Latin American exports to China register rise in 2018

Published on 18 December 2018

2018 has been a good year for extractive activities throughout the world. The reductions in metal inventories and the increase in supply in response to an industrial demand that recently weakened in the third quarter with the commercial war, the good hydrobiological conditions after a year with El Niño phenomenon, the rise in the price of the cellulose and wood for high levels of demand, and the recovery of the oil wreck; are some of the factors that have allowed a good performance.

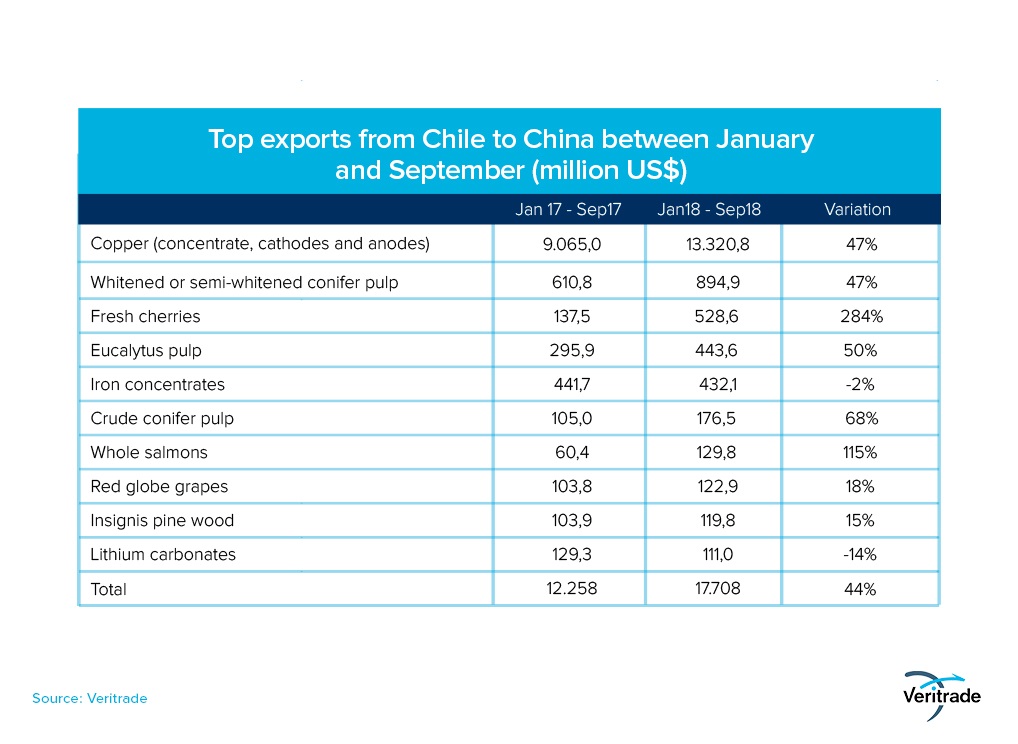

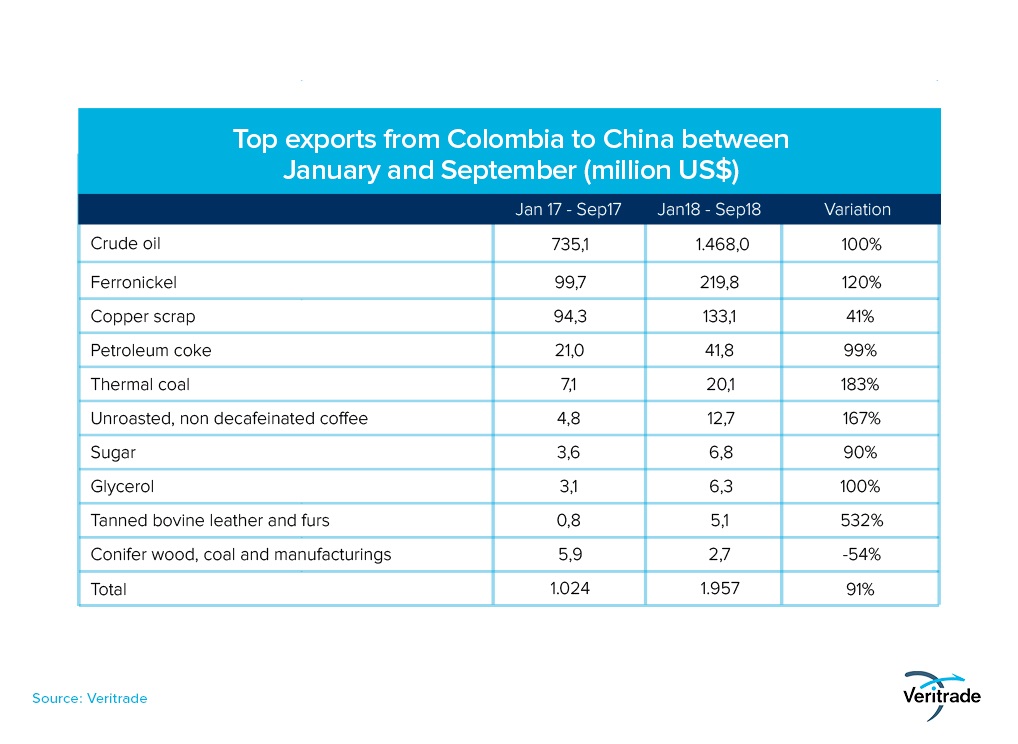

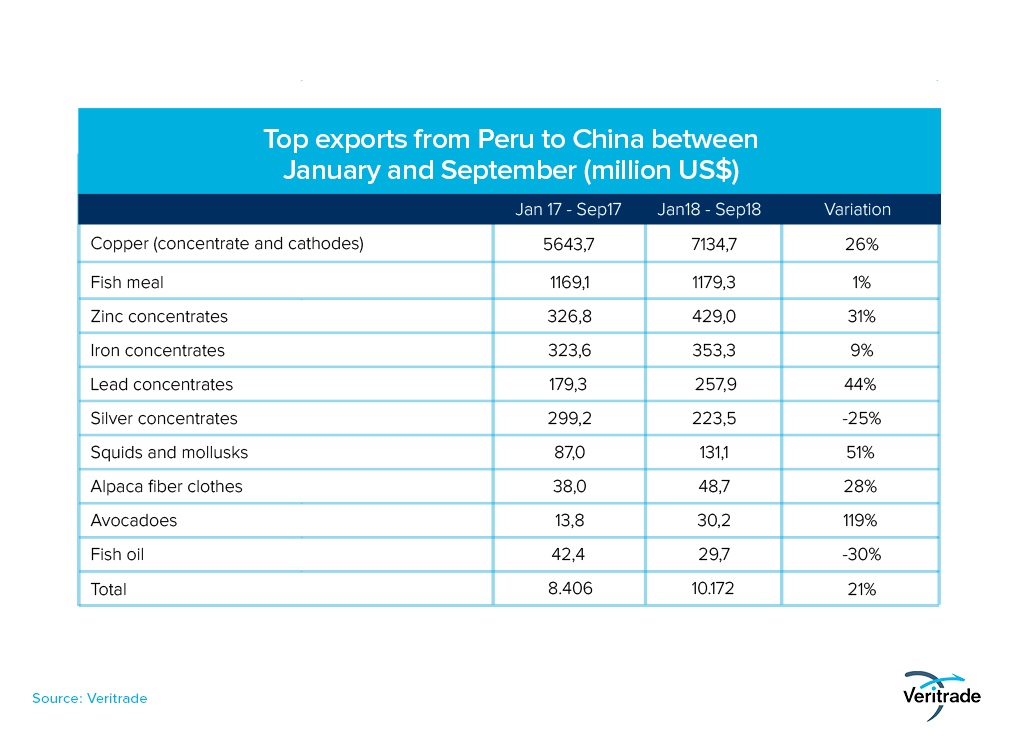

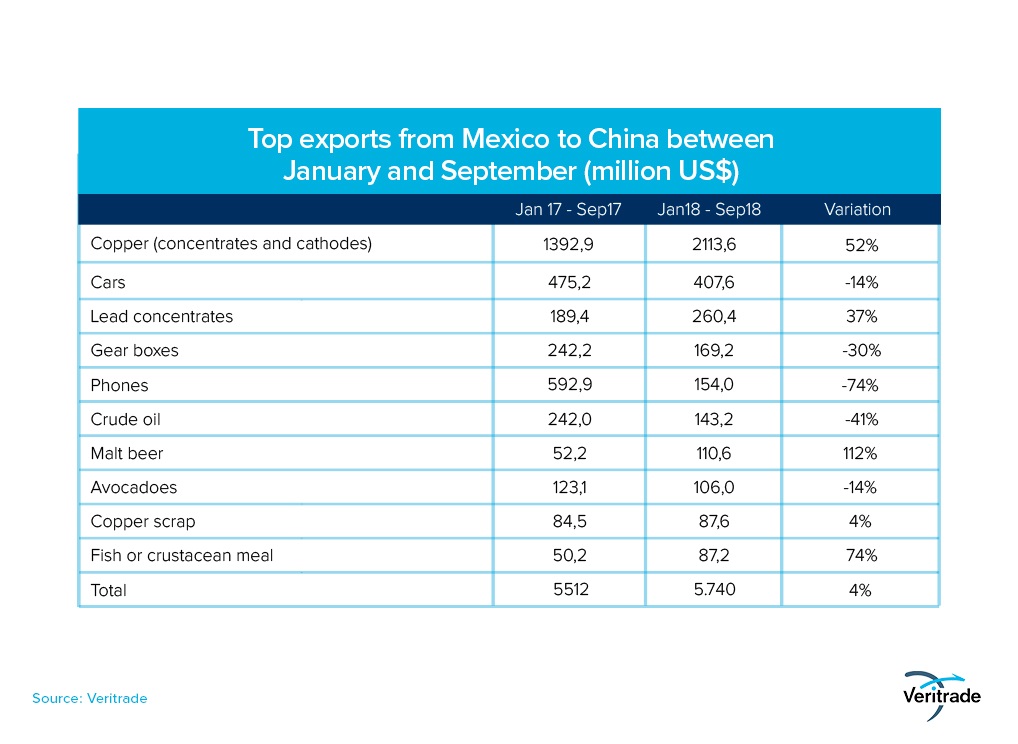

In the case of Latin America, this context has allowed the value of shipments to China to increase considerably. In the following tables, you can see the performance of the main products exported by each country of the Pacific Alliance, those with greater economic opening and use of the commercial relationship with the Asian giant.

In the case of Chile, only exports of lithium carbonates were recorded (one of the leading products due to the demand for electric vehicles, as mentioned in this note) due to a 25% reduction in the price during the period in evaluation by the excess of supply, and in iron exports, also by price but compensated by a greater weight in the shipments. The rest is in line with that explained in the first paragraph, except for the specific case of salmon, which has recorded an increase in production from 580,000 tons to more than 600,000, and for which an opportunity has been seen in the market Chinese, that although it is sourced from local production, this fish also imports.

The case of the cherry is not different, and the biggest harvest was combined with the high demand in the Chinese market. The grape, meanwhile, has in China the source of ideal diversification: while the total shipments in the 2017-2018 campaign were reduced by 4% in terms of weight, exports to China increased by 16%.

It is worth mentioning that more than 99% of the value of exports of all these products is generated by maritime shipments.

In the Colombian case, as in all other cases, the main raw material exported is the one that has generated most of the increase in value. After three and a half years under US $ 60 per barrel, in 2018 this barrier was again overcome, a level that was maintained until November. Another very important commodity for the Colombian economy is coal, which has seen a rise in its price due to lower production in China and India. Ferronickel was the other metal that benefited from the rise in prices in the first half of the year, cut by the trade war between the United States and China, while glycerol was benefited by the demand for clean fuels and the largest production, even though prices have not taken off.

On the agricultural side, coffee exports also showed that China is a good destination for diversification: despite the lower international quotation and the drop in production throughout the year, shipments to China doubled and reached 3, 65 tn during the period under evaluation.

Regarding the means of transport used, more than 99% of the value of the shipments was generated with merchandise transferred by sea.

Regarding Peru, the figure of raw materials is maintained as a driver of growth, and in fact the export of copper to China has been the driver of its economy in recent years. On the other hand, it is interesting to note that the values of iron, zinc and lead have grown despite lower prices, confirming that the Chinese industry remained strong, and that the threat of commercial war is no small thing . In the case of silver, there was a negative result due to the decrease in the price.

In the counterpart, non-traditional products are less vulnerable to changes in prices, and very sensitive to work in production and market development. In that sense, much progress has been made in the export of giant squid and other seafood, among which the first is the most important and resistant to hydrobiological conditions, although it is still underexploited by the local industry. In the case of avocados, there was an increase in production that allowed us to take advantage of a still incipient market such as China, where the potential is enormous if the consumer is trained. Meanwhile, the case of alpaca garments is similar to that of pota, although with the disadvantage of facing a more generic and competitive market.

Regarding the means of transport used, more than 99% of the value of the shipments was generated with merchandise transferred by sea.

Finally, Mexico also benefited from the good performance of copper, which compensated for the deterioration of silver and automobile exports. The deceleration of the Chinese economy has led to the reduction of exports of Mexican cars and auto parts in recent years, but in any case, the Asian country continues to be an important destination to diversify.