Ready for the change

Published on 14 May 2018

The Chilean government offers a system of prevention against foreign exchange risk for SMEs engaged in foreign trade. Let's review why it's important.

In order to protect exporters and importers from the volatility of the exchange rate, the Ministry of Economy and Finance of Chile and the BancoEstado of the same country created Seguro Dólar, which is a futures instrument that has the Chilean peso as underlying asset, and offers two operating options.

The first alternative consists in the payment of a premium to determine the application of a previously agreed fixed exchange rate, so that the exporter is not harmed with a lower exchange rate, or the importer no longer has to assume a higher ratio for stocking up. The second mechanism, as reported by the Efe agency, is the setting of a price band, without the need to pay a premium.

The insurance is aimed at SMEs, the segment most vulnerable to exchange rate fluctuations, given the better conditions that larger companies have to access such protections in the market, or to assume lower returns. One of the main vulnerabilities is the entry of foreign currency through mining exports, which press the exchange rate downwards and reduce the competitiveness of exporters who do not have the possibility of offsetting the lower value of the dollar with higher volumes or better prices. in the international market, as happens with copper.

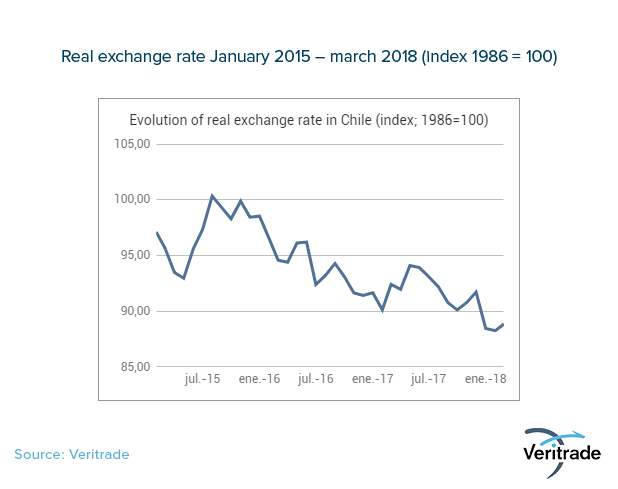

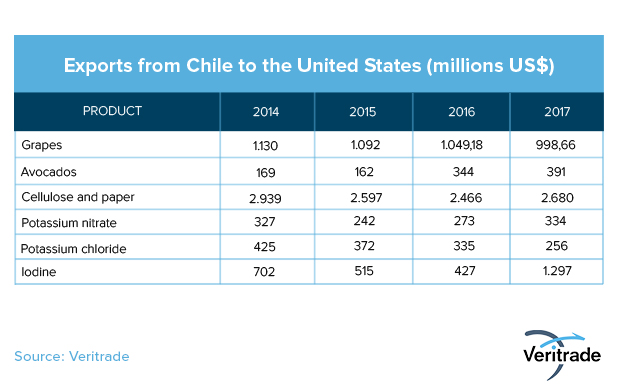

According to a report by the Chilean digital newspaper El Mostrador, the products most affected by the trend towards the appreciation of the dollar in recent months are fruits, pulp and paper, metal products and chemicals. The following graphs show the evolution of the exchange rate and the exports of some of the main products of these items.

The fall in the real exchange rate represents the loss of competitiveness of Chilean exports compared to those of the rest of the world (in the ratio presented by the Central Bank of Chile, a rise in local prices generates a greater fall and the lower either the index, the dollars or other currencies that are obtained by sales abroad will have lower purchasing power). Whether it is the strengthening of the Chilean peso relative to other currencies, or the increase in sales prices in Chile, shipments of products that have not benefited from rising international prices, such as copper, have more complex conditions for exporting.

Although the previous table does not show an absolute correlation with the rise in the exchange rate, the figures shown in the years after 2014 could be higher. The export of the products shown does not necessarily imply the participation of SMEs, but it is a reference of the vulnerability of exports to the loss of competitiveness.

If you compare the behavior of these products with commodities, you can see a coincidence in the reductions in exports. However, in this case the results depend on factors foreign to the country's exchange rate competitiveness.

It is important to specify that agricultural, metal-mechanical and chemical exports involve a greater number of small and medium-sized companies. Therefore, it is pertinent to promote a system of protection against exchange fluctuations that allows them to survive in the midst of an environment in which the Central Bank of Chile prioritizes the control of inflation.

Given that the prioritization of inflation goals is done at the cost of losing the possibility of giving more volatility to the currency, then it makes sense to assume the cost of creating a soft subsidy through the creation of a product like Seguro Dólar, which, by the way, can be self-sustaining if a correct calculation of the premiums is made on the basis of the risk to be assumed.

There is no doubt that small and medium-sized Chilean exporters will be interested in using foreign exchange insurance. In the last year, the Chilean peso appreciated 8.3% against the dollar, which made it the currency that gained the most value in the region. While this is positive for importers, exporters, who are likely to convert their income from any currency to the dollar before transferring them to pesos, have been adversely affected. Therefore, it would not be uncommon to see some willing to pay premiums of up to 5% of the value, which while representing a small loss, give predictability to the finances of entrepreneurs, and protect them from appreciations even greater than that of 2017.

For an SME, accessing derivative instruments (forwards) of currencies that protect them from fluctuations in the exchange rate can be complex, in view of the sophistication of the options available in the market, and of possible entry barriers for minimum amounts to protect. However, Dollar Insurance will allow anyone to protect themselves through a product whose procedures and contingencies have been designed for their size. If you have a small or medium company dedicated to export, we advise you to enter here to get the necessary information on how to apply for this protection.

For more information on the evolution of the values and volumes of export or import of other products during periods of exchange volatility, and even stability, you can consult the Veritrade database.

Request your test here: https://bit.ly/2wGvyVo