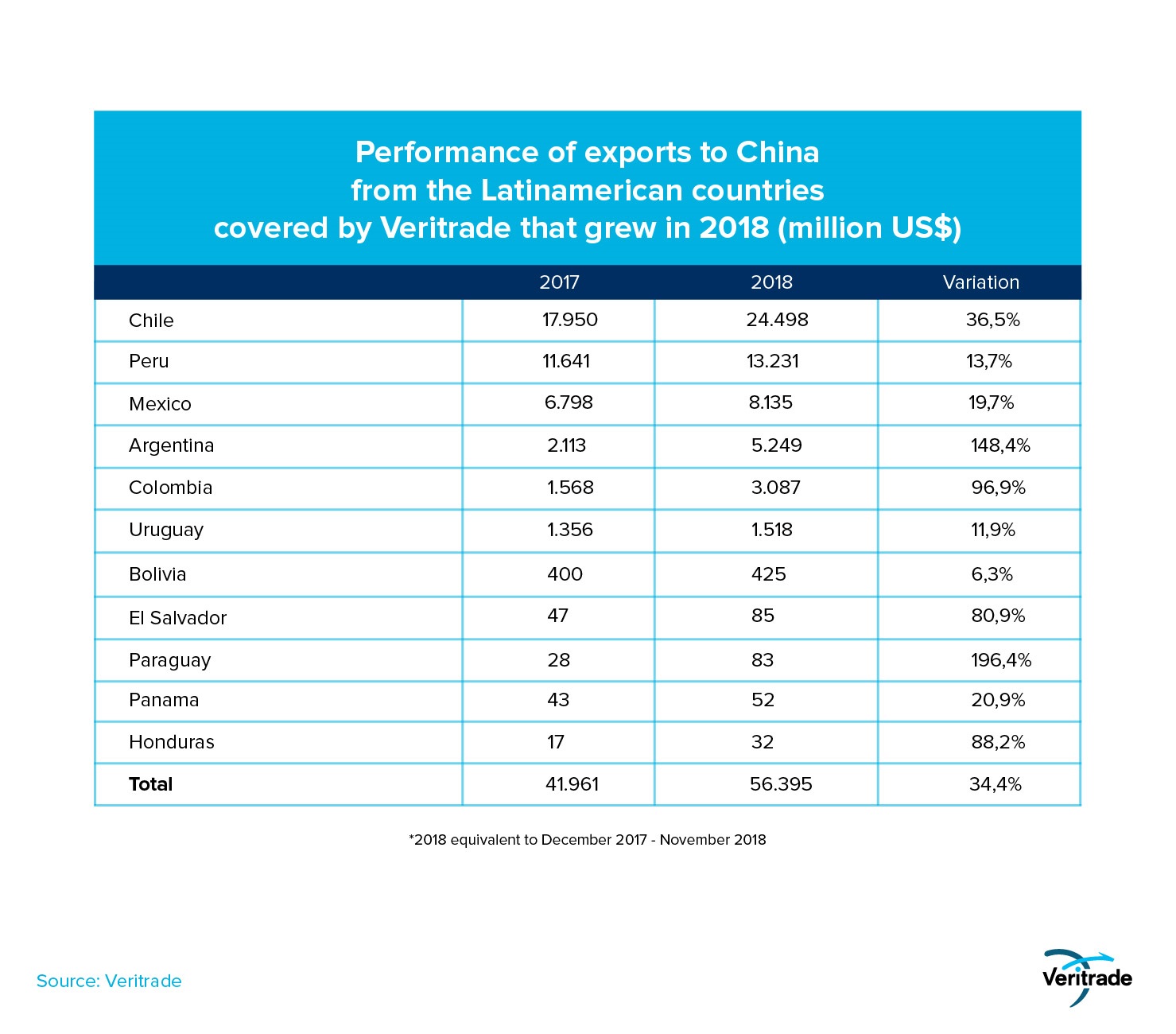

In this context, 2018 was a good year for exports from Latin American countries, which according to the Inter-American Development Bank (IDB) reached US $ 1,080,000,000,000, the highest figure in six years. The following tables show the evolution of the values generated by the shipments of the countries covered by Veritrade, which stood out for their growth in their two most important destinations globally: the United States and China.

It is worth mentioning that internal factors also favored the exports of some countries. In this sense, the case of Argentina stands out, which managed to reopen the US market for its beef, and managed to get the bone cuts to enter China. At the other extreme, the increases in Mexico, Chile, Colombia and Peru were the result of the good performance of the commodities that they export: oil, gas, coal, copper, mainly.

In a note on the Mexicoxport portal, an IDB report is cited in which it is noted that China was the fastest growing market, with a rise of 24.2%, compared to 9.9% of the total. This makes sense if one takes into account that the main driver of growth was the performance of raw materials.

However, the most valuable market for the region is the United States, with a 40% share of its total exports. Incidentally, the good performance of the US economy throughout 2018 greatly benefited Mexico as a supplier of assembled products, including vehicles and technological items.

The outlook is uncertain towards 2019 due to the commercial war, which could justly hurt countries like Mexico and China to a greater extent than the rest due to their high participation of assembled products, but the impact could be even greater. If China reduces its purchases of copper and other raw materials, metal-exporting countries could be greatly affected. Fortunately, the baseline scenario of the international consensus indicates that the global impact would be between 0.5% and 0.8% of the global GDP, and that only in an extreme case would it reach a little over 1%.

If the scenario is not complicated, Latin America will continue to have room to take advantage of diversification opportunities, while the work of governments in facilitating the expansion of extractive industries will also be fundamental to mitigate risks to price variations through greater shipments. .

For more information about the exports of Latin American countries, you can access the Veritrade portal.

Request your free trial by going to: https://bit.ly/2ENGbHU