Dollarization in Ecuador: An economic antidepressant

Published on 01 February 2018

After the abrupt and sustained depreciation of the Sucre, which in 1999 came to depreciate 90% in 2000, a fiscal deficit of 12% and the failure to pay the debt, the dollarization of the Ecuadorian economy turned out to be a palliative similar to an antidepressant for a psychiatric patient. But in spite of having disappeared the symptoms of monetary instability, what can be done is to avoid a pain at the height of an infallible, although painful, cure.

Both Pinochet's Chile and Fujimori's Peru are two examples of the economies in which an accurate economic recipe was applied, which can be assumed as a political technology (that is, it can not be used to resemble the Internet wheel). The four legs that can be used in these two things remain in fiscal discipline, the economic autonomy of monetary policy, the handling of inflation and price and currency control, and the opening to investment.

However, the aforementioned recipe is subject to a fundamental element: the respect of government authorities for the foundations of economic theory and not the populist temptation to exceed the expense or the irresponsible use of monetary stimulus. It is a last aspect in Ecuador that has failed over the years, and in which we will have to look to understand why it is necessary to trace the goal of recovering a local currency.

The inability to make monetary policy (that is, to issue currency, but above all, control interest rates), has led to the only way to stimulate the economy has been the increase in spending. This has led to the Ecuadorian public debt having risen from 15.5% in 2008 to 39% in 2017, when Peru and Chile are at 25% (the International Monetary Fund-IMF) projects that Chile's debt will reach 31.3 % in 2022, and that of Ecuador rise to 50.6% in the same year, while that of Peru would be 27%).

The warning is clear: there will be serious fiscal balance problems if the necessary adjustments are not made and the oil price is not recovered, which generates half of Ecuador's export earnings (in 2014, when the fall from prices around began). from US $ 110 per barrel up to the approximately US $ 55 that has been registered in the last two years, contributed 60% of what was generated by sales abroad). Meanwhile, in Ecuador a calm is perceived by the stability of the prices (the IMF projects an inflation of 0.7% for this year, and the Ecuadorian government expects that it reaches 1.38%) and the bad memories of the time of the sucre, but the party may end in a few years.

However, there is a group that is strongly affected by dollarization: the exporters that close their prices in the local market. The most exposed are the flower growers and coffee growers, who have suffered the loss of competitiveness against Colombian and Peruvian exporters, in whose countries the currency has depreciated against the dollar (that is, the exchange rate has risen) in the last four years and have managed to offer better prices to foreign buyers.

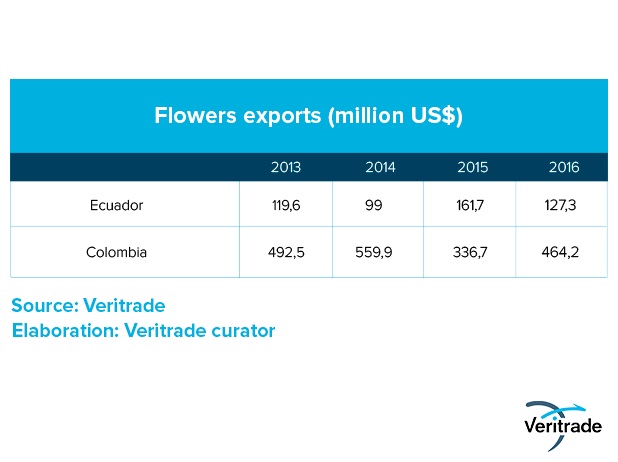

The benefit of the depreciation of a currency is that the dollars that enter the economy have a greater purchasing power, so that exporters are benefited by the increase of their income in national currency. This, at the same time, allows a greater margin to reduce prices when buyers negotiate their orders. The results can be seen in the following tables, which review the performance of the two major Ecuadorian export products that have shown high vulnerability to the revaluation of the dollar.

In addition to the affection caused by the rust plague, in 2014 Ecuador had to face the effects of the loss of competitiveness with respect to Colombian and Peruvian coffee. As shown in the graph, neither of the two countries registered a reduction in their exports of coffee beans on that date. The fall of the other two countries in 2015 is due to the price reduction during that year, and the impact of the El Niño Phenomenon in 2016.

In the case of flowers, the depreciation of the Russian ruble and the still difficult situation of the European economy could not be alleviated by the advantages explained above about the increase of the dollar with respect to a local currency, as Colombia was able to do. Although a recovery was achieved in 2015, 2016 was again a difficult year for Ecuador due to the persistence of complications in the Russian economy, where most flower shipments go, along with the United States, which maintained its power Purchasing currency parity. As a result, in 2014 the prices of Ecuadorian roses were reduced by US $ 1.21 per kg in Russia and US $ 0.5 per kg in the rest of Europe, compared to an appreciation of US $ 5.2 in the United States.

In short, today Ecuador faces the challenge of finding the right formula to protect its economy in the event of a fiscal debacle. De-dollarization can suddenly be a very abrupt change, but it can be mitigated by preparing a roadmap to start by giving the guarantees to operate a central bank of first level that merits granting the corresponding autonomy. The appointment of officials must respond to merit, and be absolutely foreign to the political.

In parallel, the Ecuadorian economy must aim more and more towards opening capital and working on its foreign trade policy to develop free trade agreements that allow it to diversify destinations and attract investments. Only at this point, an economy that today seems to be stable, will be ready to face the last step, which is to have a currency that allows responding to inflation and stimulate or adjust financial markets in response to the conditions of the economy, always within the limits imposed by an inflation targeting policy.

If the patient does not take the medicine, he will remain eternally on the couch.