Peruvian exports start 2018 on the right foot

Published on 09 July 2018

The external sector has favored the Peruvian economy and has become its driver in recent months.

Despite the problems generated in the Peruvian economy as a result of a complicated political environment and the paralysis of infrastructure projects due to corruption, 2018 is a year of recovery. The main factor behind this improvement is the growth of exports, which have benefited from commodity prices and good harvests.

It should be noted that the improvement in exports has been almost generalized, and that most of the large products have registered growth. Next, we review how the values of the income obtained by the main export products that registered a positive performance varied.

Except for the case of silver, the average price of the main metals exported by Peru has increased between the period January-April 2018 and the same period of 2017. The highest increases have been copper and zinc, with increases of 19.5% and 22.7%, respectively. In the case of precious metals, the rise in gold was more modest, with 8%, while the price of silver fell 5.1%.

It is important to note the increase in silver exports in terms of volume, which could compensate for the price drop. This is due to the fact that industrial demand has remained strong, which also reaches exports of gold and zinc. As you can see, in the cases of zinc and silver, the results have been driven by the variation in terms of quantity.

On the other hand, the reduction in the price of copper and zinc in the first third of the year should not be a concern (both fell 3.4% and 7.1%, respectively). As already mentioned, industrial demand remains solid and the global supply has not grown significantly.

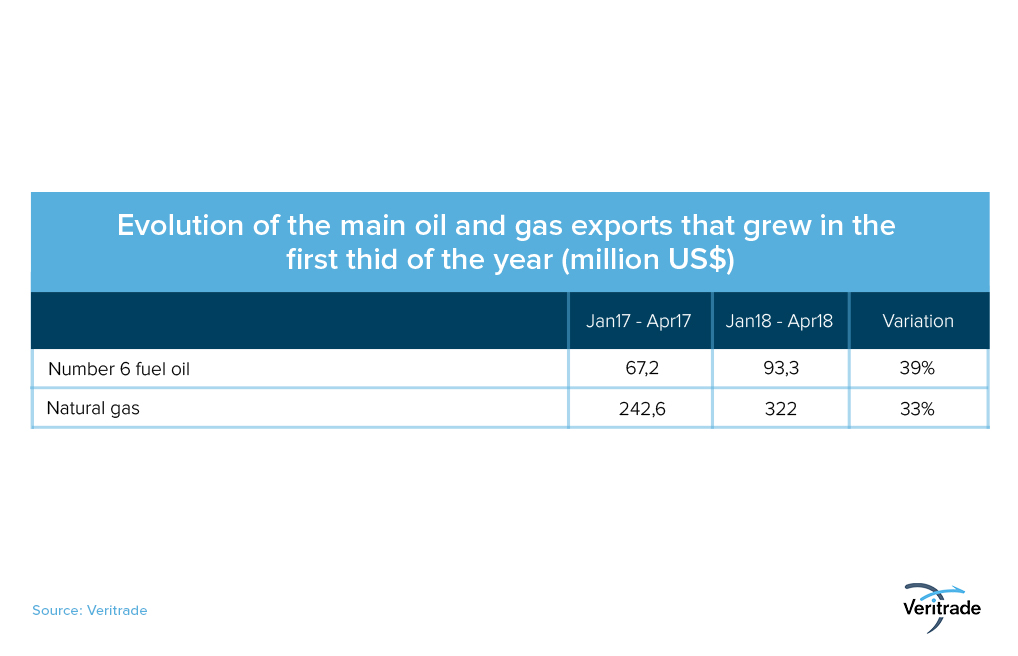

In the case of hydrocarbons, the impact of the price increase has been similar, but the most important thing to note is the trend. The average of the quotation of the residual 6 between January and April 2018 rose 13.4% with respect to the same period of 2017, in line with a 23.2% increase in the WTI oil barrel.

However, the supply restrictions on the part of the eastern countries and the economic problems of PDVSA, the Venezuelan oil company, have pushed the price up and the trend is expected to continue. Between March and April, the price of WTI rose 4.5%, and in May it increased another 4.5%. In fact, the trend is expected to continue, and there is even talk of returning to the range of US $ 100 per barrel in the medium term.

On the other hand, gas exports increased, despite the paralysis of exports for three weeks in February, due to a breakdown in Camisea's liquid pipeline: the only one in operation for gas in the country. Fortunately, it was possible to take advantage of a good level of prices in January, with US $ 3.87 in the Henry Hub, compared to US $ 3.3 in the same month of 2017. In general, the trend towards gas recovery began in March 2016, when it arrived to a floor of US $ 1.73 million per BTU. For the time being, demand is expected to remain strong, although competition with shale gas and the increase in Chinese production may curb the rise.

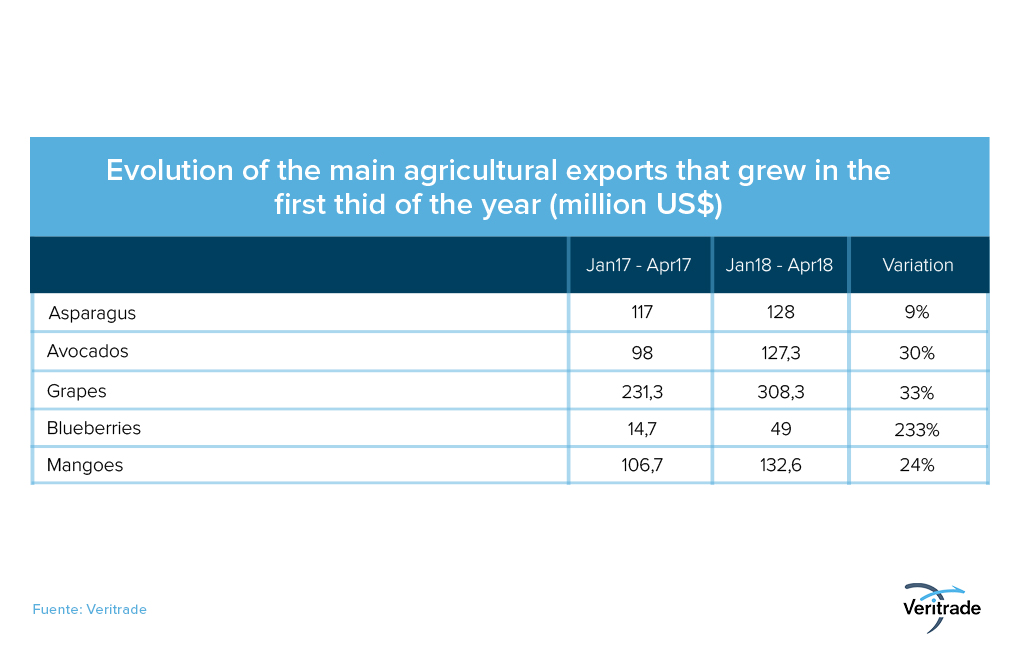

Meanwhile, non-traditional agricultural products have continued to perform excellently. The export of blueberries is highlighted by the implementation of new crops, which are part of a trend started less than a decade ago, when this product was not yet exported.

In the case of avocado, the quantity exported has continued to grow, but the impact of prices has been greater: in 2017, the tonnage of shipments increased 27%, but the value did 46%. At the beginning of 2018, good prices were taken, and it is expected that production will also continue to rise and be exported between 10% and 15% this year.

On the side of the asparagus, exports improve due to the lower base in 2017, affected by the El Niño Costero Phenomenon, and the increase in the area sown. The grapes, meanwhile, were also affected by El Niño but one season later, and the weight of shipments was reduced 6.34% between the 2017-2018 campaign and the 2016-2017 period, but the fall was offset by an increase in 19% on the price.

Finally, the mangoes have had an exceptional performance. Even in spite of El Niño, 2017 had already reached a record figure, reaching 179,000 tons in the 2016/2017 campaign. However, in the 2017/2018 campaign it would have reached 200,000 tons.

In general terms, Peruvian exports reflect the benefit of market factors such as the prices of metals and oil. In parallel, non-traditional exports benefit from structural issues such as increased production and market opening. The challenge is to take advantage of the first, continue to increase production with new projects, and work hard to maintain good agricultural production.

For more information about Peruvian exports, you can access the Veritrade page.

Request your free trial at: https://bit.ly/2MXZJun